Los Angeles, California is a vibrant and populous city located on the west coast of the United States. It is known for its stunning beaches, iconic Hollywood sign, and diverse cultural scene. The city attracts millions of visitors each year and is home to a thriving entertainment industry. In the real estate market of Los Angeles, it is common for individuals to enter into co-lease agreements for various properties. These agreements outline the details and responsibilities of multiple co-lessees who share a rental property. One crucial aspect covered in such agreements is the payment of rent and taxes. The Los Angeles California Agreement between Co-lessees as to Payment of Rent and Taxes is a legally binding document that establishes the obligations of each co-lessee with regard to rent and tax liabilities. It ensures a fair and equitable distribution of these financial responsibilities among all parties involved. There are different types of Los Angeles California Agreements between Co-lessees as to Payment of Rent and Taxes, depending on the specific circumstances and arrangement of the co-lessees. Some common variations of these agreements include: 1. Equal Payment Agreement: This type of agreement states that all co-lessees will contribute an equal amount towards the rent and tax payments. It ensures a straightforward and balanced approach to dividing the expenses among the tenants. 2. Proportional Payment Agreement: In this variant, the co-lessees' contributions towards rent and taxes are determined proportionately based on factors such as income, square footage occupied, or any other mutually agreed-upon criteria. This type of agreement acknowledges varying financial capabilities or occupancy arrangements among co-lessees. 3. Individual Responsibility Agreement: This agreement assigns specific rent and tax responsibilities to each co-lessee individually. Each tenant is solely responsible for their designated portion of the rent and taxes, regardless of any unequal division of the property. By naming these different types of agreements, it is clear that the Los Angeles California Agreement between Co-lessees as to Payment of Rent and Taxes can be customized to fit the unique needs and preferences of the co-lessees involved. It provides a framework for a transparent and efficient system of managing rent and tax obligations within a shared rental property. It is crucial for all parties involved in a co-lease agreement to carefully review and understand the terms and conditions outlined in the Los Angeles California Agreement between Co-lessees as to Payment of Rent and Taxes before signing. Seeking legal advice or assistance may be beneficial to ensure that the agreement accurately reflects the intentions and protects the rights of all co-lessees.

Los Angeles California Agreement between Co-lessees as to Payment of Rent and Taxes

Description

How to fill out Los Angeles California Agreement Between Co-lessees As To Payment Of Rent And Taxes?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations require you prepare official paperwork that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business objective utilized in your region, including the Los Angeles Agreement between Co-lessees as to Payment of Rent and Taxes.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Los Angeles Agreement between Co-lessees as to Payment of Rent and Taxes will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to get the Los Angeles Agreement between Co-lessees as to Payment of Rent and Taxes:

- Make sure you have opened the correct page with your localised form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Los Angeles Agreement between Co-lessees as to Payment of Rent and Taxes on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

AB-1482 also exempts single-family owner-occupied homes, including residences in which the owner-occupant rents or leases no more than two units or bedrooms, that are not owned by corporations or real estate investment trusts.

