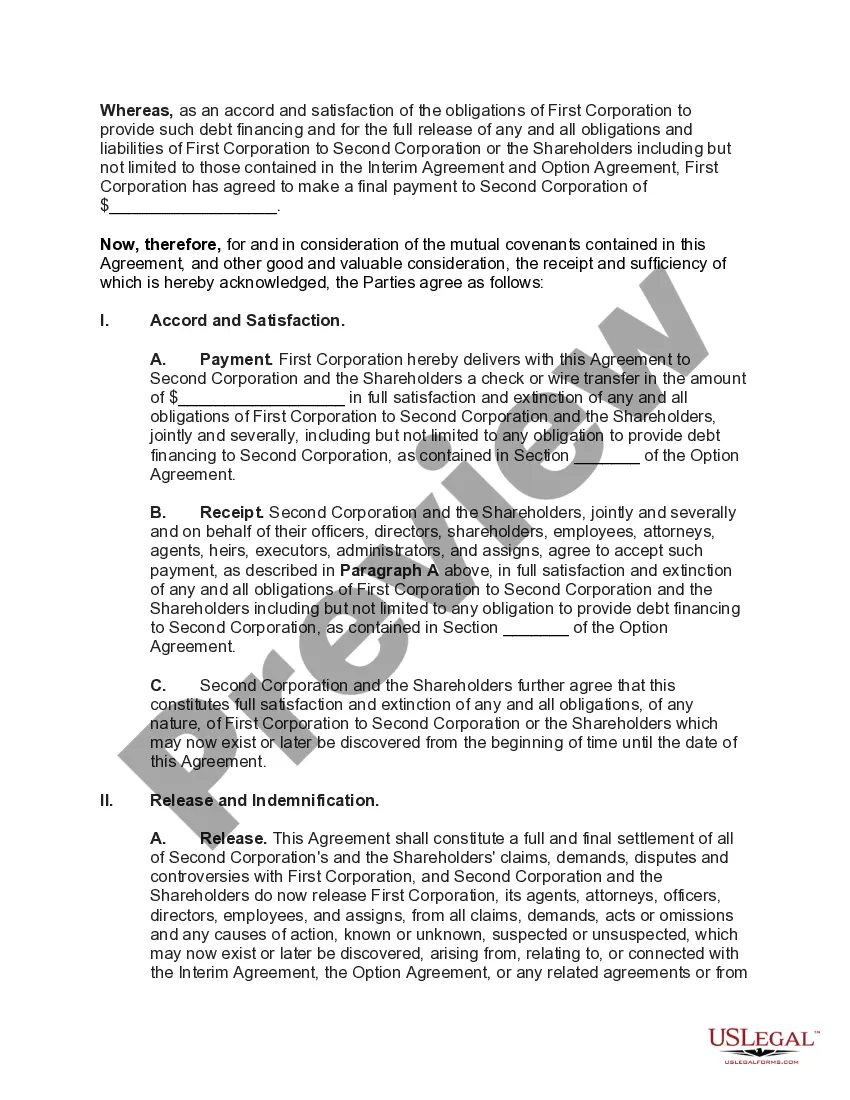

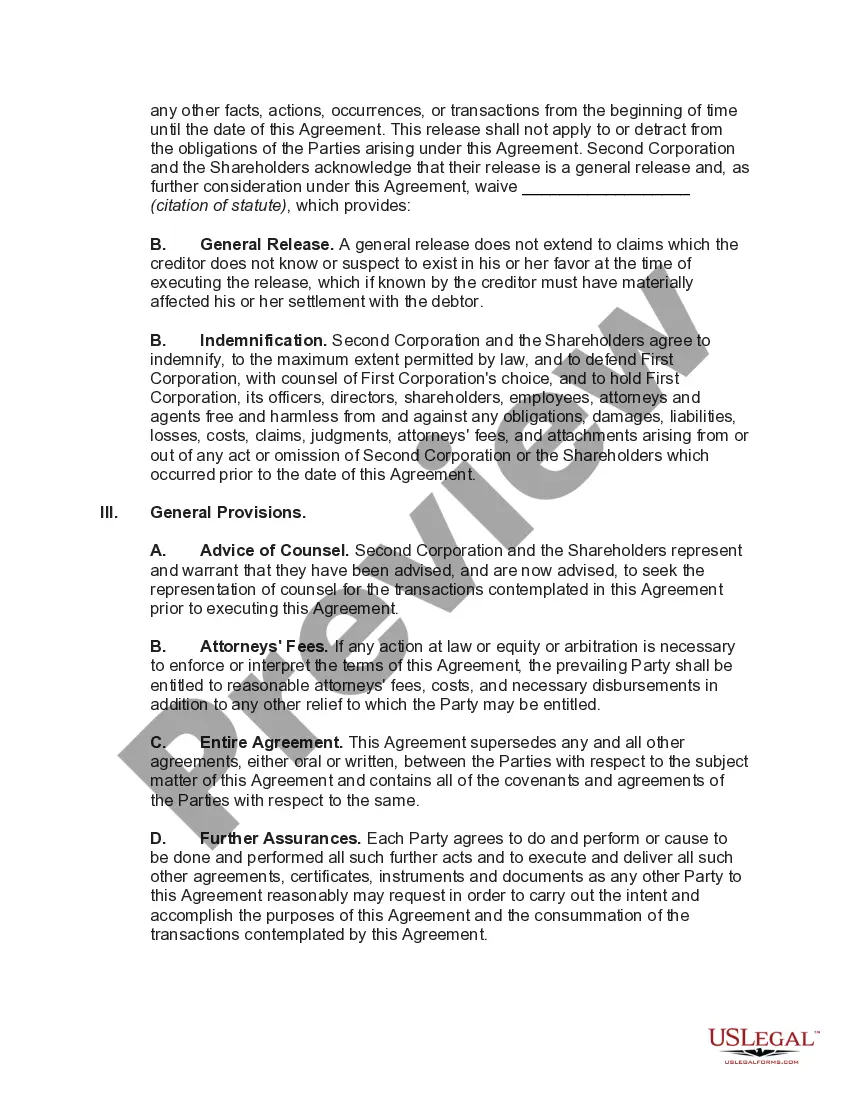

The Cuyahoga Ohio Accord and Satisfaction Release Agreement is a legally binding document designed to settle disputes between two corporations and their shareholders regarding obligations under a stock option agreement. It provides a clear and detailed framework for resolving conflicts and ensuring that all parties involved are satisfied with the outcome. The agreement outlines the terms and conditions of the resolution, including the release of any claims or liabilities between the corporations and shareholders. It aims to prevent future litigation by mutually agreeing on a settlement that is fair and satisfactory to both parties. Keywords: 1. Cuyahoga Ohio: Refers to the specific location where the agreement is applicable, reflecting the jurisdiction and legal framework in which the resolution occurs. 2. Accord and Satisfaction: Indicates the nature of the agreement, emphasizing that it is a mutually acceptable and binding settlement for both parties involved. 3. Release Agreement: Highlights the purpose of the agreement, which is to release any claims or liabilities between the corporations and shareholders. 4. Dispute: Signifies that there is a conflict or disagreement between the corporations and shareholders. 5. Two Corporations: Indicates that the dispute involves two separate corporate entities. 6. Shareholders: Refers to the individuals who have invested in the corporations and have a financial stake in their success. 7. Obligations under Stock Option Agreement: Specifies the specific focus of the dispute, which pertains to the obligations outlined within a stock option agreement. Different types of Cuyahoga Ohio Accord and Satisfaction Release Agreements regarding disputes between two corporations and shareholders regarding obligations under stock option agreements may include variations based on the nature and complexity of the dispute. These variations can be categorized based on specific focus areas, such as: 1. Payment Dispute Resolution Agreement: Specifically addresses disputes related to the payment of stock options or the calculation of shareholder dividends. 