The Wayne Michigan Agreement between Co-lessees as to Payment of Rent and Taxes is a legal document that outlines the responsibilities and obligations of multiple parties sharing a lease agreement. This type of agreement is commonly used when two or more individuals decide to enter into a lease agreement together for a property located in Wayne, Michigan. The agreement serves as a contractual arrangement between co-lessees, ensuring clarity and mutual understanding regarding the payment of rent and taxes associated with the leased property. By clearly defining each tenant's responsibilities, the agreement aims to prevent any disputes or misunderstandings that may arise during the lease term. Key terms and provisions are included in the Wayne Michigan Agreement between Co-lessees as to Payment of Rent and Taxes: 1. Parties involved: The agreement specifies the names and contact details of each co-lessee entering into the agreement. It ensures that all parties are aware of their roles and obligations. 2. Lease terms: The agreement includes the pertinent details of the lease, such as the start and end dates, the address of the leased property in Wayne, Michigan, and any specific terms agreed upon by the co-lessees. 3. Rent allocation: This section of the agreement defines how the rent will be divided among the co-lessees. It may outline the percentage or contribution each party is responsible for paying. 4. Tax obligations: The agreement addresses the payment of taxes associated with the leased property, such as property taxes. It clarifies whether these expenses will be split evenly among the co-lessees or allocated based on a predetermined agreement. 5. Rent collection: The agreement outlines the process for rent collection, including the preferred payment method and due dates. It encourages timely and consistent payment to avoid any disruptions or conflicts. 6. Default and remedies: This section covers what happens if one or more co-lessees fail to meet their financial obligations. It may specify penalties, late fees, or the steps for resolving disputes, such as mediation or arbitration. Different variations or types of the Wayne Michigan Agreement between Co-lessees as to Payment of Rent and Taxes may exist based on the specific needs or circumstances of the co-lessees. For example, variations could include agreements specific to commercial properties, residential properties, or even mixed-use properties in Wayne, Michigan. Each agreement may have personalized clauses concerning additional responsibilities, property maintenance, or subleasing restrictions. In conclusion, the Wayne Michigan Agreement between Co-lessees as to Payment of Rent and Taxes is a legal document that codifies the financial responsibilities and obligations of co-lessees sharing a lease in Wayne, Michigan. It provides a clear framework for rent and tax payments, mitigating potential conflicts and facilitating a harmonious co-tenancy.

Wayne Michigan Agreement between Co-lessees as to Payment of Rent and Taxes

Description

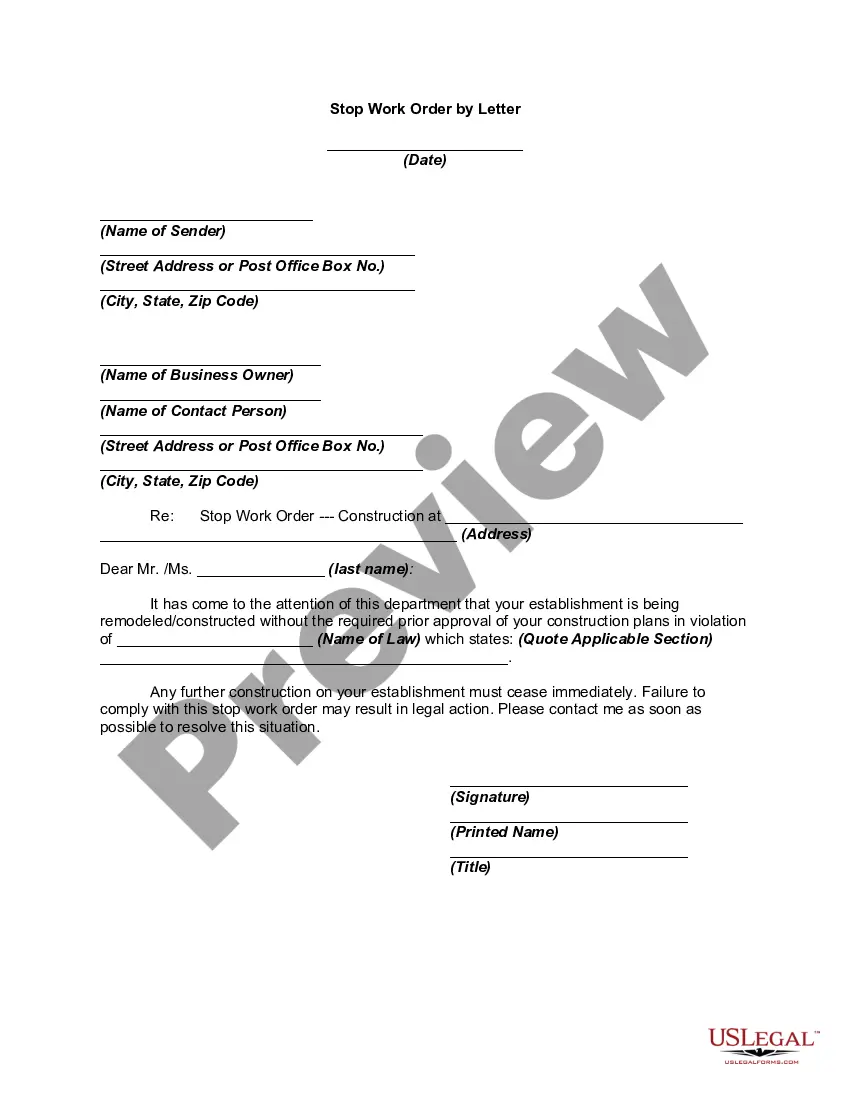

How to fill out Wayne Michigan Agreement Between Co-lessees As To Payment Of Rent And Taxes?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Wayne Agreement between Co-lessees as to Payment of Rent and Taxes, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Wayne Agreement between Co-lessees as to Payment of Rent and Taxes from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Wayne Agreement between Co-lessees as to Payment of Rent and Taxes:

- Examine the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

The two most common types of leases are operating leases and financing leases (also called capital leases).

There are different types of leases, but the most common types are absolute net lease, triple net lease, modified gross lease, and full-service lease. Tenants and proprietors need to understand them fully before signing a lease agreement.

Rental Property Escrow To enroll in escrow, the applicant must complete an application and attach the necessary documents (rental documents, utility bills, and photo ID) online.Submission, the application is reviewed by BSEED for approval. Upon approval, an email is generated to ODFS for sub-account creation.

A lease is classified as a finance lease if it transfers the ownership of assets to the lessee. The example of finance lease may be the car lease in which lessee makes periodic payments to the lessor and after a specific period of time say after five years, the possession of car is transferred to the lessee.

As a responsible tenant, you should never break your side of the agreement. Don't withhold your rent as this could lead to you being evicted by the landlords and losing your home. You have a legal obligation to continue paying your rent.

45 Days or Double. Your landlord has 45 days from when you move out to start a court case for damages.

Different Types of Lease Financial Lease or Capital Lease. Operating Lease. Conveyance Type Lease. Leveraged and Non-Leveraged Lease. Tax-Oriented Lease. Non-Payout and Full Lease. Sales Aid Lease. Net and Non-net Lease.

If the rent is not paid, the Tribunal can terminate the lease and order the eviction of the occupants.

The three main types of leasing are finance leasing, operating leasing and contract hire. Finance leasing.Operating leasing.Contract hire.

To be classified as an operating lease, the lease must meet certain requirements under generally accepted accounting principles (GAAP). An operating lease is treated like rentinglease payments are considered as operating expenses.