Maricopa Arizona Daily Accounts Receivable is a financial term that refers to the process of tracking, monitoring, and managing the money owed to a business or organization on a daily basis within the Maricopa, Arizona region. It involves keeping records of all incoming payments from customers, clients, or debtors, as well as maintaining a record of outstanding debts and unpaid invoices. The primary objective of Maricopa Arizona Daily Accounts Receivable is to ensure the timely collection of funds owed to the business and to minimize the risk of bad debts. By closely monitoring and maintaining accurate records of accounts receivable, businesses can have a clear overview of their cash flow, improve financial stability, and make informed decisions regarding budgeting and investment. In Maricopa Arizona, there may be different types of Daily Accounts Receivable, including: 1. Commercial Accounts Receivable: This type of accounts receivable involves businesses that sell products or provide services to other businesses or clients within the Maricopa area. It encompasses industries such as retail, wholesale, manufacturing, and professional services. 2. Consumer Accounts Receivable: Consumer accounts receivable refers to the debts owed to businesses by individual consumers residing in Maricopa, Arizona. This category typically includes industries such as healthcare, utilities, telecommunications, and e-commerce. 3. Government Accounts Receivable: This category involves any outstanding billings from local, state, or federal government entities within Maricopa, Arizona. It applies to businesses that provide goods or services to government agencies or organizations, including contractors, vendors, and suppliers. To effectively manage Maricopa Arizona Daily Accounts Receivable, businesses often utilize dedicated software or accounting systems. These systems allow tracking and generating reports related to outstanding invoices, aging of debt, payment history, and customer creditworthiness. Additionally, businesses may employ trained professionals or hire accounting firms to handle the tasks associated with accounts receivable management, such as invoicing, payment processing, debt collection, and reconciliation. Implementing effective accounts receivable practices within Maricopa, Arizona is crucial for ensuring financial stability, maintaining positive cash flow, and fostering strong relationships with customers and clients. Through diligent management and timely collection efforts, businesses can optimize their receivables and promote sustainable growth within the region.

Maricopa Arizona Daily Accounts Receivable

Description

How to fill out Maricopa Arizona Daily Accounts Receivable?

