Maricopa Arizona Agreement for Auditing Services between Accounting Firm and Municipality is a comprehensive contract that outlines the terms and conditions under which an accounting firm will provide auditing services to a municipality in Maricopa, Arizona. This agreement is essential for maintaining transparency, accountability, and financial integrity within the municipality. The Maricopa Arizona Agreement for Auditing Services typically includes the following key elements: 1. Objective and Scope: The agreement clearly defines the purpose and scope of the audit, outlining the specific focus areas, such as financial statement auditing, compliance auditing, internal controls assessment, or performance auditing. 2. Duration: This section specifies the agreed-upon time frame for performing the audit, ensuring that the accounting firm has sufficient time to complete the task effectively and efficiently. 3. Duties and Responsibilities: The agreement aims to establish the obligations of both the accounting firm and the municipality. It defines the responsibilities the municipality must provide, including access to relevant financial records and personnel cooperation, while outlining the duties of the accounting firm, such as performing necessary audit procedures and preparing audit reports. 4. Standards and Methodology: The agreement typically references the auditing standards that the accounting firm must follow during the audit to ensure the highest level of professionalism and adherence to generally accepted auditing practices. 5. Compensation and Payment Terms: This section specifies the payment structure, including the fee arrangement for the audit services provided by the accounting firm. It may outline the billing milestones and payment schedule, ensuring clarity and proper financial arrangements between both parties. Different types of Maricopa Arizona Agreements for Auditing Services between Accounting Firm and Municipality may vary based on specific requirements and circumstances. Some potential variations may include: 1. Performance Audit Agreement: This agreement focuses on evaluating the efficiency and effectiveness of municipality programs or activities, aiming to enhance performance and productivity. 2. Forensic Audit Agreement: In cases where financial irregularities or fraud are suspected, this agreement outlines the specific investigative procedures and techniques the accounting firm will employ to uncover any potential financial misconduct. 3. Compliance Audit Agreement: This agreement primarily emphasizes assessing the municipality's compliance with relevant laws, regulations, and policies, ensuring adherence to legal requirements. 4. Financial Statement Audit Agreement: This type of agreement focuses on the examination and verification of the municipality's financial statements, ensuring accuracy, completeness, and compliance with accounting principles. These different types of agreements address specific auditing areas and cater to the unique needs of each municipality in Maricopa, Arizona. By utilizing the appropriate agreement, municipalities can ensure reliable financial reporting, proper risk management, and enhance overall governance.

Maricopa Arizona Agreement for Auditing Services between Accounting Firm and Municipality

Description

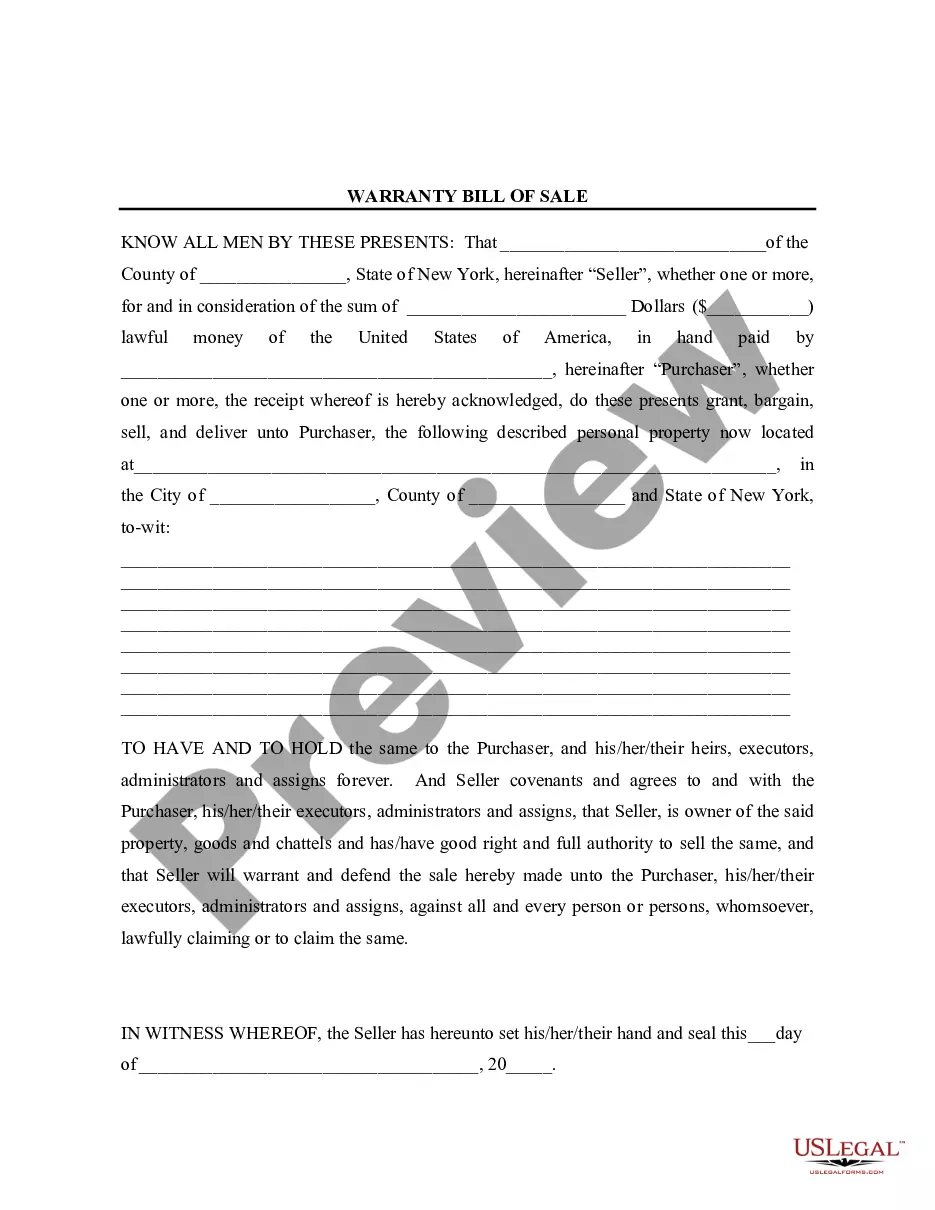

How to fill out Maricopa Arizona Agreement For Auditing Services Between Accounting Firm And Municipality?

If you need to find a reliable legal document supplier to obtain the Maricopa Agreement for Auditing Services between Accounting Firm and Municipality, consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning materials, and dedicated support make it easy to find and complete various papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply type to look for or browse Maricopa Agreement for Auditing Services between Accounting Firm and Municipality, either by a keyword or by the state/county the document is intended for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Maricopa Agreement for Auditing Services between Accounting Firm and Municipality template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and select a subscription option. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less costly and more reasonably priced. Create your first company, arrange your advance care planning, draft a real estate contract, or complete the Maricopa Agreement for Auditing Services between Accounting Firm and Municipality - all from the convenience of your home.

Join US Legal Forms now!