Maricopa, Arizona Agreement between Co-lessees as to Payment of Rent and Taxes In Maricopa, Arizona, a Co-lessee Agreement between tenants regarding the payment of rent and taxes is a legally binding document that outlines the responsibilities of each co-lessee in terms of sharing the financial obligations associated with renting a property. This agreement is designed to establish clear guidelines and avoid any potential disputes or misunderstandings that may arise between co-lessees. It ensures that each tenant adheres to their agreed-upon financial commitments, which include both rent and taxes associated with the rental property. There may be various types of Maricopa, Arizona Agreement between Co-lessees as to Payment of Rent and Taxes, depending on the specific needs and circumstances of the tenants. Some common variations include: 1. Equal Payment Agreement: This type of agreement stipulates that each co-lessee is responsible for an equal share of the monthly rent and taxes. For instance, if there are three co-tenants, each will be liable for one-third of the total rental expenses. 2. Proportional Payment Agreement: In this scenario, the rent and taxes are divided proportionally based on each co-lessee's individual share of the total living space. For example, if one co-lessee occupies 60% of the property, they would be responsible for 60% of the rent and taxes, while the others would cover the remaining percentage based on their allotted space. 3. Individual Responsibility Agreement: This type of agreement outlines that each co-lessee is individually responsible for their portion of the rent and taxes. It means that if one tenant fails to pay their portion, the other co-lessees are not obligated to cover the shortfall, potentially leading to legal action or eviction. Regardless of the specific type of Co-lessee Agreement, there are certain elements that are commonly found in Maricopa, Arizona agreements. These may include the start and end dates of the lease, the total amount of rent and taxes due, the payment schedule, the method of payment, late payment penalties, consequences of default, and any additional provisions agreed upon by the co-lessees. It is crucial for all parties involved to carefully review and understand the terms and conditions of the agreement before signing. Seeking legal advice or consulting a real estate professional can ensure that the agreement is fair, comprehensive, and compliant with applicable Arizona laws. Overall, the Co-lessee Agreement as to Payment of Rent and Taxes in Maricopa, Arizona is essential for establishing transparency, accountability, and harmony amongst co-tenants. By clearly delineating the financial responsibilities and obligations, this agreement helps create a positive renting experience for all parties involved.

Maricopa Arizona Agreement between Co-lessees as to Payment of Rent and Taxes

Description

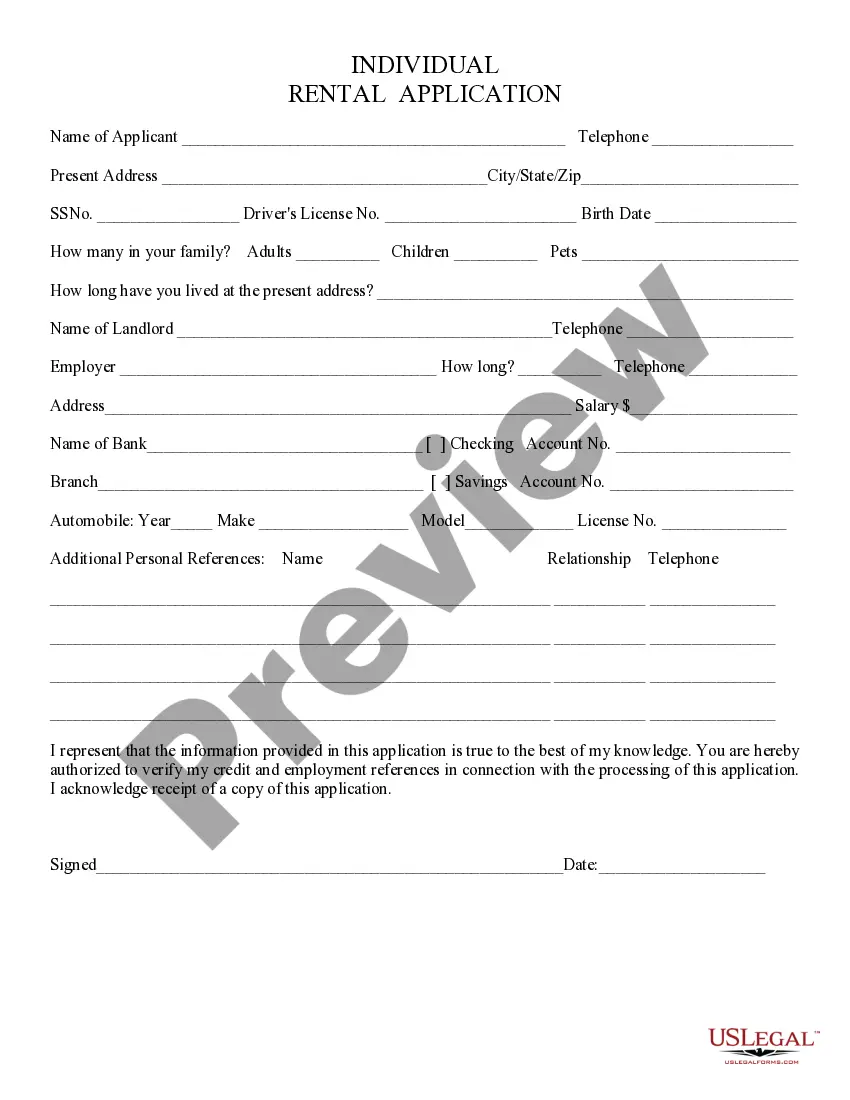

How to fill out Maricopa Arizona Agreement Between Co-lessees As To Payment Of Rent And Taxes?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any personal or business objective utilized in your region, including the Maricopa Agreement between Co-lessees as to Payment of Rent and Taxes.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Maricopa Agreement between Co-lessees as to Payment of Rent and Taxes will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to obtain the Maricopa Agreement between Co-lessees as to Payment of Rent and Taxes:

- Ensure you have opened the correct page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Maricopa Agreement between Co-lessees as to Payment of Rent and Taxes on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!