2. Breach of Contract Settlement Agreement: Pertains to situations where one party has failed to fulfill their contractual obligations under the stock option agreement. 3. Buyout or Acquisition Agreement: Addresses disputes arising from disagreements over the terms and conditions of a potential buyout or acquisition of shares. 4. Corporate Governance Dispute Resolution Agreement: Focuses on resolving conflicts regarding decision-making processes and corporate governance issues within the corporations. 5. Dispute over Valuation Agreement: Specifically deals with disagreements regarding the valuation of the corporation and its impact on stock options and shareholder value. These different agreement types may have their own specific clauses and provisions tailored to address the nuances of each unique dispute.

Cuyahoga Ohio Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement

Description

How to fill out Cuyahoga Ohio Accord And Satisfaction Release Agreement Regarding Dispute Between Two Corporations And Shareholders Regarding Obligations Under Stock Option Agreement?

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Cuyahoga Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various categories ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less challenging. You can also find information materials and guides on the website to make any activities associated with paperwork execution simple.

Here's how you can locate and download Cuyahoga Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the validity of some documents.

- Examine the related document templates or start the search over to find the correct file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Cuyahoga Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Cuyahoga Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement, log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you need to deal with an exceptionally challenging situation, we recommend using the services of an attorney to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Become one of them today and get your state-compliant documents effortlessly!