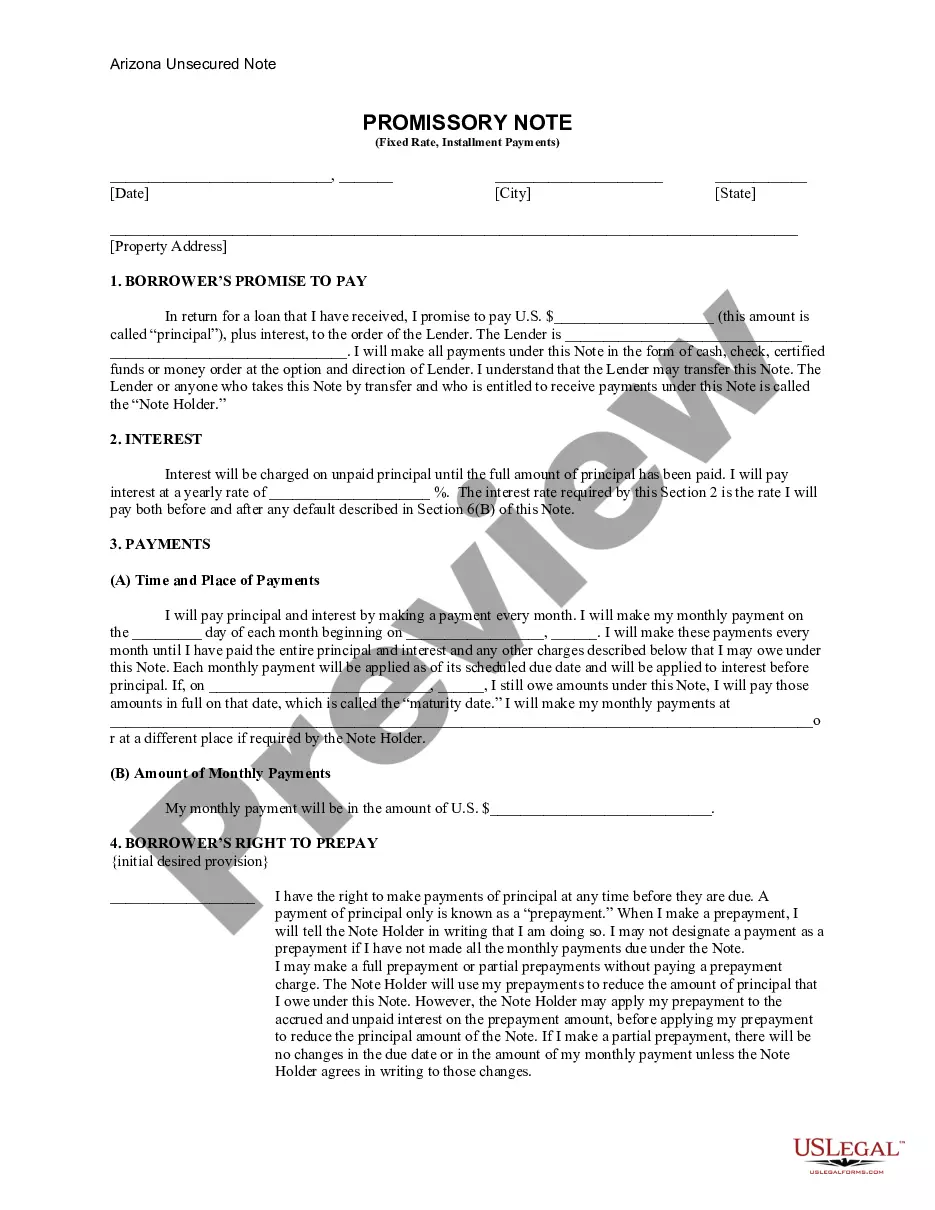

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business purpose utilized in your county, including the Maricopa Daily Accounts Receivable.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Maricopa Daily Accounts Receivable will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Maricopa Daily Accounts Receivable:

- Make sure you have opened the proper page with your regional form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Maricopa Daily Accounts Receivable on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Maricopa County is Arizona's most populous and fastest growing county. It is the largest of Arizona's fifteen counties and the fourth largest county in the nation. Approximately four and half million people call Maricopa County home, more than half of the entire population of Arizona.

According to the United States Census Bureau, the county has a total area of 9,224 sq mi (23,890 km2), of which 24 sq mi (62 km2) (0.3%) are covered by water. Maricopa County is one of the largest counties in the United States by area, with a land area greater than that of four other US states.

District 1602-506-1776. District 2602-506-7431. District 3602-506-7562. District 4602-506-7642. District 5602-506-7092.

During the 1850s and 1860s, Maricopa Wells became a major stagecoach relay station for the first organized semi-public transportation in Arizona ? the San Antonio and San Diego Mail Line and then the Butterfield Overland Mail Line.

Parks. Permitting Services. Public Safety. Attorney's Office. Sheriff's Office. Victim Services. Traffic. Road Closures. Traffic Counts. Transportation Projects. Veterans Resources. Waste & Recycling. Water Management. Rainfall Data. Flood Control Projects.

WASHINGTON ? Maricopa County added more new residents than any county in the nation last year, continuing a trend that local officials call a credit to the region's opportunities and affordability.

Maricopa County is one of the best places to live in Arizona. In Maricopa County, most residents own their homes. In Maricopa County there are a lot of bars, restaurants, coffee shops, and parks. Many families and young professionals live in Maricopa County and residents tend to lean conservative.

Cost of Living in Maricopa, AZ Cost of livingOne personFamily of 4? Total with rent$1985$4509?? Without rent$701$2303? Rent & Utilities$1284$2206?? Food$507$13214 more rows

If you are looking for a safe, affordable, thriving, and friendly place to raise a family, then consider Maricopa for your new home. With many parks in the area and exceptional schools for your students, you are sure to meet new friends and make lasting memories.

Maricopa's Proud History. Maricopa is one of the oldest and most historic communities in the state of Arizona. It is hidden in the middle of the Sonoran Desert, surrounded by mountain ranges that include the beautiful Sierra Estrellas, Palo Verde, Saddleback Mountains and Haley Hills.

Interesting Questions

More info

Accounts Receivable analysis and a customized quote. PAYMENTS for past-due taxes, social security, medicare, medicaid, workers compensation and Unemployment insurance, past due medical needs (i.e. treatment, prescriptions, medical services) may be denied since the claimant may not have made any payments due. However, in-kind contributions made to the Obligated Group must be reported separately. Past-due taxes, social security, medicare, medicaid, workers compensation and Unemployment insurance, past due medical needs (i.e. treatment, prescriptions, medical services) may be denied since the claimant may not have made any payments due. However, in-kind contributions made to the Obligated Group must be reported separately. Payroll taxes due to EBA are reported separately.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.