A Contra Costa California Credit Memo Request Form is a document used by entities in Contra Costa County, California, to request a credit memo for various transactions. This form serves as an application to rectify an overcharge, return of goods, or other errors related to billing or sales invoices. The Credit Memo Request Form is an essential tool for both businesses and consumers to ensure accuracy in financial transactions. It allows individuals and organizations in Contra Costa County to reconcile their accounts and resolve any discrepancies promptly. Key elements of the Contra Costa California Credit Memo Request Form often include: 1. Contact Information: The form will require the requestor to provide their name, address, email, phone number, and any other necessary contact details for efficient communication. 2. Vendor/Customer Information: This section will gather pertinent details about the vendor or customer, such as their name, the account number, and the transaction date and number to help identify the specific transaction. 3. Justification for Credit Memo: The form will include a space for the requestor to provide a detailed explanation of the reasons for requesting a credit memo. It may include issues such as overcharges, damaged goods, or any other valid justifications for a refund or adjustment. 4. Supporting Documentation: To process the credit memo request accurately, the form may require attaching relevant supporting documents, such as copies of invoices, receipts, or any other evidence of the alleged discrepancy. 5. Authorized Signatures: Depending on the parties involved, the form may require the customer's or vendor's authorized signature to verify the request and authorize further action. It is important to note that there may be different types of Contra Costa California Credit Memo Request Forms available, depending on the specific industries or organizations involved. For example: 1. Business-to-Business Credit Memo Request Form: This form is used when one business requests a credit memo from another business in Contra Costa County for various purposes, such as overcharges, incorrect billing, or unsatisfactory goods. 2. Retail Consumer Credit Memo Request Form: This form is designed specifically for retail customers in Contra Costa County to request credit memos for issues like damaged products, incorrect pricing, or wrongful charges. 3. Service Provider Credit Memo Request Form: This form is used by service providers, such as contractors or consultants, operating in Contra Costa County, to request credit memos for services that were not provided as expected, or to rectify billing errors. In summary, a Contra Costa California Credit Memo Request Form is a crucial document utilized by businesses and consumers in the county to request credit memos for various reasons. It facilitates the resolution of financial discrepancies between parties and ensures transparent and accurate billing practices.

Contra Costa California Credit Memo Request Form

Description

How to fill out Contra Costa California Credit Memo Request Form?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal paperwork that varies from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Contra Costa Credit Memo Request Form.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Contra Costa Credit Memo Request Form will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to get the Contra Costa Credit Memo Request Form:

- Make sure you have opened the right page with your localised form.

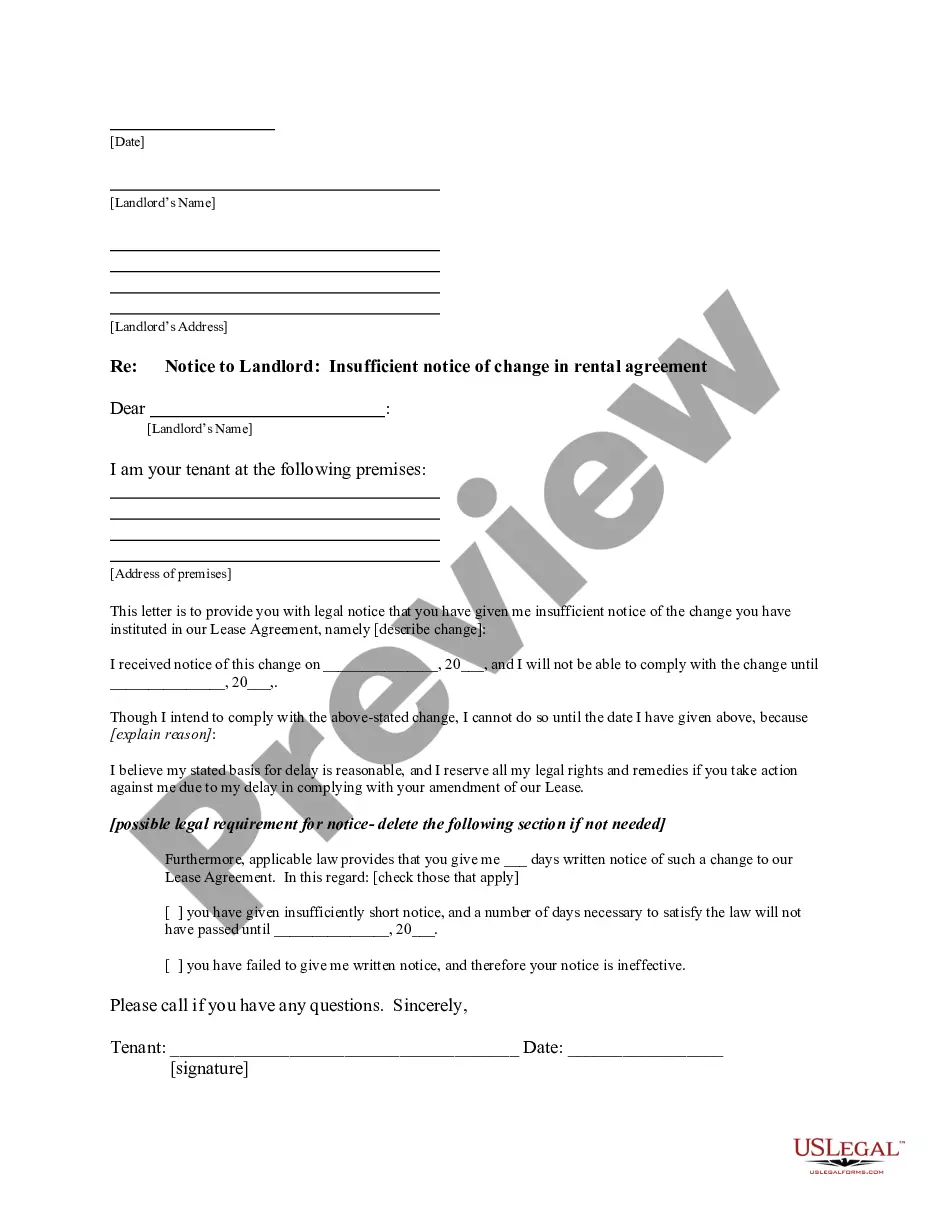

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Contra Costa Credit Memo Request Form on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!