King Washington Agreement for Auditing Services between Accounting Firm and Municipality is a legal document that establishes a contractual relationship between a certified accounting firm and a municipality in the King Washington region. The purpose of the agreement is to define the terms, conditions, and expectations related to auditing services to be provided by the accounting firm to the municipality. This agreement ensures transparency, accuracy, and compliance regarding financial statements and records of the municipality's operations. The agreement encompasses various essential elements, including the scope of the audit, timeline, fees, deliverables, and regulatory compliance. It also outlines the responsibilities of both parties involved, ensuring a smooth and efficient auditing process. There are different types of King Washington Agreement for Auditing Services between Accounting Firm and Municipality, namely: 1. Initial Audit Agreement: This type of agreement is established when the accounting firm is engaged for the first time by the municipality to conduct an initial audit. It lays down the groundwork for future audit engagements. 2. Annual Audit Agreement: This agreement is renewed annually between the accounting firm and the municipality to ensure regular and consistent audit services. It specifies the requirements and expectations for each annual audit cycle. 3. Special Audit Agreement: In specific circumstances, a municipality may require a special audit to be conducted. This agreement sets out the unique terms and conditions related to the special audit engagement, such as the focus areas, duration, and additional fees. 4. Re-audit Agreement: If the municipality requires a reassessment of its financial statements and records, a re-audit agreement can be established. This agreement revisits the relevant terms and conditions to conduct an extensive review of previously audited financial information. The King Washington Agreement for Auditing Services between Accounting Firm and Municipality serves as a crucial document that guides the accounting firm's auditing activities and ensures compliance with relevant laws and regulations. It facilitates clear communication, minimizes misunderstandings, and builds trust between both parties.

King Washington Agreement for Auditing Services between Accounting Firm and Municipality

Description

How to fill out King Washington Agreement For Auditing Services Between Accounting Firm And Municipality?

Whether you intend to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like King Agreement for Auditing Services between Accounting Firm and Municipality is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few additional steps to obtain the King Agreement for Auditing Services between Accounting Firm and Municipality. Adhere to the guidelines below:

- Make sure the sample meets your individual needs and state law requirements.

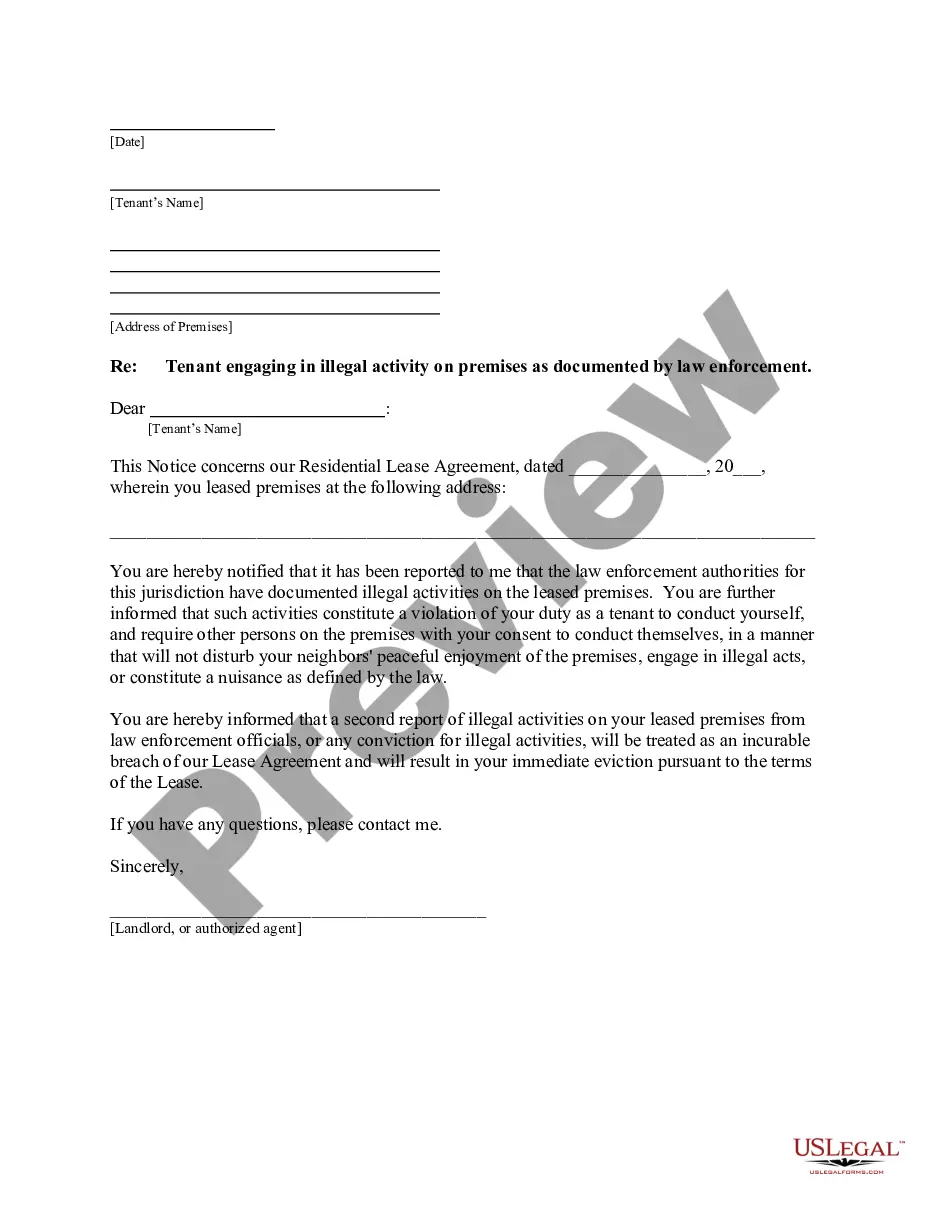

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the King Agreement for Auditing Services between Accounting Firm and Municipality in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!