Title: Understanding the Tarrant Texas Agreement between Co-lessees for Rent and Tax Payment: Types and Key Considerations Introduction: The Tarrant Texas Agreement between Co-lessees as to Payment of Rent and Taxes is a legally binding contract that outlines the financial responsibilities and obligations between multiple tenants (co-lessees) of a property in Tarrant County, Texas. This comprehensive agreement covers various aspects related to the payment of rent and taxes, ensuring a fair and transparent arrangement among the co-tenants. Different types of this agreement may exist based on specific scenarios or lease arrangements. This article aims to provide a detailed description of the Tarrant Texas Agreement between Co-lessees as to Payment of Rent and Taxes, discussing its key components and essential considerations to make. Key Components of the Agreement: 1. Co-tenancy Information: The agreement begins with a detailed description of all co-lessees involved, including their names, addresses, contact information, and lease start and end dates. It is vital to accurately document this information to establish a clear understanding among the co-lessees. 2. Rent Payment Obligations: This section outlines the rental amount, the due date, and the acceptable payment methods for each co-lessee. It may include provisions for late fees, penalties, and acceptable means of providing notice to other co-lessees. 3. Tax Payment Responsibilities: This component specifies how the co-lessees will distribute and handle property tax payments. It clarifies each tenant's obligations and ensures that tax liabilities are shared based on a fair and agreed-upon formula or percentage. 4. Utilities and Expenses: This section provides guidelines on sharing the costs of utilities, maintenance expenses, repairs, insurance, and any additional expenses associated with the property. Co-lessees determine whether these expenses will be divided equally or allocated proportionally based on the size of their leased areas. 5. Default and Breach: This clause defines the consequences of non-payment, breach of terms, or violation of the agreement by any co-lessee. It usually includes provisions for resolving disputes, remedies for default, and potential termination of the lease agreement. Types of Tarrant Texas Agreements between Co-lessees as to Payment of Rent and Taxes: 1. Equal Distribution Agreement: Under this type of agreement, all co-lessees are equally responsible for paying rent and taxes, regardless of the size or value of their leased areas. 2. Proportional Distribution Agreement: In this scenario, the rent and tax obligations are divided proportionally among the co-lessees, considering the size, commercial value, or specific terms of their respective leased spaces. 3. Customized Agreements: Co-lessees may also create customized agreements to address their unique needs and circumstances. These agreements may include specific provisions related to rent, tax payment, utilities, expenses, and other relevant factors, tailored to the co-tenants' preferences and requirements. Conclusion: The Tarrant Texas Agreement between Co-lessees as to Payment of Rent and Taxes is a crucial legal document that establishes clear guidelines for rent and tax obligations among multiple tenants. By understanding the various components of this agreement and considering the different types available, co-lessees can create a fair and harmonious co-tenancy arrangement. Seeking legal advice or consulting an experienced professional is always recommended ensuring the agreement accurately reflects the intentions and protects the rights and interests of all co-lessees involved.

Tarrant Texas Agreement between Co-lessees as to Payment of Rent and Taxes

Description

How to fill out Tarrant Texas Agreement Between Co-lessees As To Payment Of Rent And Taxes?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Tarrant Agreement between Co-lessees as to Payment of Rent and Taxes, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types ranging from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find detailed resources and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how you can find and download Tarrant Agreement between Co-lessees as to Payment of Rent and Taxes.

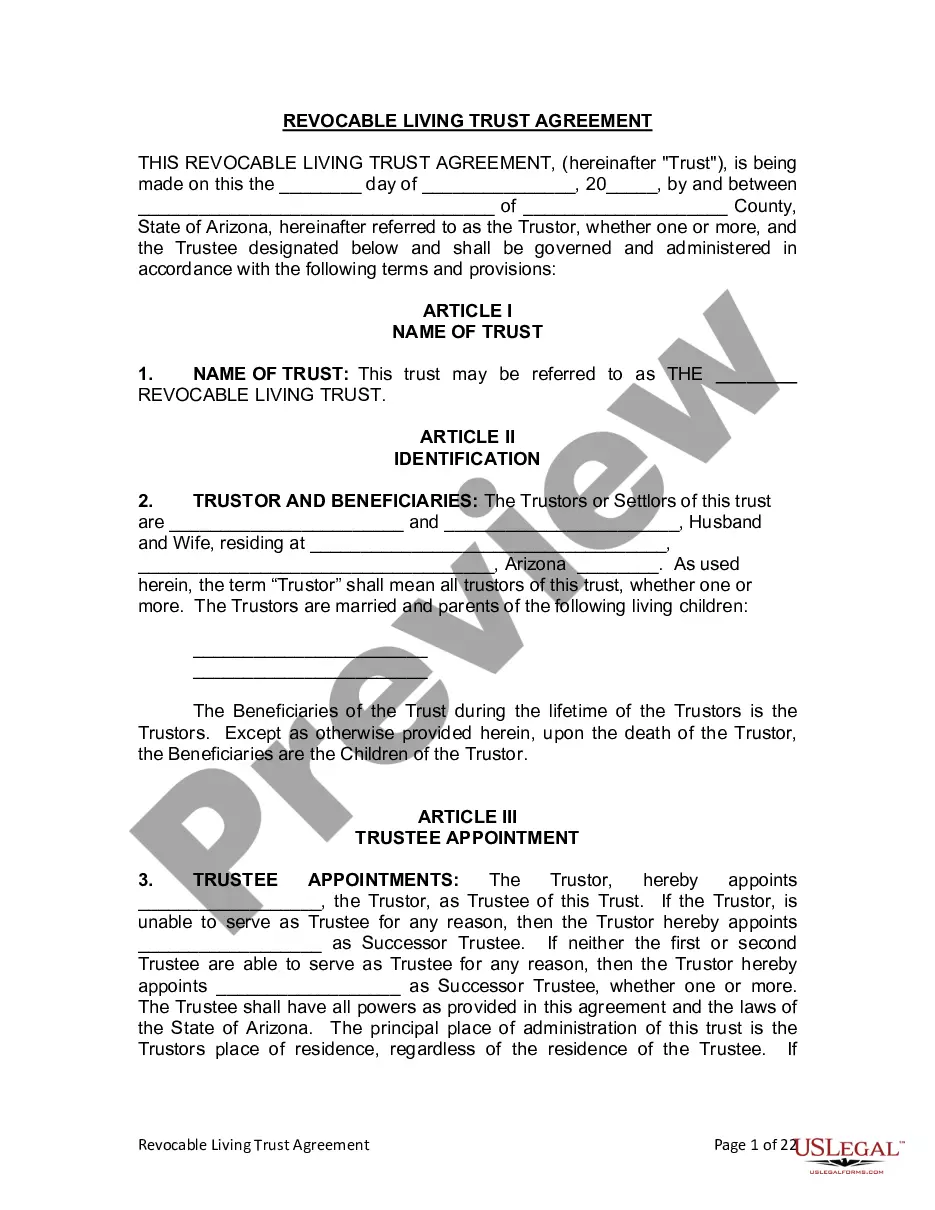

- Go over the document's preview and description (if provided) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the validity of some documents.

- Check the similar forms or start the search over to locate the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and buy Tarrant Agreement between Co-lessees as to Payment of Rent and Taxes.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Tarrant Agreement between Co-lessees as to Payment of Rent and Taxes, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional completely. If you have to cope with an extremely complicated situation, we recommend getting an attorney to check your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and get your state-compliant documents with ease!