The Franklin Ohio Agreement for Services between an Attorney and an Accountant to Audit Party's Financial Condition and to Testify in Court is a comprehensive legal document that outlines the specific terms and conditions by which an attorney and an accountant come together to perform financial auditing services and provide expert testimony in court proceedings. This agreement ensures a professional and ethical partnership between the two parties involved in assessing and presenting accurate financial information in legal matters. Keywords: Franklin Ohio, Agreement for Services, attorney, accountant, audit, financial condition, testify in court. Types of Franklin Ohio Agreement for Services between Attorney and Accountant: 1. Franklin Ohio Agreement for Services to Audit Party's Financial Condition and to Testify in Court: This type of agreement lays out the terms and conditions solely for auditing the party's financial records, preparing financial reports, and providing expert testimony in court. It focuses on the accountant's responsibilities related to financial assessment and testimony. 2. Franklin Ohio Agreement for Services between Attorney and Accountant to Audit and Verify Party's Financial Condition and to Testify in Court: This type of agreement emphasizes both the attorney's and the accountant's responsibilities in evaluating and verifying the party's financial condition. It also covers their roles in providing expert testimony and ensures a collaborative effort in presenting the financial information accurately. 3. Franklin Ohio Agreement for Services between Attorney and Forensic Accountant to Audit Party's Financial Condition and to Testify in Court: This specific type of agreement involves a forensic accountant who works closely with the attorney to investigate and analyze complex financial matters. It may involve detecting fraud, uncovering hidden assets, and providing forensic testimony in court proceedings. 4. Franklin Ohio Agreement for Services between Attorney, Accountant, and Tax Consultant to Audit Party's Financial Condition and to Testify in Court: This agreement includes a third party, a tax consultant, who offers expertise on tax-related matters. The agreement addresses all three professionals' responsibilities concerning auditing the financial condition, providing taxation insights, and offering expert testimony if necessary. In summary, the Franklin Ohio Agreement for Services between an Attorney and an Accountant to Audit Party's Financial Condition and to Testify in Court is a legally binding document that ensures a collaborative and professional relationship in evaluating financial records, preparing reports, and offering expert testimony. Different types of agreements may exist based on the specific roles and additional expertise required, such as forensic accounting or tax consultation.

Franklin Ohio Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court

Description

How to fill out Franklin Ohio Agreement For Services Between Attorney And Accountant To Audit Party's Financial Condition And To Testify In Court?

