The Nassau New York Agreement between Co-lessees as to Payment of Rent and Taxes is a legal contract that outlines the terms and conditions agreed upon by individuals who are co-lessees of a property in Nassau, New York, regarding the payment of rent and taxes. This agreement ensures clarity and cooperation between co-lessees, preventing any potential disputes or conflicts that may arise in relation to the financial obligations associated with the lease of the property. Keywords: Nassau New York Agreement, Co-lessees, Payment of Rent, Payment of Taxes, Agreement between Co-lessees, Rent and Taxes, Nassau New York, Lease Agreement, Property Lease, Financial Obligations. Different types of Nassau New York Agreements between Co-lessees as to Payment of Rent and Taxes might include: 1. Fixed Responsibility Agreement: This type of agreement dictates that each co-lessee is responsible for a specific, predetermined portion of the rent and taxes, regardless of any changes in circumstances or occupancy. 2. Proportional Responsibility Agreement: This type of agreement states that each co-lessee is responsible for a proportionate share of the rent and taxes based on the portion of the property they occupy or the percentage of their ownership interest. 3. Joint and Several Responsibility agreements: Under this agreement, each co-lessee shares equal responsibility for paying the entire amount of rent and taxes. If one co-lessee fails to pay their share, the other co-lessees are liable for covering the unpaid amount. 4. Separate Responsibility Agreement: This agreement outlines that each co-lessee is responsible for paying their individual portion of the rent and taxes directly to the landlord or relevant authorities. It effectively separates the financial obligations of each co-lessee. 5. Assignable Responsibility Agreement: This type of agreement allows co-lessees to assign or transfer their responsibility for paying rent and taxes to another co-lessee with the approval of all parties involved. It provides flexibility for co-lessees to redistribute their financial obligations if necessary. Keywords: Fixed Responsibility Agreement, Proportional Responsibility Agreement, Joint and Several Responsibility agreements, Separate Responsibility Agreement, Assignable Responsibility Agreement, Co-lessees, Rent and Taxes, Nassau New York Agreement, Lease Agreement.

Nassau New York Agreement between Co-lessees as to Payment of Rent and Taxes

Description

How to fill out Nassau New York Agreement Between Co-lessees As To Payment Of Rent And Taxes?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Nassau Agreement between Co-lessees as to Payment of Rent and Taxes, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any tasks associated with document completion simple.

Here's how to locate and download Nassau Agreement between Co-lessees as to Payment of Rent and Taxes.

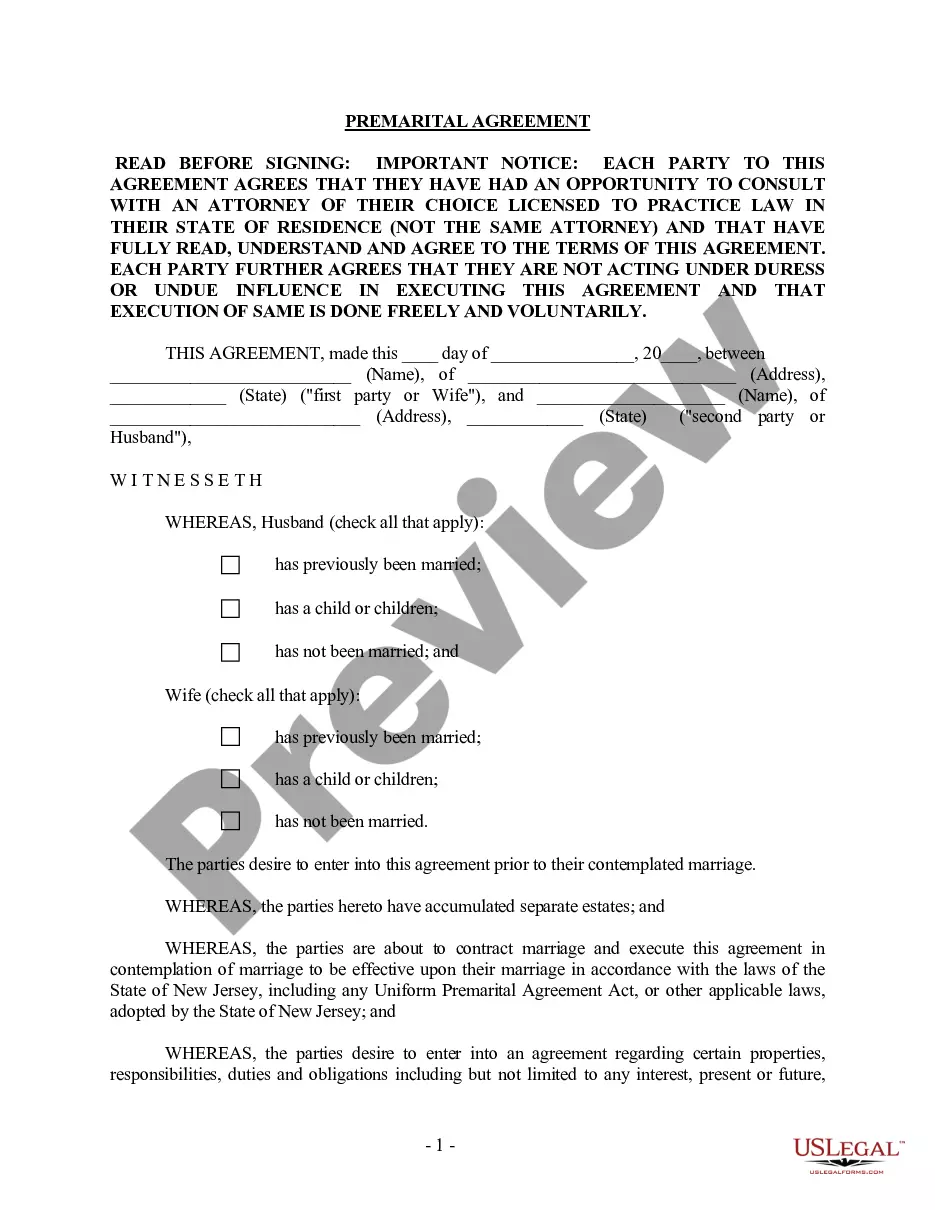

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can affect the legality of some records.

- Examine the related document templates or start the search over to find the correct file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Nassau Agreement between Co-lessees as to Payment of Rent and Taxes.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Nassau Agreement between Co-lessees as to Payment of Rent and Taxes, log in to your account, and download it. Of course, our website can’t take the place of a legal professional completely. If you need to cope with an extremely challenging case, we advise getting a lawyer to examine your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and get your state-compliant documents effortlessly!