Maricopa Arizona Credit Inquiry: A Comprehensive Analysis of Credit Checking Procedures in Maricopa, Arizona Introduction: Maricopa, Arizona Credit Inquiry refers to the process of reviewing an individual's credit history, financial information, and creditworthiness by financial institutions and lenders in the Maricopa area. This inquiry is an essential step for assessing an individual's creditworthiness before granting credit, loans, mortgages, or entering into any financial agreement. In this article, we will explore the different types of Maricopa Arizona Credit Inquiries, their significance, and the benefits they offer. Types of Maricopa Arizona Credit Inquiries: 1. Soft Credit Inquiry: A soft credit inquiry involves a preliminary check of an individual's credit report without affecting their credit score. Soft inquiries are typically performed for informational purposes, such as background checks, pre-approval offers, or when a person requests their own credit report. 2. Hard Credit Inquiry: A hard credit inquiry occurs when lenders or financial institutions review an individual's credit report as part of a loan or credit application process. Unlike soft inquiries, hard inquiries are visible to other lenders and can slightly impact the individual's credit score. Multiple hard inquiries within a short period may indicate a higher credit risk. 3. Employment Credit Inquiry: Employment credit inquiries are conducted by potential employers as part of the hiring process to assess an applicant's financial responsibility. These inquiries do not impact the credit score and focus on the overall creditworthiness and financial stability of the individual. 4. Tenant Screening Credit Inquiry: Landlords or property management companies often perform tenant screening credit inquiries to evaluate the creditworthiness and financial stability of prospective renters. These inquiries help ensure that tenants can fulfill their rental obligations and are less likely to default on rent payments. Significance and Benefits of Maricopa Arizona Credit Inquiry: 1. Risk Assessment: Maricopa Arizona Credit Inquiry plays a crucial role in risk assessment for lenders and financial institutions. By reviewing an individual's credit history, lenders can evaluate the likelihood of timely payments, potential defaults, and assess the overall credit risk involved. 2. Creditworthiness Evaluation: Credit inquiries help determine an individual's creditworthiness, enabling lenders to make informed decisions regarding loan approvals and interest rates. A positive credit history signifies responsible financial behavior and aids in securing favorable credit terms. 3. Fraud Detection: Credit inquiries help detect fraudulent activities, such as identity theft or unauthorized credit applications. Regular monitoring of credit inquiries allows individuals to identify unusual or unauthorized access to their credit history, initiating remedial actions promptly. Conclusion: Maricopa Arizona Credit Inquiry refers to the examination of an individual's credit history, financial information, and creditworthiness by lenders, employers, and landlords. It aids in evaluating credit risk, determining creditworthiness, and detecting fraudulent activities. By understanding the different types of credit inquiries and their significance, individuals can actively monitor their credit reports, improve creditworthiness, and make informed financial decisions in Maricopa, Arizona.

Maricopa Arizona Credit Inquiry

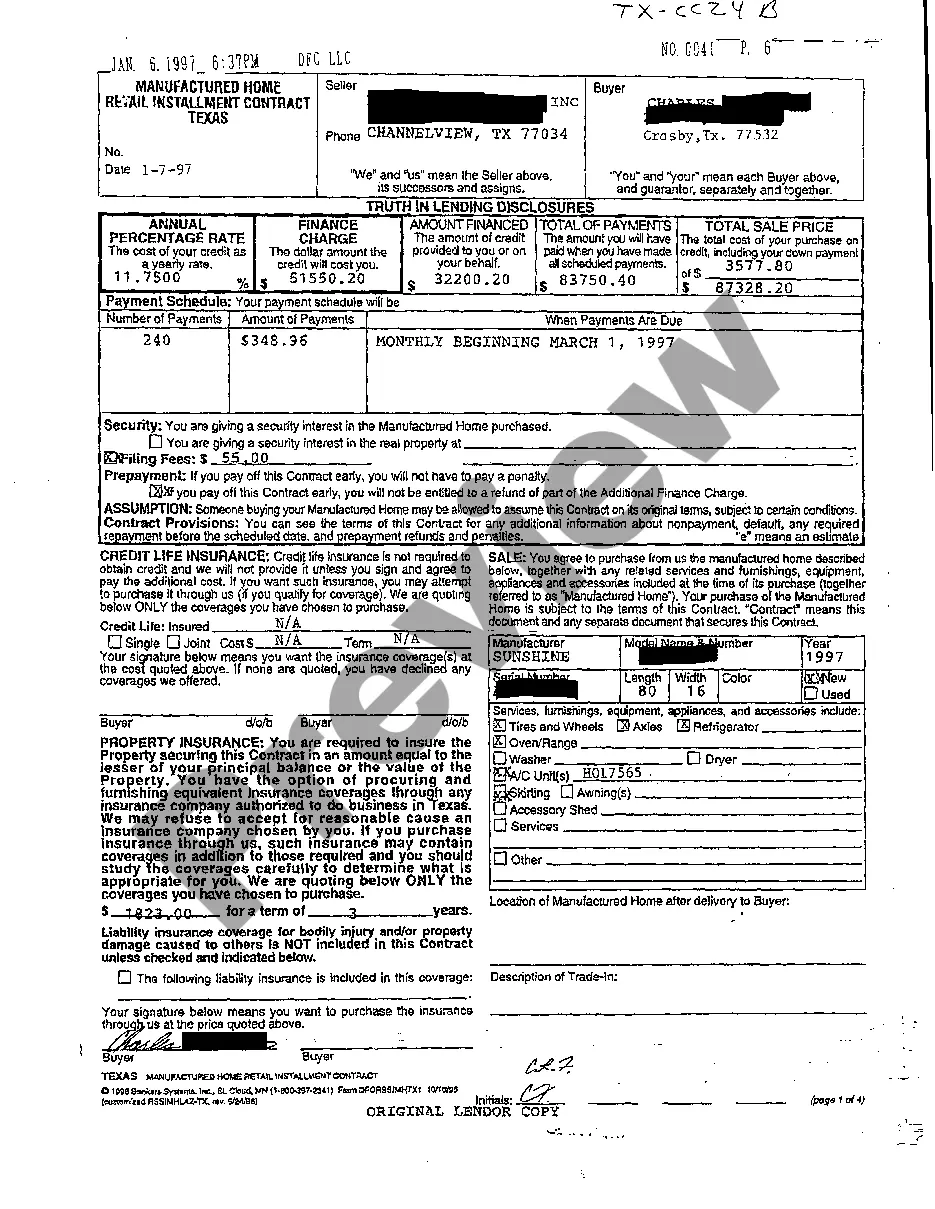

Description

How to fill out Maricopa Arizona Credit Inquiry?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Maricopa Credit Inquiry suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the Maricopa Credit Inquiry, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Maricopa Credit Inquiry:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Maricopa Credit Inquiry.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!