Cuyahoga Ohio is a county located in the state of Ohio. It is home to various cities and towns, including Cleveland, the county seat and one of the largest cities in the state. When drafting an Accord and Satisfaction Agreement in Cuyahoga Ohio, there are several important matters to consider. This checklist will outline some key points to address: 1. Parties involved: Identify all parties involved in the agreement, including the debtor (individual or entity owing the debt) and the creditor (individual or entity owed the debt). 2. Debt details: Clearly state the details of the debt being addressed, including the specific amount owed, the original agreement or contract, and any interest or fees accrued. 3. Satisfaction amount: Specify the agreed upon amount that will satisfy the debt. This may include the full original amount, a reduced settlement, or other negotiated terms. 4. Payment terms: Outline the payment terms, such as the due date, frequency, and method of payment (e.g., cash, check, electronic transfer). 5. Release of liability: Include a clause that releases the debtor from any further liability upon receipt of the agreed payment. This ensures that once the debt is satisfied, the creditor cannot pursue additional legal action. 6. Compliance with laws: Ensure that the agreement complies with all applicable federal, state, and local laws, including any specific regulations in Cuyahoga Ohio. 7. Dispute resolution: Specify the process for resolving any disputes that may arise from the agreement. This may include mediation, arbitration, or another agreed-upon method. 8. Governing law: Identify the governing law that will apply to the agreement. In Cuyahoga Ohio, this would typically be Ohio state law. 9. Confidentiality and non-disclosure: Consider including provisions to maintain the confidentiality of the settlement and prevent either party from disclosing sensitive information related to the agreement. 10. Execution and signatures: Clearly state how the agreement can be executed and indicate that all parties must sign the document to make it binding. Different types of Cuyahoga Ohio Checklist of Matters to be Considered in Drafting an Accord and Satisfaction Agreement may include variations based on specific circumstances, such as: — Business debts: If the debt is owed by a business entity, additional considerations may arise, such as the authority of the individuals signing on behalf of the business and the potential impact on the business's credit rating. — Personal debts: If the debt relates to an individual, factors like personal financial hardship or specific payment arrangements may need to be considered. — Legal representation: Parties involved may want to seek legal advice or have legal representation to ensure that their rights and interests are protected throughout the agreement drafting process. In summary, when drafting an Accord and Satisfaction Agreement in Cuyahoga Ohio, it is crucial to consider the parties involved, debt details, satisfaction amount, payment terms, release of liability, compliance with laws, dispute resolution, governing law, confidentiality, and execution process. Adaptations may arise based on different types of situations, such as business debts, personal debts, and the involvement of legal representation.

Cuyahoga Ohio Checklist of Matters to be Considered in Drafting an Accord and Satisfaction Agreement

Description

How to fill out Cuyahoga Ohio Checklist Of Matters To Be Considered In Drafting An Accord And Satisfaction Agreement?

Preparing papers for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to draft Cuyahoga Checklist of Matters to be Considered in Drafting an Accord and Satisfaction Agreement without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Cuyahoga Checklist of Matters to be Considered in Drafting an Accord and Satisfaction Agreement by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Cuyahoga Checklist of Matters to be Considered in Drafting an Accord and Satisfaction Agreement:

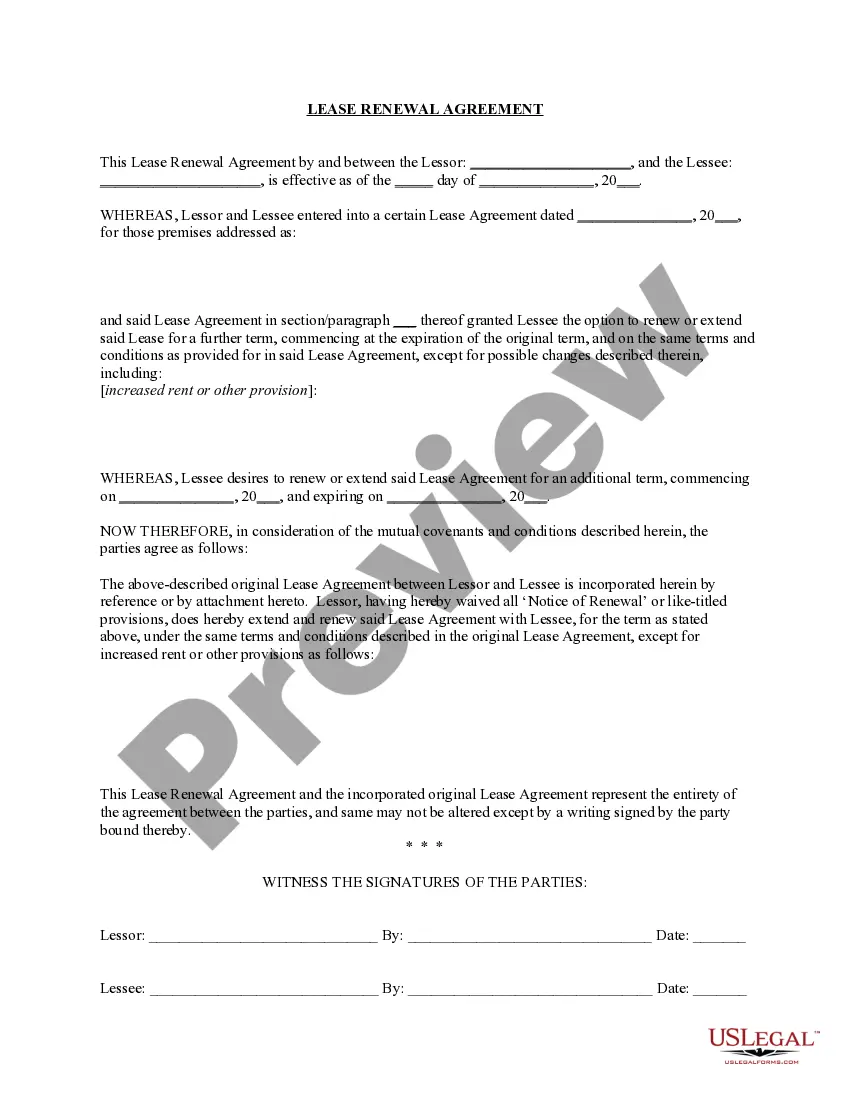

- Look through the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!