Dallas Texas Agreement between Co-lessees as to Payment of Rent and Taxes is a legally binding document that outlines the responsibilities and obligations of multiple parties involved in a lease agreement related to rent and taxes. This agreement ensures clarity and fairness in the payment arrangement among co-lessees, promoting a harmonious cohabitation environment and preventing potential disputes. There are different types of Dallas Texas Agreements between Co-lessees as to Payment of Rent and Taxes, each covering specific scenarios and requirements. Here are some common types: 1. Equal Split Agreement: This type of agreement involves all co-lessees agreeing to split the rent and tax payments equally among themselves. It ensures that each party pays an equal share, regardless of differences in income or room size. 2. Proportional Share Agreement: In this agreement, the parties determine the rent and tax payments based on a predetermined formula, taking into account factors such as income, room size, or personal preferences. This type of agreement ensures a fair distribution of financial obligations, reflecting the individual circumstances of each co-lessee. 3. Primary Tenant Agreement: In situations where one co-lessee assumes primary responsibility for lease-related payments, this agreement specifies that the primary tenant will be solely responsible for paying rent and taxes. The other co-lessees may contribute to covering these expenses but are not legally obligated to do so. 4. Sublet Agreement: If one co-lessee sublets a portion of the leased property to another person, a sublet agreement may be required to define the payment responsibilities between the co-lessee and the subtenant. This agreement outlines the terms of rent and tax payments, ensuring that all parties involved are aware of their financial obligations. Regardless of the specific type of Dallas Texas Agreement between Co-lessees as to Payment of Rent and Taxes, it is essential for all parties to carefully review and understand the terms and conditions. Consulting with a legal professional is advisable to ensure that the agreement adequately protects the rights and interests of each co-lessee.

Dallas Texas Agreement between Co-lessees as to Payment of Rent and Taxes

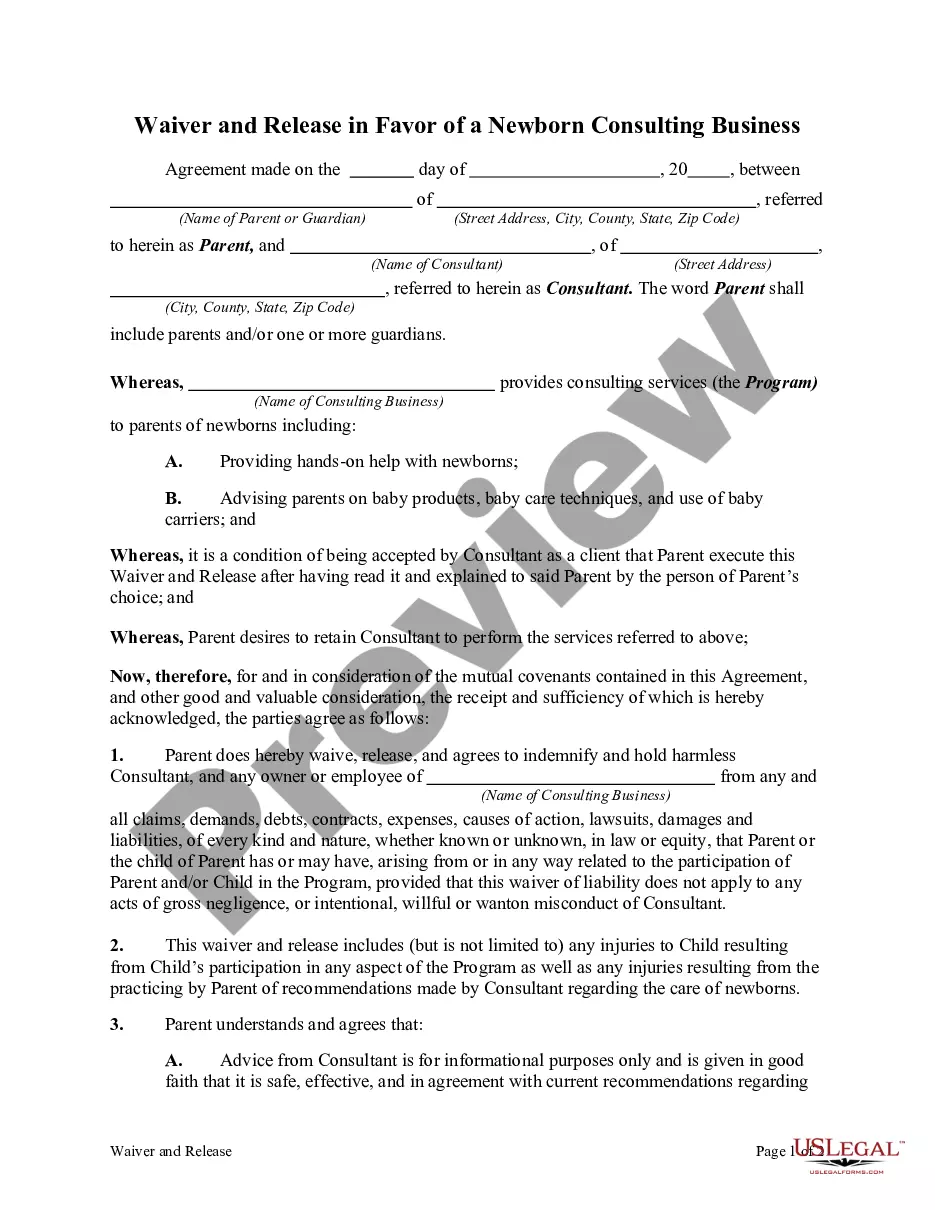

Description

How to fill out Dallas Texas Agreement Between Co-lessees As To Payment Of Rent And Taxes?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Dallas Agreement between Co-lessees as to Payment of Rent and Taxes meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often costly. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Apart from the Dallas Agreement between Co-lessees as to Payment of Rent and Taxes, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Dallas Agreement between Co-lessees as to Payment of Rent and Taxes:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Dallas Agreement between Co-lessees as to Payment of Rent and Taxes.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!