Oakland Michigan Agreement for Auditing Services between Accounting Firm and Municipality is a legally binding document that outlines the terms and conditions under which an accounting firm will provide auditing services to a municipality located in Oakland County, Michigan. This agreement serves as a framework for a professional relationship between the accounting firm and the municipality to ensure compliance with relevant laws and regulations. The Oakland Michigan Agreement for Auditing Services is designed to promote transparency, accountability, and integrity in the financial operations of the municipality. It establishes the scope of the audit, the responsibilities of both parties, and the fee structure for the services rendered. The agreement may also include provisions for the duration of the engagement, termination clauses, and dispute resolution mechanisms. Keywords: Oakland Michigan, Agreement, Auditing Services, Accounting Firm, Municipality, Oakland County, legally binding, terms and conditions, professional relationship, compliance, transparency, accountability, integrity, financial operations, scope of the audit, responsibilities, fee structure, duration, termination clauses, dispute resolution mechanisms. Different types of Oakland Michigan Agreement for Auditing Services between Accounting Firm and Municipality can include variations based on the specific needs and requirements of the municipality. Some of these variations may include: 1. Comprehensive Audit Agreement: This agreement includes a detailed examination of the municipality's financial statements, internal controls, compliance with laws and regulations, and overall financial management. It aims to provide a comprehensive picture of the municipality's financial health and identify areas for improvement. 2. Limited-Scope Audit Agreement: This agreement focuses on specific areas or departments of the municipality's financial operations rather than a comprehensive examination. It may be used when the municipality wants to target specific areas of concern or when time or budget constraints restrict the scope of the audit. 3. Compliance Audit Agreement: This type of agreement emphasizes evaluating the municipality's compliance with laws, regulations, and internal policies. It ensures that the municipality is adhering to legal and regulatory requirements specific to its operations. 4. Performance Audit Agreement: This agreement concentrates on assessing the efficiency and effectiveness of the municipality's financial operations, aiming to identify opportunities for cost savings, process improvements, and enhanced financial performance. 5. Special Audit Agreement: This agreement is designed to address specific circumstances or events that require an independent examination, such as investigating suspected fraud, embezzlement, or financial irregularities. In conclusion, the Oakland Michigan Agreement for Auditing Services between Accounting Firm and Municipality is a crucial document that establishes the expectations and responsibilities of both the accounting firm and the municipality regarding auditing services. These agreements can vary in scope and focus depending on the specific needs and requirements of the municipality.

Oakland Michigan Agreement for Auditing Services between Accounting Firm and Municipality

Description

How to fill out Oakland Michigan Agreement For Auditing Services Between Accounting Firm And Municipality?

Preparing papers for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Oakland Agreement for Auditing Services between Accounting Firm and Municipality without professional help.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Oakland Agreement for Auditing Services between Accounting Firm and Municipality by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Oakland Agreement for Auditing Services between Accounting Firm and Municipality:

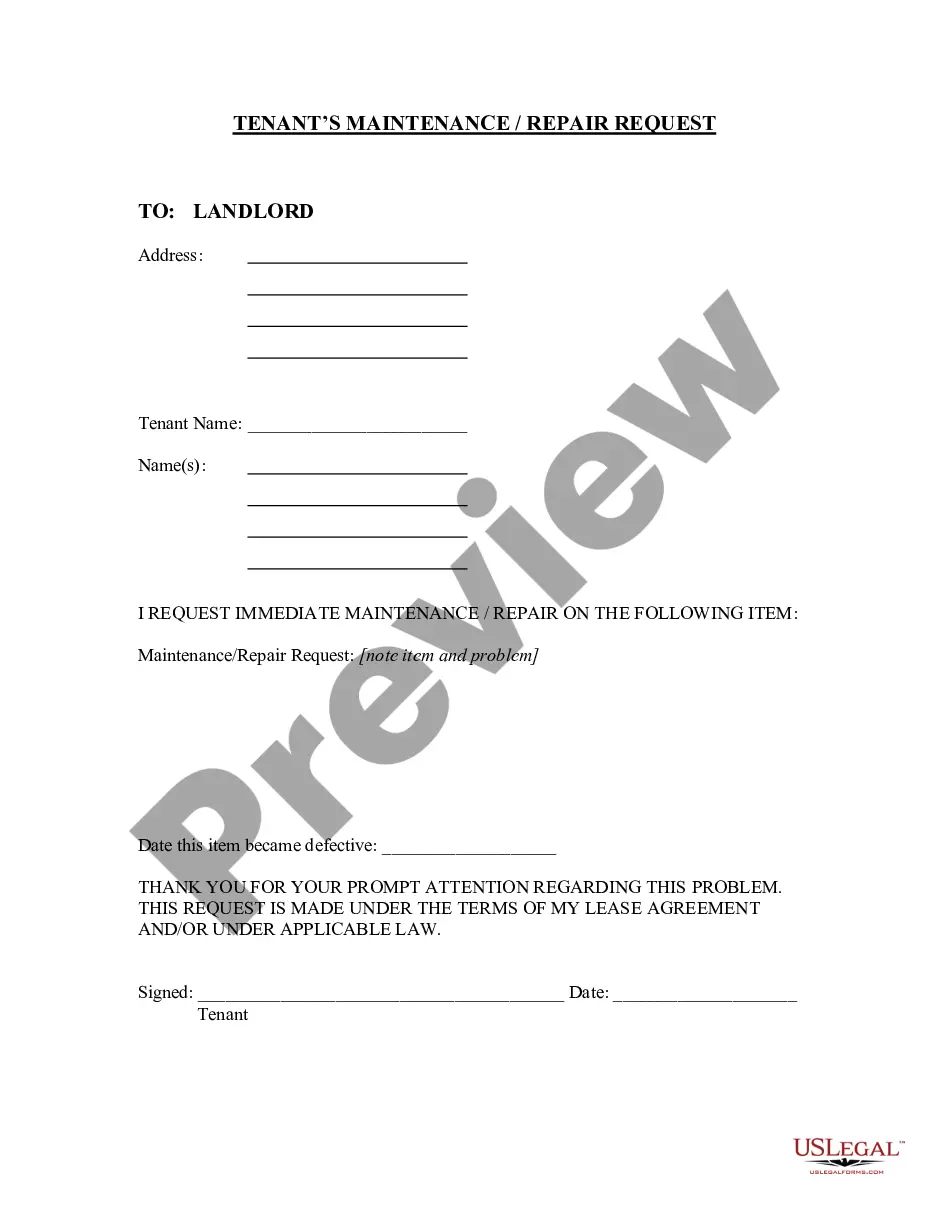

- Examine the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any use case with just a couple of clicks!