The Wake North Carolina Charitable Contribution Payroll Deduction Form is a vital document that allows employees in Wake County, North Carolina, to make contributions to charitable organizations directly from their payroll. This form is typically provided by employers to their staff members as part of their employee benefits program and philanthropic initiatives. The Wake North Carolina Charitable Contribution Payroll Deduction Form is designed to simplify the process of giving back to the community by allowing employees to contribute a portion of their wages to eligible charitable organizations of their choice on a regular basis. By completing this form, employees can allocate a specific amount or percentage of their paycheck to be deducted automatically each pay period and directly donated to the charitable organization(s) they select. This form serves as a formal agreement between the employee, their employer, and the chosen charitable organization(s). It outlines the specific terms and conditions of the payroll deduction program, including the duration of the contribution, frequency of deductions, and the amount or percentage to be deducted from each paycheck. By utilizing the Wake North Carolina Charitable Contribution Payroll Deduction Form, employees have the flexibility to support various causes close to their hearts, such as education, healthcare, poverty alleviation, environmental conservation, and more. The form ensures an efficient and hassle-free process, making it convenient for employees to make a significant impact through regular charitable giving. There may be different variations or types of Wake North Carolina Charitable Contribution Payroll Deduction Forms, depending on specific employer programs or policies. Some possible variations could include: 1. General Charitable Contribution Payroll Deduction Form: This form allows employees to contribute to any eligible charitable organization registered in Wake County, North Carolina, based on their personal choice. 2. Workplace Giving Campaign Deduction Form: Some employers organize workplace giving campaigns where they partner with specific charitable organizations. This form enables employees to support these designated charities through regular payroll deductions. 3. Emergency Relief Fund Deduction Form: In times of natural disasters, employers might establish emergency relief funds to help affected communities. This form enables employees to contribute to such funds via payroll deductions, ensuring a coordinated response to urgent needs. In summary, the Wake North Carolina Charitable Contribution Payroll Deduction Form empowers employees in Wake County to make a positive difference in their community by conveniently donating a portion of their earnings to worthy causes. Its flexible nature and commitment to regular giving make it an effective tool for encouraging philanthropy and supporting charitable organizations.

Wake North Carolina Charitable Contribution Payroll Deduction Form

Description

How to fill out Wake North Carolina Charitable Contribution Payroll Deduction Form?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Wake Charitable Contribution Payroll Deduction Form, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Wake Charitable Contribution Payroll Deduction Form from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Wake Charitable Contribution Payroll Deduction Form:

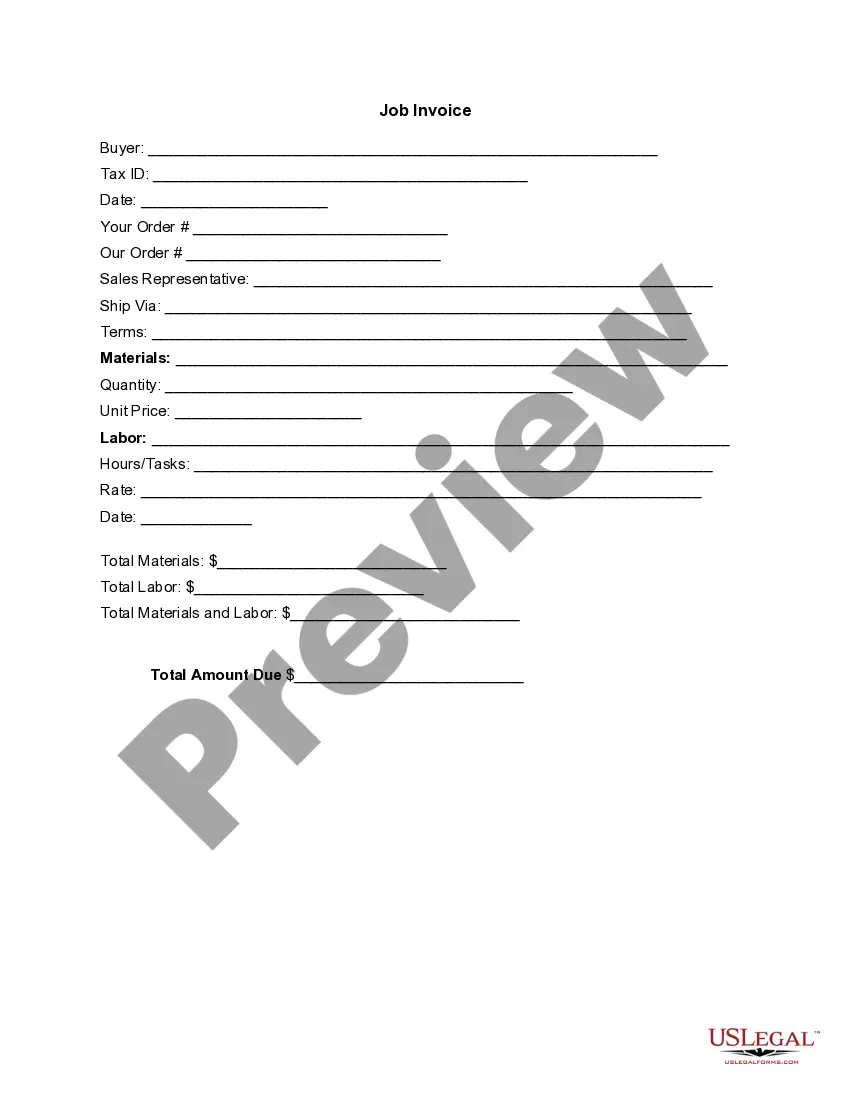

- Analyze the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!