Fulton Georgia Credit Inquiry is a process where an individual or organization seeks to access an individual's credit report and related information from the credit reporting agencies. This inquiry is crucial for financial institutions, lenders, landlords, and potential employers to assess an individual's creditworthiness and make informed decisions. In Fulton County, Georgia, credit inquiries are commonly conducted by various entities for different purposes. These inquiries can be broadly classified into two types: "hard inquiries" and "soft inquiries." 1. Hard Inquiries: Hard inquiries occur when a person or entity requests access to an individual's credit report with their explicit consent. Such inquiries typically happen when an individual applies for a mortgage, car loan, credit card, or any other form of credit. Hard inquiries affect an individual's credit score as they indicate potential new credit obligations. However, a single hard inquiry is unlikely to significantly impact the credit score. 2. Soft Inquiries: Soft inquiries are initiated without an individual's involvement or explicit consent. They occur when a person or organization accesses an individual's credit report for informational purposes, background checks, preapproved credit offers, or account reviews. Soft inquiries do not impact an individual's credit score since they are not related to new credit applications. Examples of soft inquiries include credit checks by landlords, credit monitoring services, or potential employers for background screening. Fulton Georgia Credit Inquiries play a vital role in the financial landscape as they assist in determining an individual's creditworthiness, managing risk, and making informed decisions regarding extending credit, rental agreements, employment, or business partnerships. It is essential for individuals to regularly review their credit reports from major credit reporting agencies, such as Equifax, Experian, and TransUnion, to stay informed about the inquiries made and to promptly address any inaccuracies or fraudulent activities. Note: The specific procedures and regulations regarding credit inquiries may vary over time or due to factors like changes in legislation. It is advisable to consult official sources and professionals for the most up-to-date and accurate information regarding Fulton Georgia Credit Inquiry processes.

Fulton Georgia Credit Inquiry

Description

How to fill out Fulton Georgia Credit Inquiry?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Fulton Credit Inquiry, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Fulton Credit Inquiry from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Fulton Credit Inquiry:

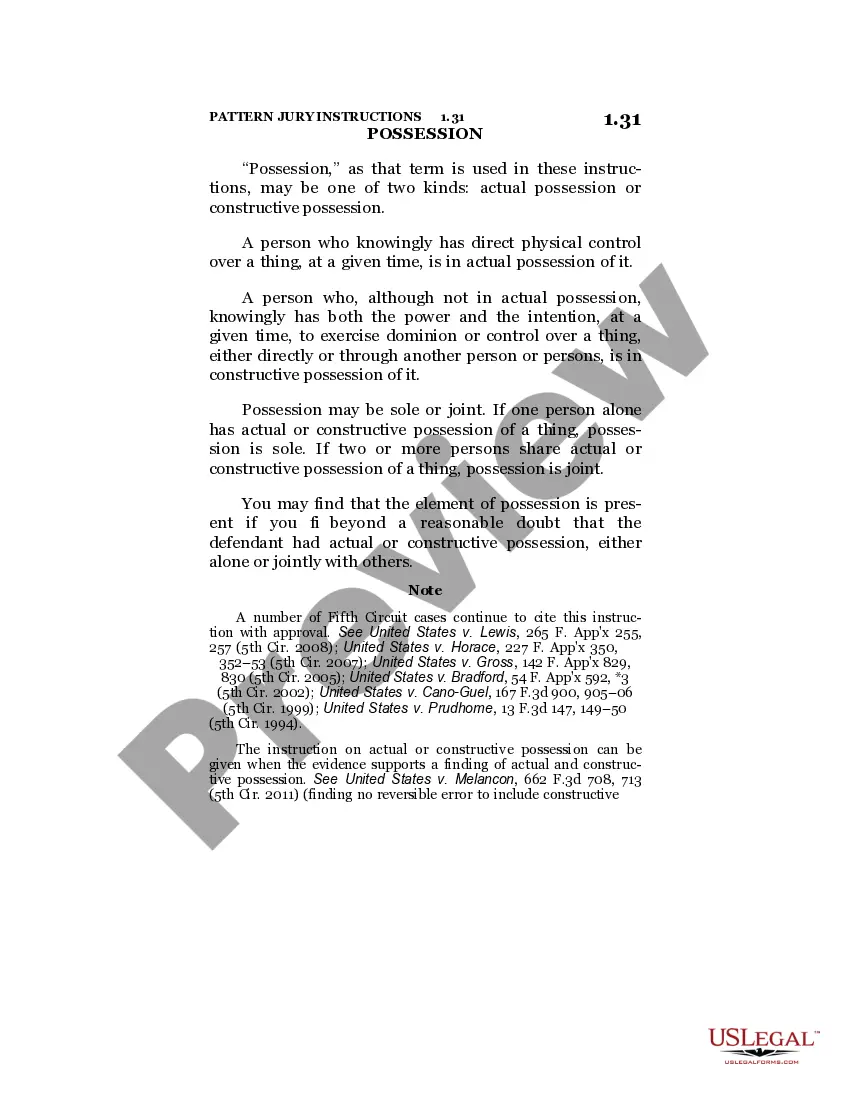

- Analyze the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!