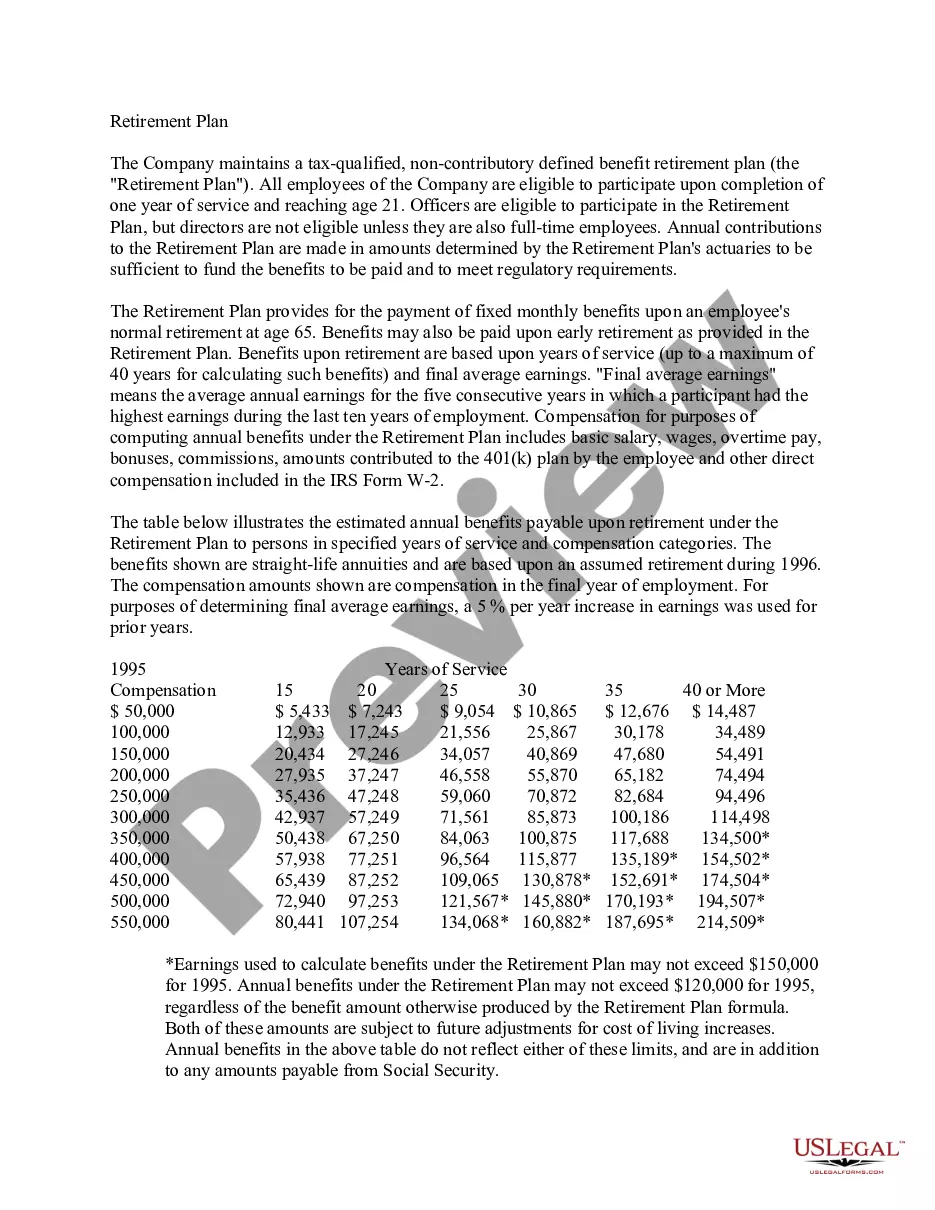

The amount levied is calculated according to the land value and any improvements/buildings added to it, based on the property's market value. With a rental property, the Municipal rates & taxes are also usually paid for by and are the responsibility of the Landlord without reference to the Tenant.

Minimum legal components of a lease are a statement of the parties, a description of the property, the duration of the lease, the amount of the rental, and the time and manner of the rental payment.

AB 1482: A Brief Overview In 2019, California Governor Gavin Newsom signed Assembly Bill 1482 to cap rent increases statewide for the next 10 years. Effective on January 1, 2020, the bill limits annual rent increases at 5 percent, plus any rise in the consumer price index, which cannot exceed 10 percent.

According to California law, if a landlord agrees to lease an apartment to a tenant for more than a year, the agreement must be in writing. If a lease for longer than a year is not in writing, it will not be legally binding, and will not be enforceable be either party.

Although it is always preferable to document every aspect of a tenancy in writing, the lack of a written rental agreement does not deprive you of tenant status. An oral agreement for a month-to-month rental arrangement or for a fixed term of a year or less is valid in California.

A rental agreement is short-term and the terms can be changed by either party, usually at the end of a 30-day period. Whereas a rental lease is a long-term agreement, with agreed terms and conditions that cannot be changed until the end of the lease, unless there is written agreement from both parties.

A California lease agreement allows a landlord of residential or commercial property to write a legally binding rental contract with a tenant. The agreement will describe the property, specify the monthly rent, and list the responsibilities of both parties.

A notice of exemption from AB 1482 is a notice that lets your tenants know that your rental property is exempt from AB 1482. This bill sets the maximum rent increase in California to 5% plus CPI, or at 10% (whichever is lower) per a 12 month period.

A lease refers to a contract where one party grants a right to use a property or land to another party in return for consideration and for a specific period of time. Both the parties enter into a lease agreement specifying the terms and conditions of the agreement.