Title: Understanding the Harris Texas Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court Keywords: Harris Texas Agreement, Services, Attorney, Accountant, Audit, Financial Condition, Testify, Court Introduction: The Harris Texas Agreement for Services between Attorney and Accountant plays a crucial role when it comes to auditing a party's financial condition and providing expert testimony in court proceedings. This detailed description aims to shed light on the key aspects of this agreement while highlighting any potential variations that may exist. 1. Purpose of the Agreement: The Harris Texas Agreement for Services between Attorney and Accountant serves as a legally binding document that outlines the responsibilities and obligations of both the attorney and accountant involved in auditing a party's financial condition. The primary purpose is to ensure accuracy and objectivity in assessing financial records, uncovering any irregularities, and providing expert testimony if required in a court of law. 2. Scope of Services: This agreement specifies the specific tasks that the accountant and attorney will undertake during the financial audit. These may include: — Reviewing financial statements and records: The accountant will meticulously analyze the company's financial documents such as balance sheets, income statements, and cash flow statements to assess its fiscal health. — Performing forensic accounting: If any suspicion of fraud or misconduct arises, the accountant may engage in forensic accounting techniques to identify and document any evidence. — Conducting interviews and obtaining supporting documentation: The accountant, with the attorney's guidance, may conduct interviews with employees, stakeholders, and other relevant parties. They may also gather additional documentation deemed necessary to validate financial statements. — Preparing expert reports: The findings of the financial audit will be consolidated into comprehensive reports, which may be utilized as evidence if the case proceeds to court. 3. Confidentiality and Privilege: Recognizing the sensitive nature of financial information, this agreement emphasizes confidentiality and privileged communication between the attorney and accountant. Both parties must abide by strict ethical standards to maintain the confidentiality of client information and protect it from unauthorized disclosure. 4. Testifying as an Expert Witness: If the case proceeds to court, the accountant may be called upon to present expert testimony. The agreement should outline the responsibilities and compensation associated with this crucial aspect. It should also clarify the accountant's preparation for court proceedings, explaining whether mock testimony sessions or discussions with the attorney are required. Different Types of Harris Texas Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court: While the core elements of the agreement remain consistent, there may be variations depending on the specific requirements and circumstances of the case. Some possible variations include: — General Agreement for Financial Audit and Expert Testimony: This standard agreement covers the auditing of financial records and providing expert testimony but does not involve any specialized forensic accounting procedures. — Agreement for Forensic Accounting and Expert Testimony: This type of agreement requires the accountant to focus specifically on investigating financial irregularities, potential fraud, or other forensic accounting tasks, in addition to providing expert testimony. — Limited Scope Agreement for Expert Testimony Only: In certain instances, an attorney may solely require the accountant to provide expert testimony and may not need a comprehensive financial audit. This more concise agreement would cater to such requirements. Conclusion: The Harris Texas Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court serves as the blueprint for conducting a thorough financial audit and providing expert testimony in court proceedings. It defines the roles, responsibilities, and confidentiality requirements, ensuring a professional and comprehensive approach to resolving disputes and presenting accurate financial information in a legal context.

Harris Texas Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court

Description

How to fill out Harris Texas Agreement For Services Between Attorney And Accountant To Audit Party's Financial Condition And To Testify In Court?

Preparing documents for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft Harris Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court without expert help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Harris Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Harris Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court:

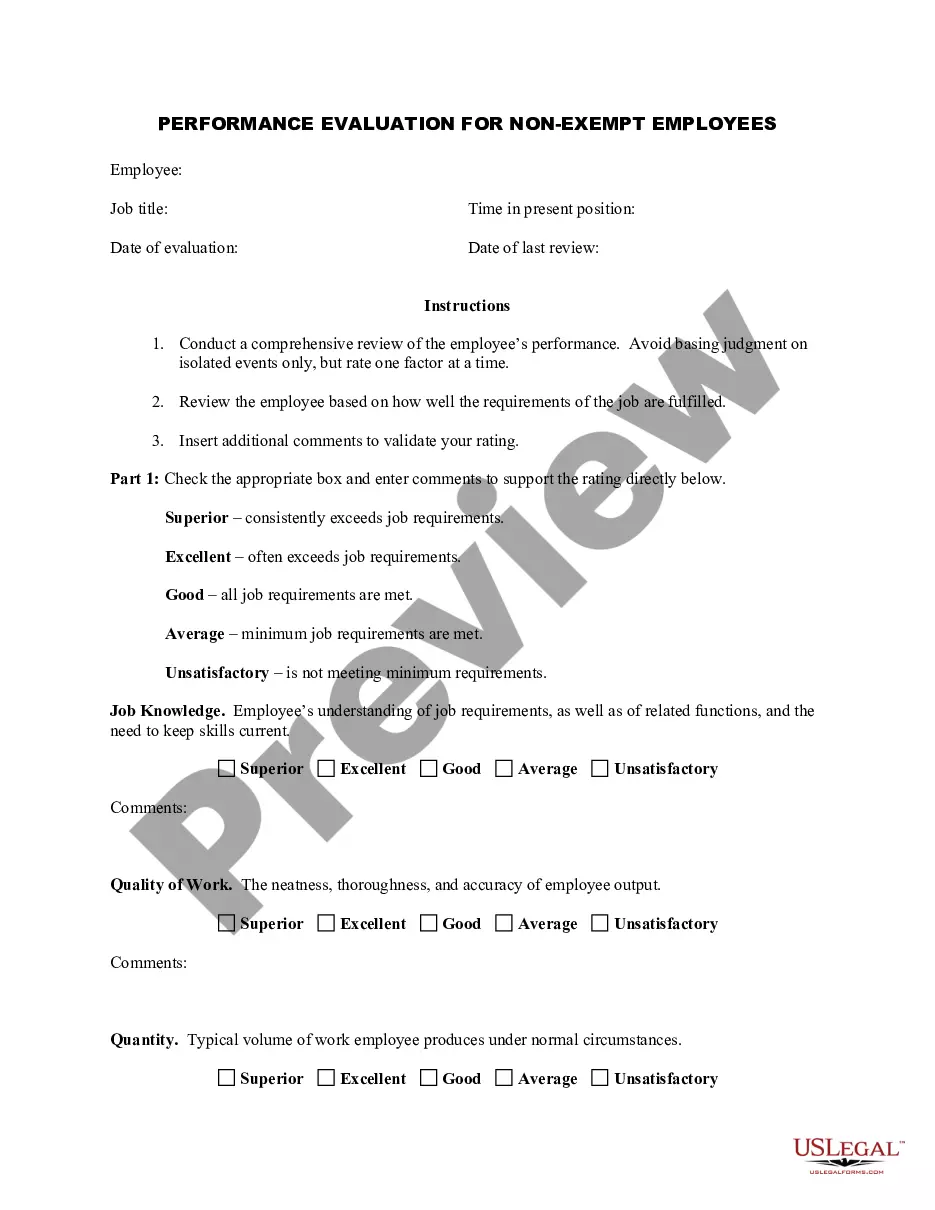

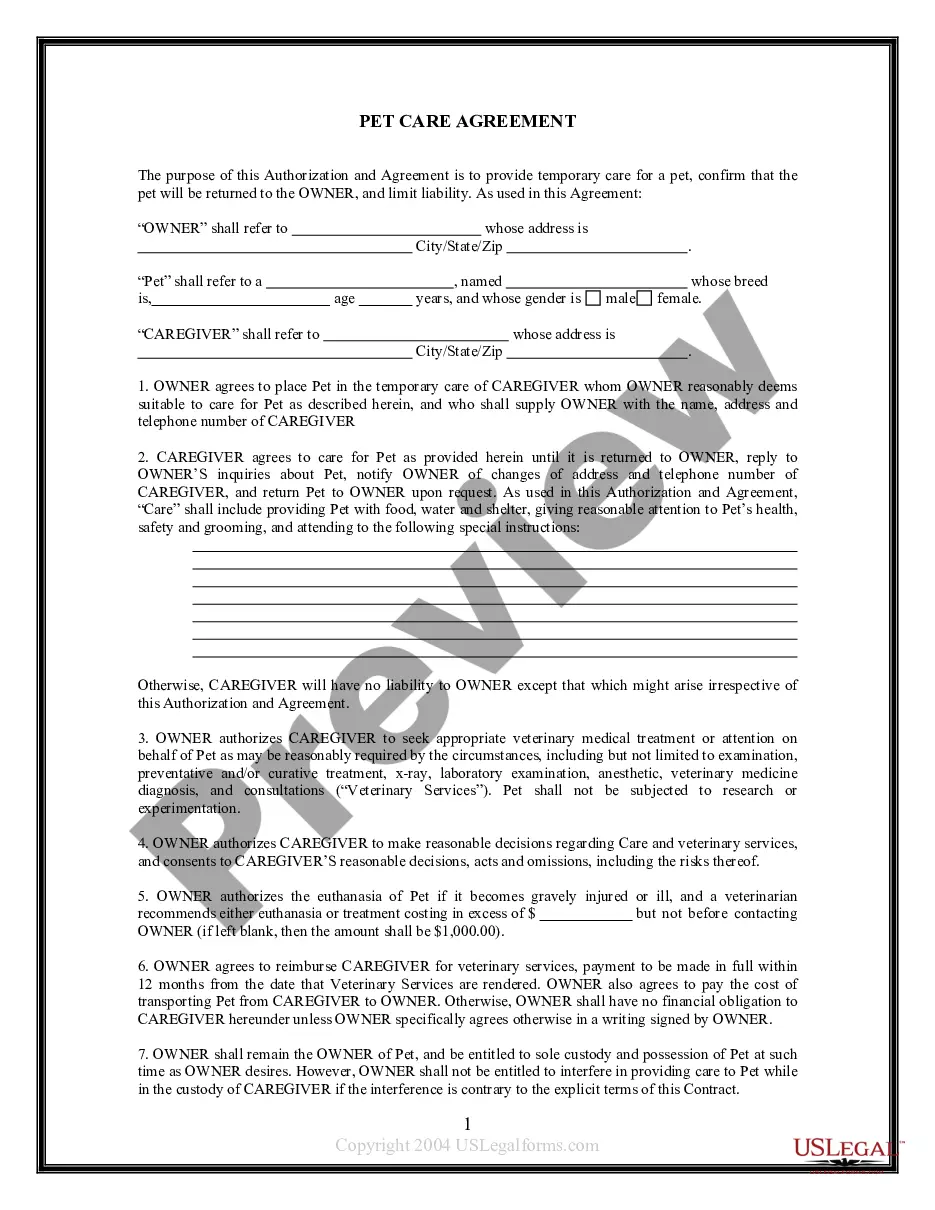