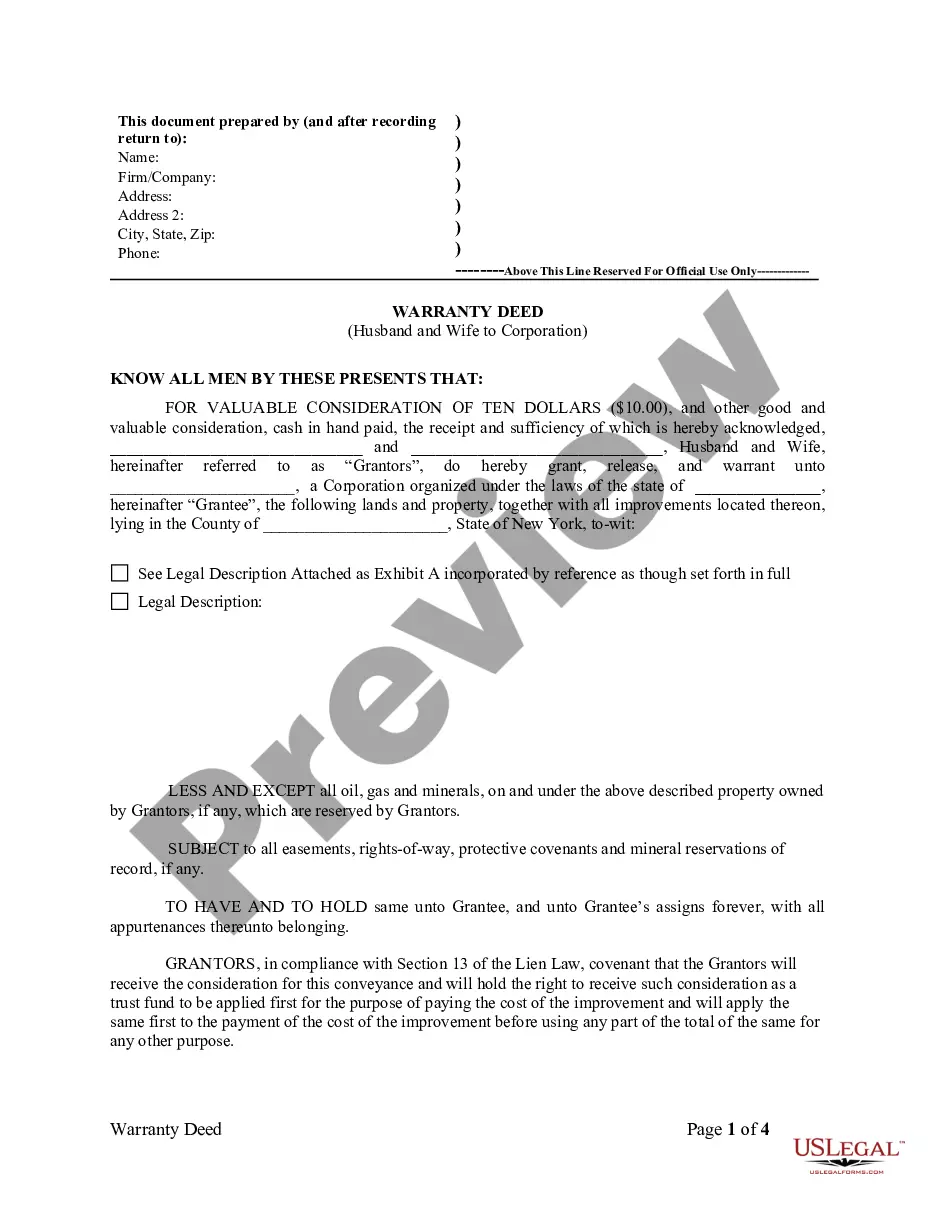

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Franklin Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Franklin Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Franklin Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court:

- Examine the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

First, the Institute's ethical code forbids auditors to provide non-audit services to audit clients if that would present a threat to independence for which no adequate safeguards are available. In such circumstances, the firm must either resign as auditor or refuse to supply the non-audit services.

In the discussion accompanying the rules, the section on tax services says CPAs can continue to provide them for audit clients. Examples of allowable services include compliance, planning and advisory engagements. The rules do not limit allowable services to federal or state income tax issues.

The auditor is prohibited from providing the following non-audit services to an audit client including its affiliates: Bookkeeping. Financial information systems design and implementation. Appraisal or valuation services, fairness opinions, or contribution-in-kind reports.

To be held liable for ordinary negligence, the auditors must have been aware that the financial statements were to be used for a particular purpose, although the identity of the third party need not necessarily be known.

Physical examination. Physical evidence gathered by the auditors themselves to verify whether or not certain assets actually exist, or to verify the asset's condition. Physical examination is also a main source of audit evidence used primarily for any fixed assets, such as usage of machinery or supplies.

The most common type of evidence is simply asking the client and employees questions. This is known as inquiries of the client. Inquiries are the most common because they are the easiest type of evidence to obtain and they can result in direct answers to the questions the audit is attempting to ask.

Auditors review cash management procedures, accounting policies and controls, trial balance accounts and relationships with creditors. If necessary, the auditing firm can provide oversight with capital restructuring or with the complete overhaul or upgrade of the internal accounting system.

Auditor shall not accept an audit engagement if the management imposes any limitation on the scope which will result in the auditor disclaiming an opinion on the financial statements, unless required by law or regulation to do so.

Audit of fixed assets Step 1: understand the client procedure of Fixed Assets acquisition and disposal.Step 2: Obtain Fixed Assets Register as maintained by the Client.Step 3: Vouching of Additions to Fixed Assets. Step 4: Vouching of Deletion from Fixed Assets. Step 5: Depreciation and Amortization.Step 6: Revaluation.

Auditors cannot provide consulting to any client. Once again, the two markets don't interact at all. The consulting competitor now has to price its services at a level that can attract all three client firms, and the two auditors face similar incentives as in the first scenario.

Interesting Questions

More info

A summary of the terms for this agreement, as they appear in the statute, is set forth in Appendix A. The agreement provides for the appointment of a financial advisor to the corporation to supervise the filing of the articles of organization, as well as to provide for the appointment of an accountant to the corporation, together with terms and conditions for making the appointment. The financial advisor is to be appointed, if needed, by the corporation itself. The appointment is in effect until dissolved by the corporation or until the appointment is terminated under the terms set forth in Appendix B.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.