Collin Texas Credit Inquiry

Description

How to fill out Credit Inquiry?

Creating documents for business or personal requirements is always a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it’s crucial to consider all federal and state laws and mandates of the particular area.

However, small counties and even towns also possess legislative guidelines that you must take into account.

To discover the one that satisfies your requirements, employ the search tab in the page header.

- All these factors make it tedious and time-consuming to prepare Collin Credit Inquiry without professional help.

- It is feasible to save money on attorneys crafting your documents and produce a legally sound Collin Credit Inquiry independently, utilizing the US Legal Forms online collection.

- This is the largest online repository of state-specific legal paperwork that is professionally validated, so you can be confident in their legitimacy when selecting a template for your county.

- Previously registered users simply need to Log In to their accounts to retain the necessary form.

- If you do not yet have a subscription, adhere to the step-by-step instruction below to obtain the Collin Credit Inquiry.

- Inspect the page you’ve accessed and verify if it contains the sample you require.

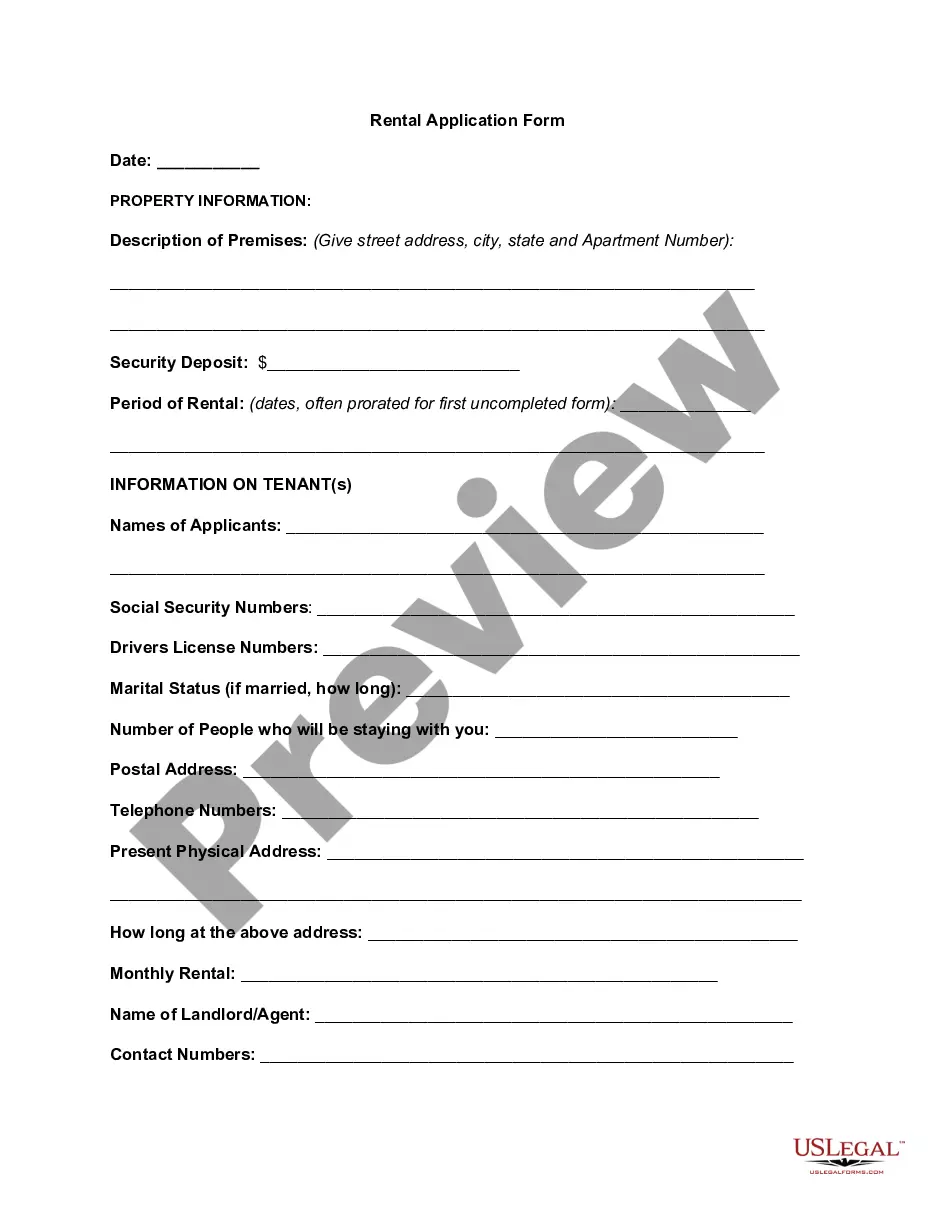

- For this purpose, utilize the form description and preview if these features are available.

Form popularity

FAQ

Collin College has received stimulus money in the form of emergency grants for students who are enrolled in summer. Students can receive this grant even if they are not able to receive other federal funding such as Pell grants and loans.

For the credit to be applied at Collin, the student must have their AP score report sent to Collin from the College Board and request the credit be applied to their Collin record. An official score report must be sent to Collin from the College Board. The College Code for AP is 1951.

What are the GPA requirements? Cumulative GPAs are generated from the Admissions department. If you do not have a GPA with Collin College, the system will generate a GPA from your previous high school, college or university. All applicants are required to have a minimum GPA of at least 2.5.

Collin County Community College District is accredited by the Southern Association of Colleges and Schools Commission on Colleges (SACSCOC) to award baccalaureate degrees, associate degrees and certificates.

The incentive program is a one off grant to help financially that enables a member to display at our annual exhibition/convention. This is open to all members that have not displayed there work before at the show. It is designed to encourage those that may be a bit nervous about doing so.

Student Eligibility In order to qualify for a CARES Act Grant, students must meet all existing Title IV eligibility requirements, which includes completion of a valid 2020-21 FAFSA, as well as the FAFSA verification process. In addition to the FAFSA, students must submit an online application and: be Title IV Eligible.

"Collin College is an affordable university that provides students with a great education at half the price. Collin College has focused teachers who care about the students success and drive the students of the campus to pursue their interests with their best abilities.

Collin County Community College District Is Regionally Accredited. Regional accreditation is a good thing. Attending a regionally accredited institution is important if you may want to transfer credits to another institution or if you want to attend a post-graduate program.

Cost of Attendance In County - Off CampusTuition and Fees$ 1960Books & Supplies1460Housing and Food13,434Transportation27963 more rows

Collin College participates in the following financial aid programs: Federal Pell Grant.