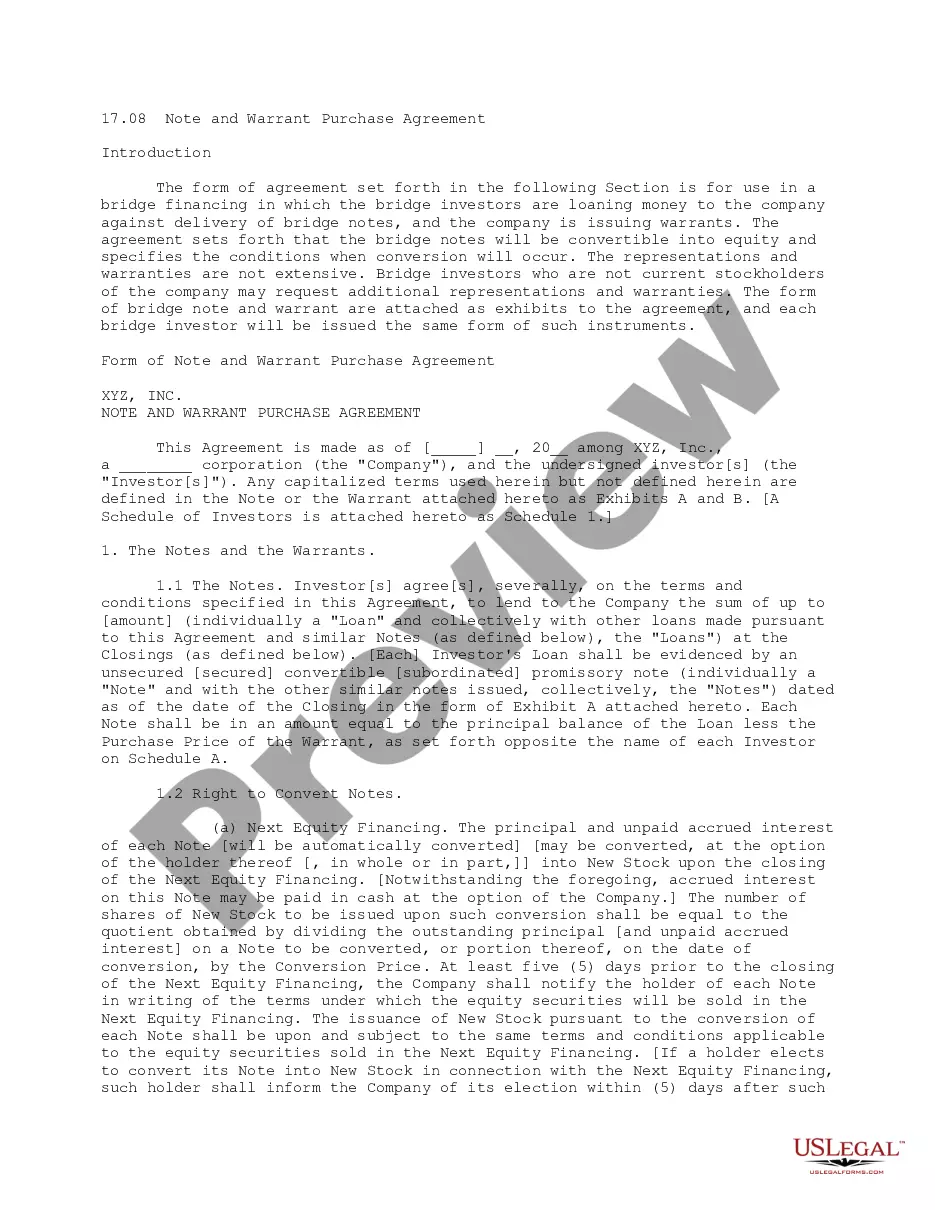

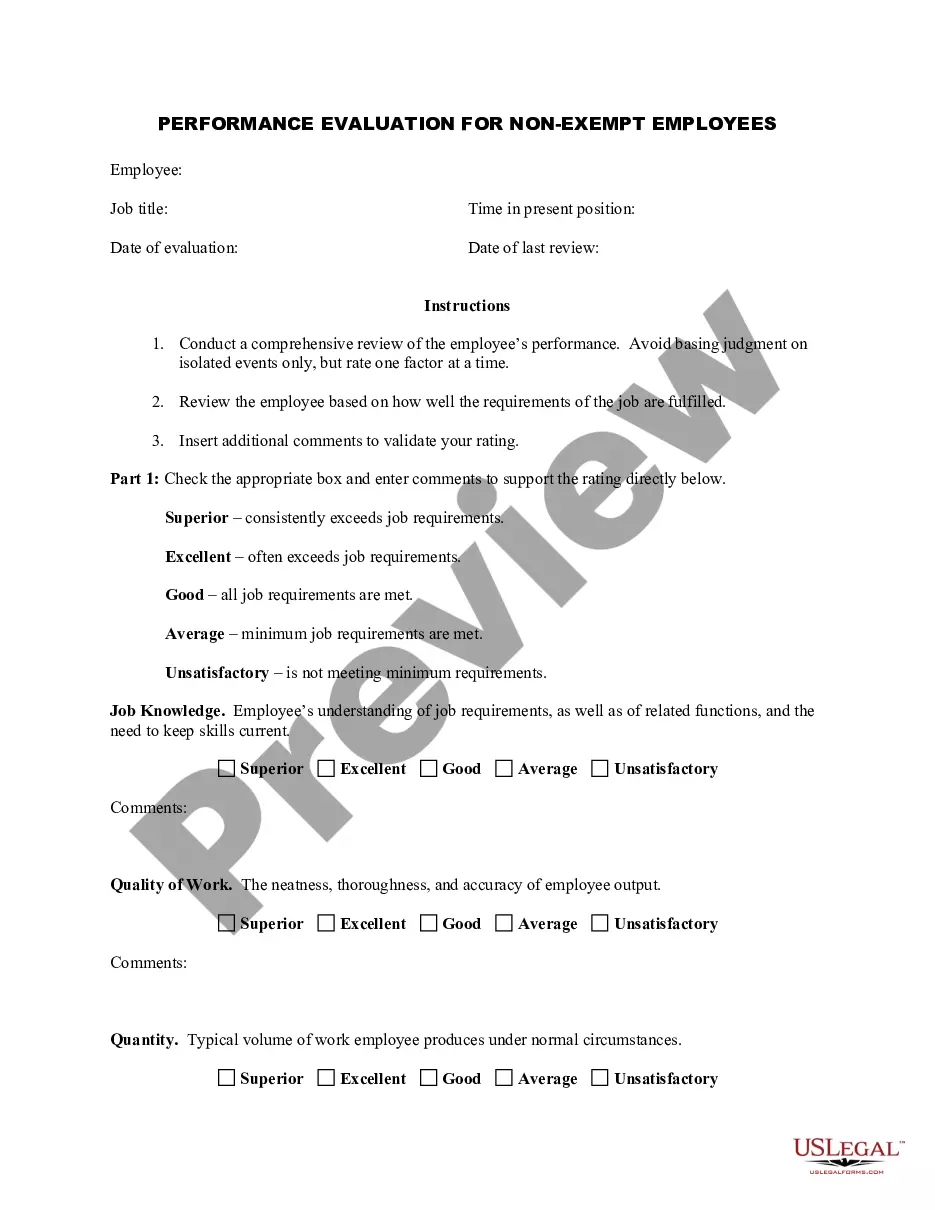

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any scenario with just a couple of clicks!