Cook Illinois Agreement for Services is a legally binding contract entered into between an attorney and an accountant to conduct a comprehensive examination of a party's financial condition and provide expert testimony in court proceedings. This agreement aims to ensure the accuracy, transparency, and credibility of financial information presented during legal matters. The following are key aspects covered in a Cook Illinois Agreement for Services: 1. Parties involved: The agreement specifies the names and contact details of the attorney and the accountant engaged in the partnership, along with their professional qualifications and licenses. 2. Scope of engagement: The agreement outlines the specific services to be provided by the accountant, which typically include conducting a thorough audit of the party's financial records, analyzing financial statements, evaluating the accuracy of financial reporting, identifying potential irregularities and discrepancies, and providing expert opinions based on their findings. 3. Timelines and deadlines: The agreement establishes the duration of the engagement, including the commencement and completion dates for the accountant's services. It may also include specific deadlines for submitting audit reports, testifying in court, or providing any other required documentation. 4. Fee structure and payment terms: The agreement details the accountant's fees and the payment schedule. This may include an hourly rate, a flat fee, or a combination of both, depending on the nature and complexity of the engagement. Additionally, it specifies how expenses (such as travel costs or research materials) will be reimbursed. 5. Confidentiality and non-disclosure: This agreement includes clauses regarding the confidentiality of financial data and information shared during the engagement. Both the attorney and the accountant are typically ethically bound to maintain the privacy and confidentiality of their client's financial records, unless legally obliged to disclose certain information. 6. Indemnification and liability: The agreement defines the extent of liability and indemnification for both parties involved. It may outline the accountant's responsibility for errors or omissions that may arise during the audit process, as well as any limitations on liability. Different types of Cook Illinois Agreements for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court may include various specializations tailored to specific industries or legal matters. Some examples are: 1. Cook Illinois Agreement for Services related to divorce litigation: This agreement often involves scrutinizing a party's financial records to evaluate assets, income, and liabilities, which are critical in determining spousal support, child support, or the division of property. 2. Cook Illinois Agreement for Services related to bankruptcy proceedings: In this case, the accountant's role may focus on reviewing financial records to identify potential fraud, undisclosed assets, or improper financial transactions, aiding in the determination of the party's financial condition. 3. Cook Illinois Agreement for Services related to business litigation: Such an agreement could involve the accountant providing expert testimony regarding financial damages, lost profits, business valuation, or the identification of financial irregularities within a business dispute. In conclusion, a Cook Illinois Agreement for Services between an attorney and an accountant plays a vital role in ensuring the accuracy and credibility of financial information during legal proceedings. This agreement sets forth the terms, responsibilities, and obligations of both parties, enabling an effective and efficient audit of the party's financial condition and providing expert testimony in court proceedings.

Cook Illinois Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court

Description

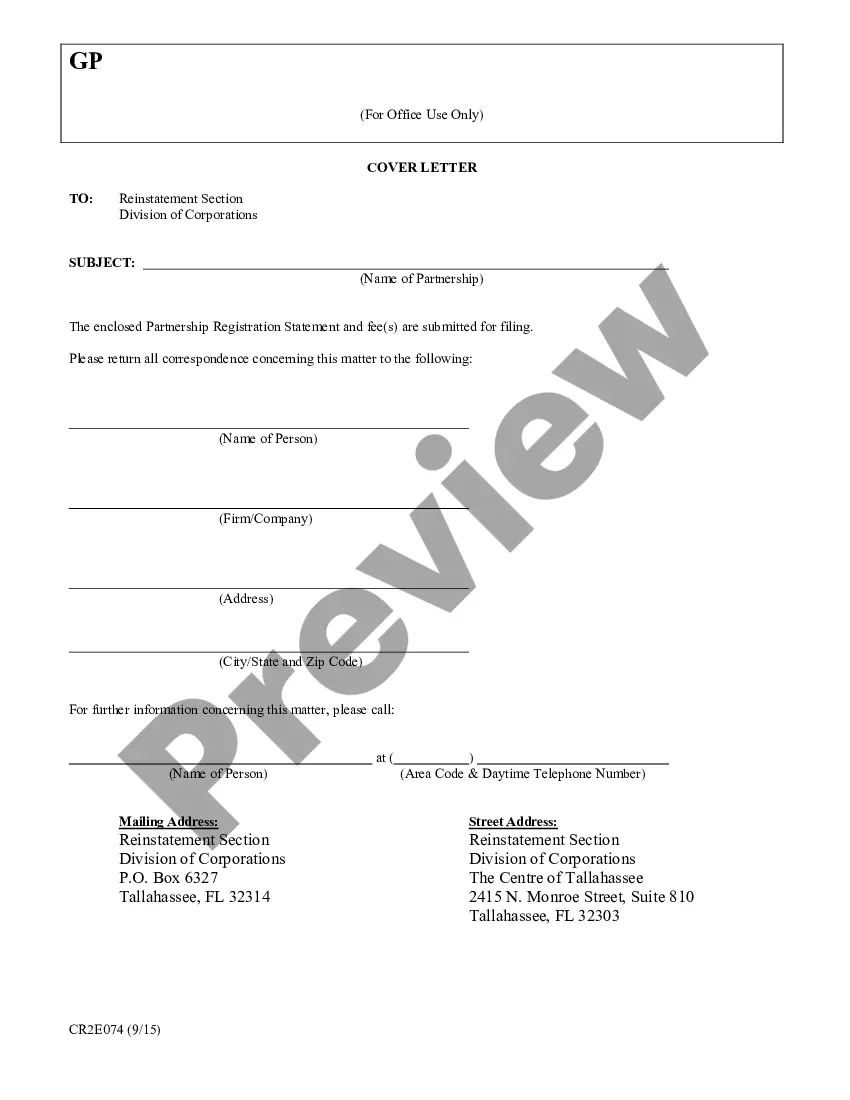

How to fill out Cook Illinois Agreement For Services Between Attorney And Accountant To Audit Party's Financial Condition And To Testify In Court?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Cook Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Cook Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Cook Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court:

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!