The Franklin Ohio Agreement between Co-lessees as to Payment of Rent and Taxes is a legally binding contract that outlines the division of financial responsibilities between multiple tenants sharing a leased property in Franklin, Ohio. This agreement ensures clarity and fairness in terms of rent payment and tax obligations, promoting harmony and avoiding potential disputes amongst co-lessees. The primary purpose of the Franklin Ohio Agreement between Co-lessees as to Payment of Rent and Taxes is to establish a framework for shared financial obligations. It typically covers various aspects such as: 1. Rent Allocation: This section defines how the rent amount is divided amongst co-lessees. It outlines the percentage or amount each tenant is responsible for paying. This allocation may be based on factors like the size of each co-lessee's portion of the property or the agreed-upon terms. 2. Payment Terms: The agreement specifies the date and method of payment for rent. It may outline whether the payment should be made collectively or separately, and the consequences for late or missed payments. 3. Tax Responsibilities: This section outlines each co-lessee's liability for property taxes. It defines how tax payments will be shared, either equally or proportionally based on individual shares. 4. Additional Expenses: The agreement may address the sharing of other expenses related to the property, such as utilities, maintenance, repairs, or insurance. It clarifies whether such expenses will be shared equally or based on each co-lessee's share. Different types or variations of the Franklin Ohio Agreement between Co-lessees as to Payment of Rent and Taxes may exist, depending on the specific circumstances and needs of the co-lessees. Some possible variations include: 1. Equal Responsibility Agreement: In this type of agreement, all co-lessees equally share the rent and tax payments, regardless of the size or value of their respective portions of the property. 2. Proportional Responsibility Agreement: This agreement allocates rent and tax payments based on each co-lessee's share or interest in the property. For instance, if one co-lessee occupies a larger area or has a higher stake in the property, they may bear a higher financial burden. 3. Individual Billing Agreement: Instead of sharing payments collectively, this type of agreement allows each co-lessee to receive an individual bill for their portion of the rent and taxes. It ensures accountability and makes it easier for each tenant to track their own expenses. The Franklin Ohio Agreement between Co-lessees as to Payment of Rent and Taxes is an essential document to establish clear financial obligations, foster cooperation, and prevent conflicts amongst co-lessees. It provides a structured framework for sharing the costs associated with renting a property in Franklin, Ohio.

Franklin Ohio Agreement between Co-lessees as to Payment of Rent and Taxes

Description

How to fill out Franklin Ohio Agreement Between Co-lessees As To Payment Of Rent And Taxes?

Draftwing forms, like Franklin Agreement between Co-lessees as to Payment of Rent and Taxes, to take care of your legal affairs is a tough and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can consider your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms intended for different cases and life circumstances. We ensure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Franklin Agreement between Co-lessees as to Payment of Rent and Taxes form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before downloading Franklin Agreement between Co-lessees as to Payment of Rent and Taxes:

- Make sure that your form is specific to your state/county since the rules for writing legal papers may differ from one state another.

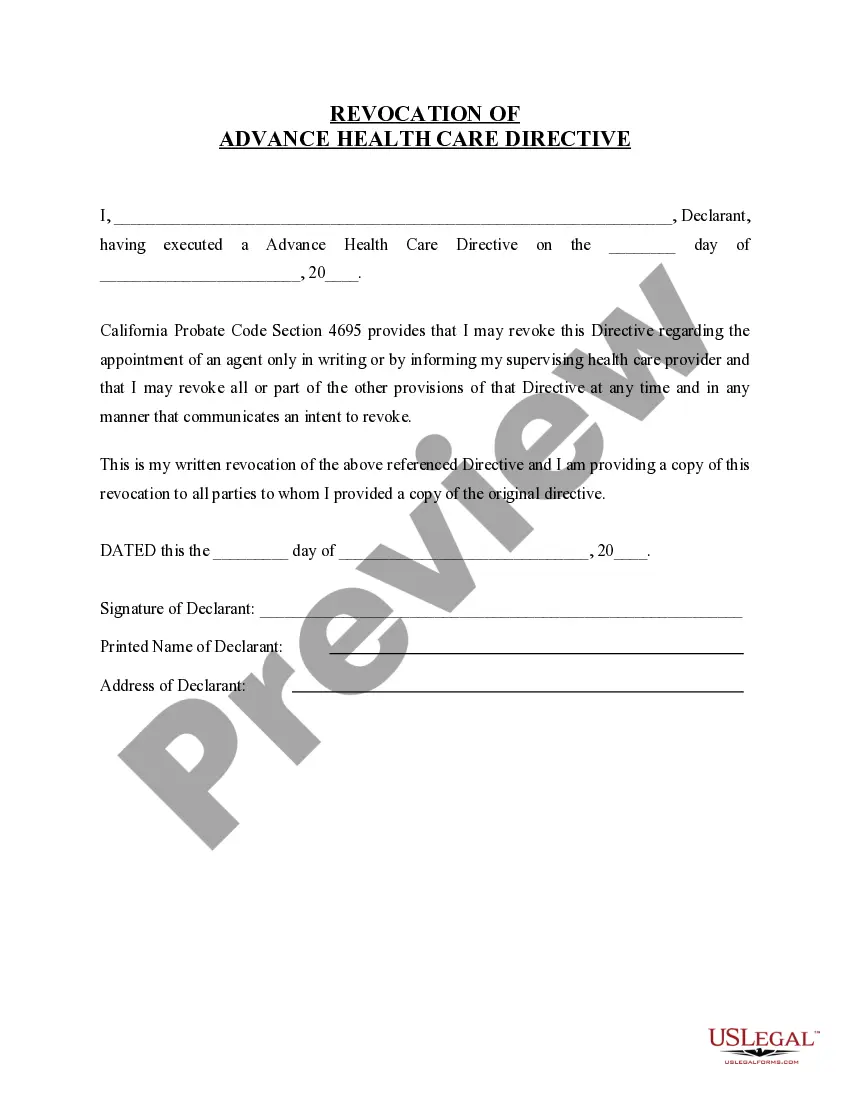

- Find out more about the form by previewing it or reading a quick description. If the Franklin Agreement between Co-lessees as to Payment of Rent and Taxes isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start utilizing our service and download the form.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!