Lima, Arizona is a town located in Pinal County, known for its rich history and beautiful scenery. When it comes to legal matters, understanding the process involved in drafting an Accord and Satisfaction Agreement is crucial. This agreement helps in resolving financial disputes, typically involving a creditor and debtor. Here is a checklist of matters to be considered when creating an effective Accord and Satisfaction Agreement in Lima, Arizona, along with some variations of this agreement: 1. Intent and Purpose: — Clearly define the intention and purpose of the agreement, which is to settle a debt or dispute. — State that both parties acknowledge the debtor's offer to settle the debt by paying an agreed-upon amount. 2. Accurate Identification: — Identify the creditor and debtor accurately, including their legal names, addresses, and contact information. 3. Debt Description: — Specify the exact amount owed, including any interest or outstanding fees. — Identify the original debt obligation, such as a loan, contract, or invoice. 4. Payment Terms: — Outline the terms of the settlement, including the amount to be paid and the deadline for payment. — State the accepted methods of payment, such as cash, check, or electronic transfer. 5. Release and Satisfaction: — Include a clause that once the agreed payment is made, the debtor is released from further liability related to the debt. — Specify that upon receipt of payment, the creditor will consider the debt fully satisfied, releasing any legal claims. 6. Mutual Covenants: — Mutual promises between the creditor and debtor may include confidentiality obligations or non-disparagement clauses. — Optionally, both parties can agree to refrain from any further legal action related to the settled debt. 7. Governing Law and Jurisdiction: — Determine the governing law, specifying that any disputes related to the agreement will be resolved under the laws of Lima, Arizona. — Mention the jurisdiction and venue for potential legal actions, often a local court in Pima County. 8. Signatures and Witnesses: — Provide space for the signatures of both parties, including dates. — Consider including an optional witness section to strengthen the validity of the agreement. Variations of Accord and Satisfaction Agreements: — Full and Final Settlement Agreement: This type of agreement ensures that once the agreed amount is paid, the debtor is absolved from any future claims by the creditor. — Partial Payment Agreement: In situations where the debtor cannot fulfill the entire debt, a partial payment agreement can be drafted, outlining a specific amount and timeline for completion. — Release of Liability Agreement: This agreement focuses on releasing the debtor from any legal liability related to a particular debt, ensuring future protection. In conclusion, a well-drafted Accord and Satisfaction Agreement in Lima, Arizona provides a solid foundation for resolving financial disputes. It is essential to consider the aforementioned checklist and, if necessary, one of the variations to ensure all parties are protected and understand the terms outlined in the agreement.

Pima Arizona Checklist of Matters to be Considered in Drafting an Accord and Satisfaction Agreement

Description

How to fill out Pima Arizona Checklist Of Matters To Be Considered In Drafting An Accord And Satisfaction Agreement?

Drafting paperwork for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to create Pima Checklist of Matters to be Considered in Drafting an Accord and Satisfaction Agreement without professional help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Pima Checklist of Matters to be Considered in Drafting an Accord and Satisfaction Agreement by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Pima Checklist of Matters to be Considered in Drafting an Accord and Satisfaction Agreement:

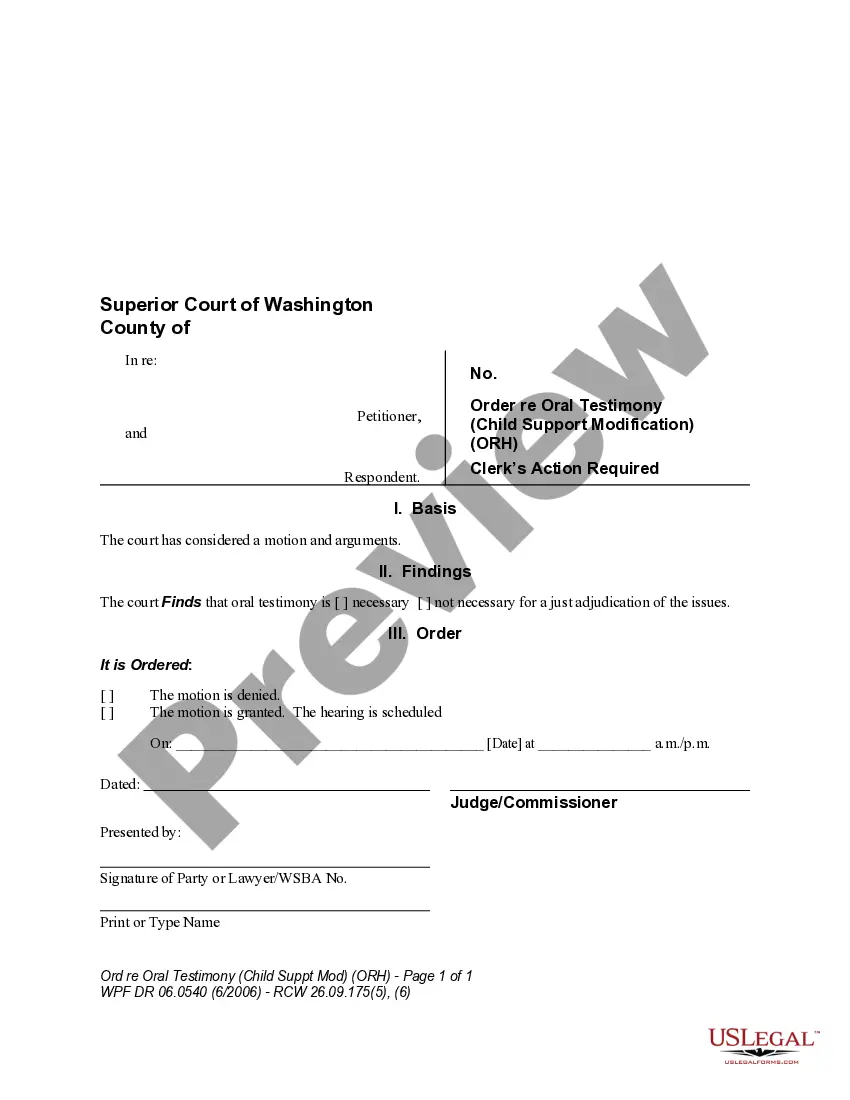

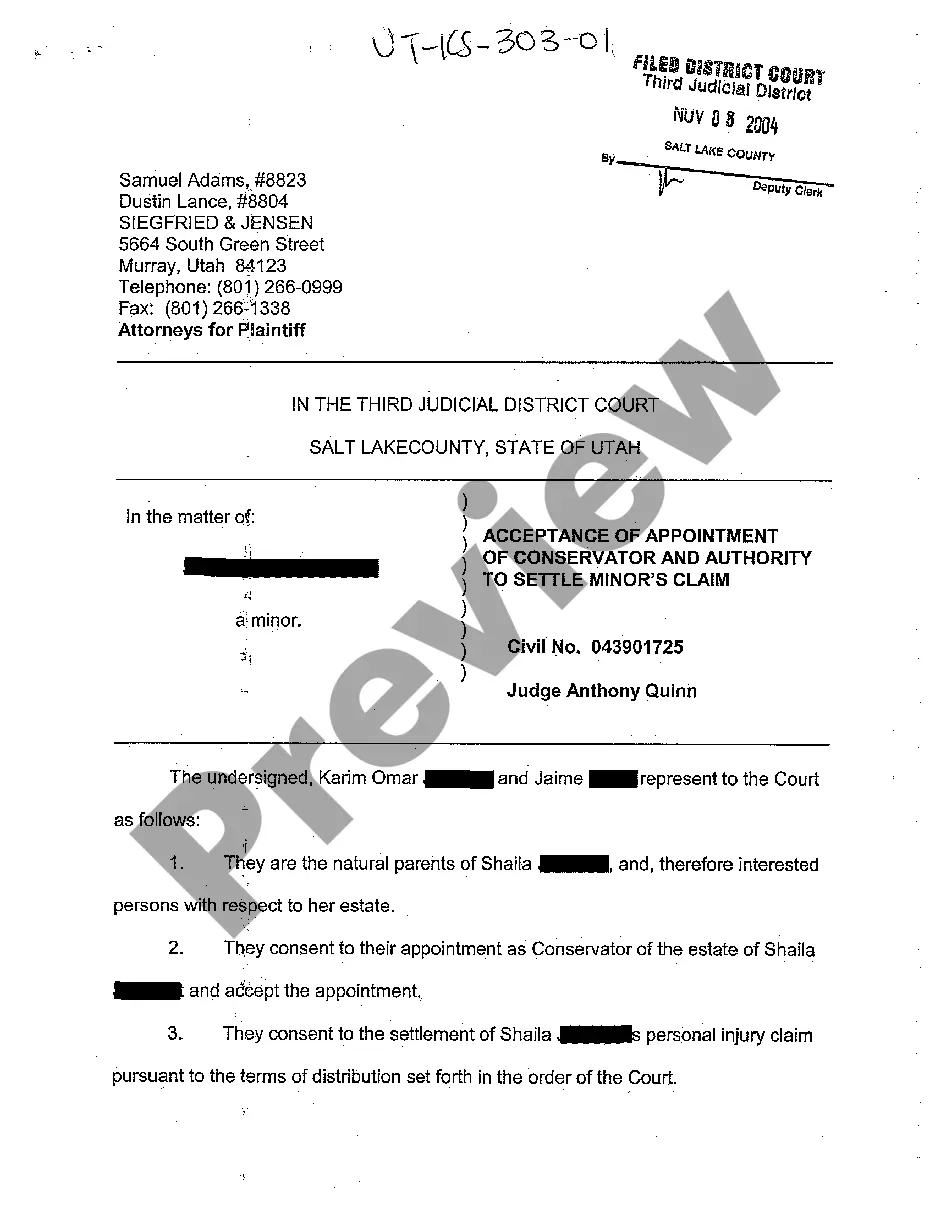

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

The accord is the agreement to discharge the obligation and the satisfaction is the legal "consideration" which binds the parties to the agreement.

Under most state law, a valid accord and satisfaction requires four elements as a minimum, usually, (1) proper subject matter, (2) competent parties, (3) meeting of the minds of the parties and (4) adequate consideration.

Offer and Acceptance A contract needs to have a valid, understandable, and specific offer, and there must be acceptance of the offer. Both the offer and acceptance of offer must be brief but clear enough so there will be no room for error. Acceptance can be oral, written, or by way of conduct.

The definition of accord is to come to a compromise or agreement. An example of coming to an accord is the signing of a peace treaty between two countries. Accord means by choice. An example of the usage of this colloquialism is: No one asked me to do so, but I cleaned the entire house on my own accord.

Definition. An agreement (accord) between two contracting parties to accept alternate performance to discharge a preexisting duty between them and the subsequent performance (satisfaction) of that agreement.

Definition. An agreement (accord) between two contracting parties to accept alternate performance to discharge a preexisting duty between them and the subsequent performance (satisfaction) of that agreement.

Accord and satisfaction deals with a debtors offer of payment and a creditors acceptance. of a lesser amount than the creditor originally purported to be owed. It is a method of discharging a claim by settlement of the claim and performing the agreement.

Accord and satisfaction is a settlement of an unliquidated debt. For example, a builder is contracted to build a homeowner a garage for $35,000. The contract called for $17,500 prior to starting construction, to disburse $10,000 during various stages of construction, and to make a final payment of $7,500 at completion.

554, 561 (2001), for the rule that three elements must exist for there to be an accord and satisfaction: (a) there must be a (good faith) dispute about the existence or extent of liability, (b) after the dispute arises, the parties must enter into an agreement in which one party must agree to pay more than that party