Orange California Daily Accounts Receivable refers to the financial management process that involves recording, tracking, and monitoring the money owed to a business or organization on a daily basis in Orange, California. It encompasses various activities related to invoicing, collections, and credit management. The daily accounts receivable function plays a crucial role in a company's cash flow management and financial stability. Keywords: Orange California, daily accounts receivable, financial management, recording, tracking, monitoring, money owed, business, organization, invoicing, collections, credit management, cash flow management, financial stability. Different types of Orange California Daily Accounts Receivable include: 1. Customer Invoicing and Billing: In this type, businesses generate invoices on a daily basis to document the products sold or services rendered to their customers in Orange, California. The invoices outline important details such as the billing amount, due date, payment terms, and any applicable discounts or penalties. 2. Payment Processing: This type involves the daily processing of customer payments in Orange, California. It includes tasks such as verifying payment methods, depositing checks, updating accounting systems, and reconciling payments with outstanding invoices. 3. Collections and Follow-up: This type focuses on tracking and managing overdue accounts in Orange, California. It involves sending payment reminders, making collection calls, negotiating settlements, and initiating legal actions if necessary. The objective is to reduce the outstanding accounts receivable balance and improve cash flow. 4. Credit Management: This type encompasses evaluating creditworthiness, setting credit limits, and managing credit terms for customers in Orange, California. It involves assessing customer financial information, conducting credit checks, and establishing payment terms and conditions to minimize the risk of non-payment or late payments. 5. Reporting and Analysis: This type involves generating daily reports and analyzing accounts receivable metrics in Orange, California. Key performance indicators such as the average collection period, accounts aging, and bad debt ratios are monitored to assess the efficiency of the daily accounts receivable process and identify areas for improvement. In conclusion, Orange California Daily Accounts Receivable is a crucial financial management process that entails recording, tracking, and monitoring the money owed to a business on a daily basis in Orange, California. It encompasses tasks such as invoicing, collections, credit management, payment processing, and reporting. Proper management of daily accounts receivable is essential for maintaining a healthy cash flow and financial stability for businesses operating in Orange, California.

Orange California Daily Accounts Receivable

Description

How to fill out Orange California Daily Accounts Receivable?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Orange Daily Accounts Receivable, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Orange Daily Accounts Receivable from the My Forms tab.

For new users, it's necessary to make some more steps to get the Orange Daily Accounts Receivable:

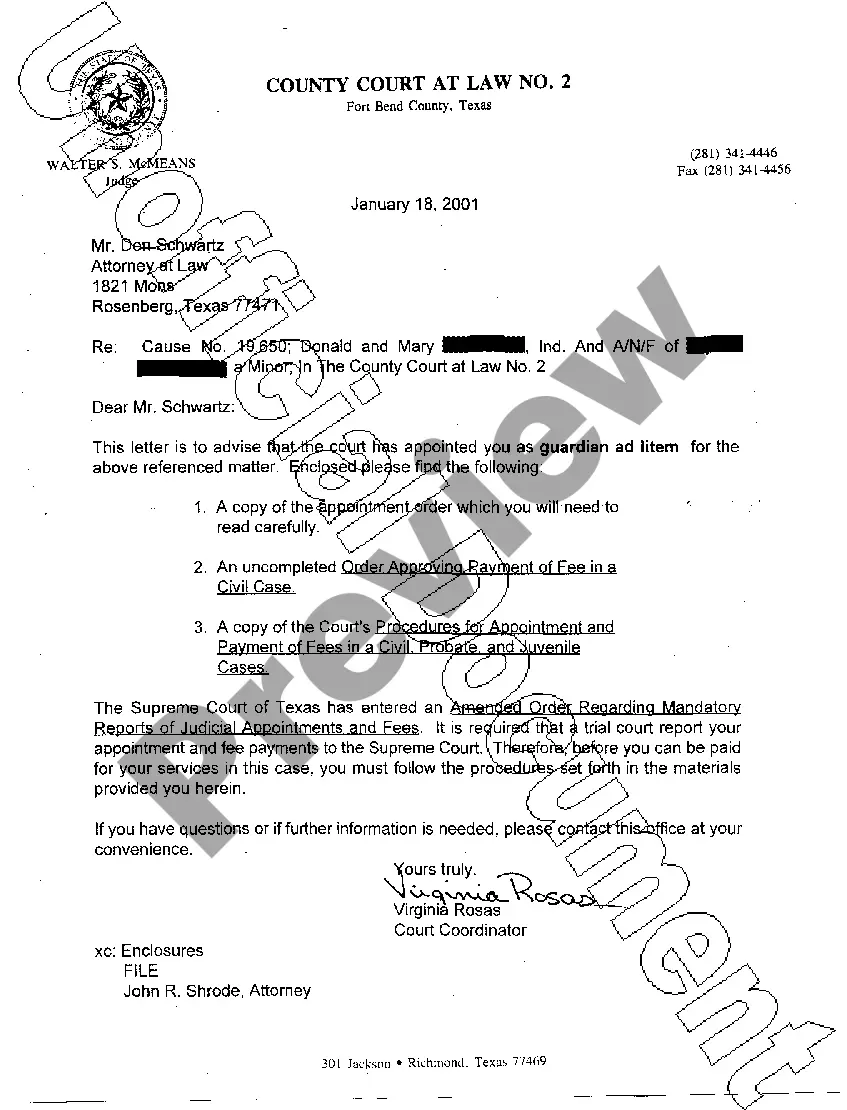

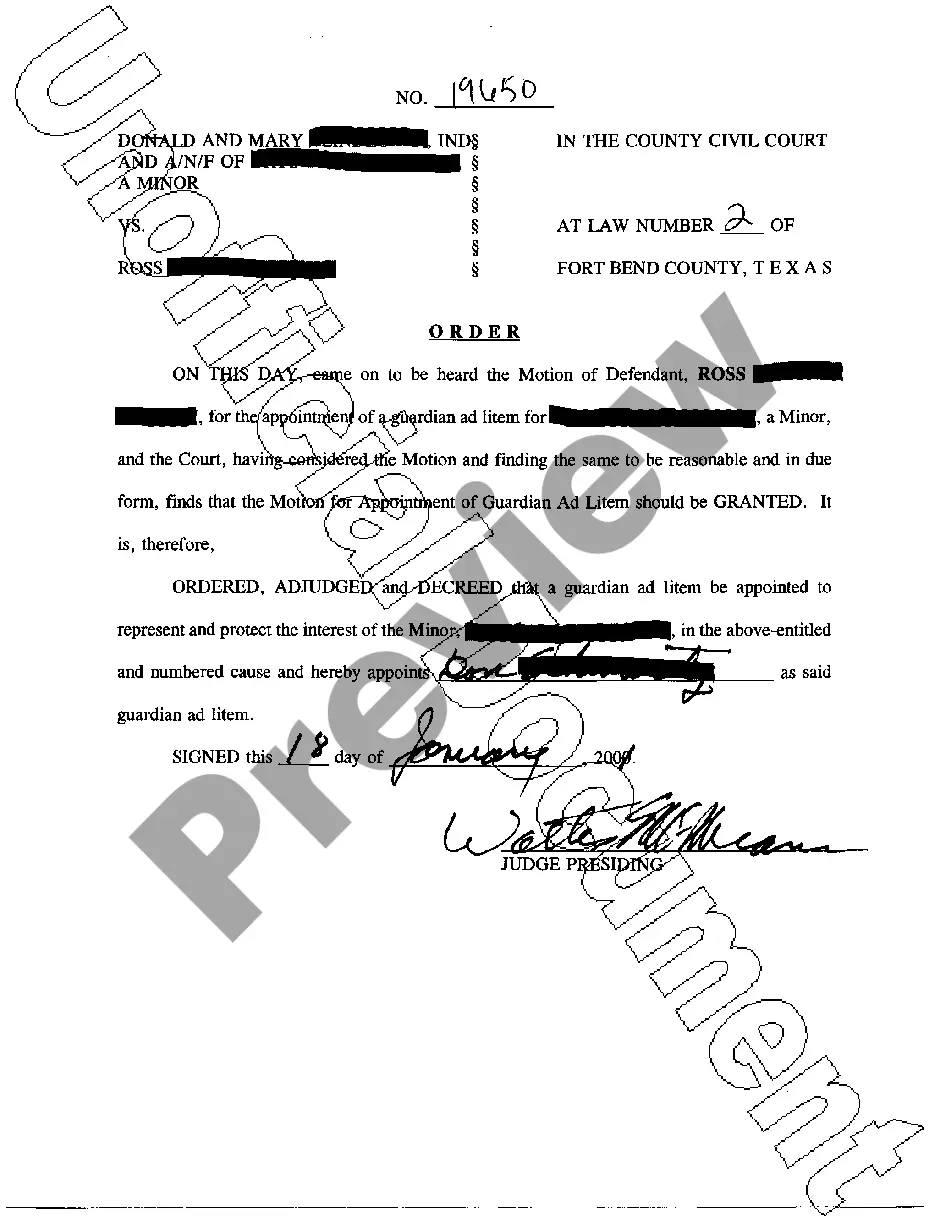

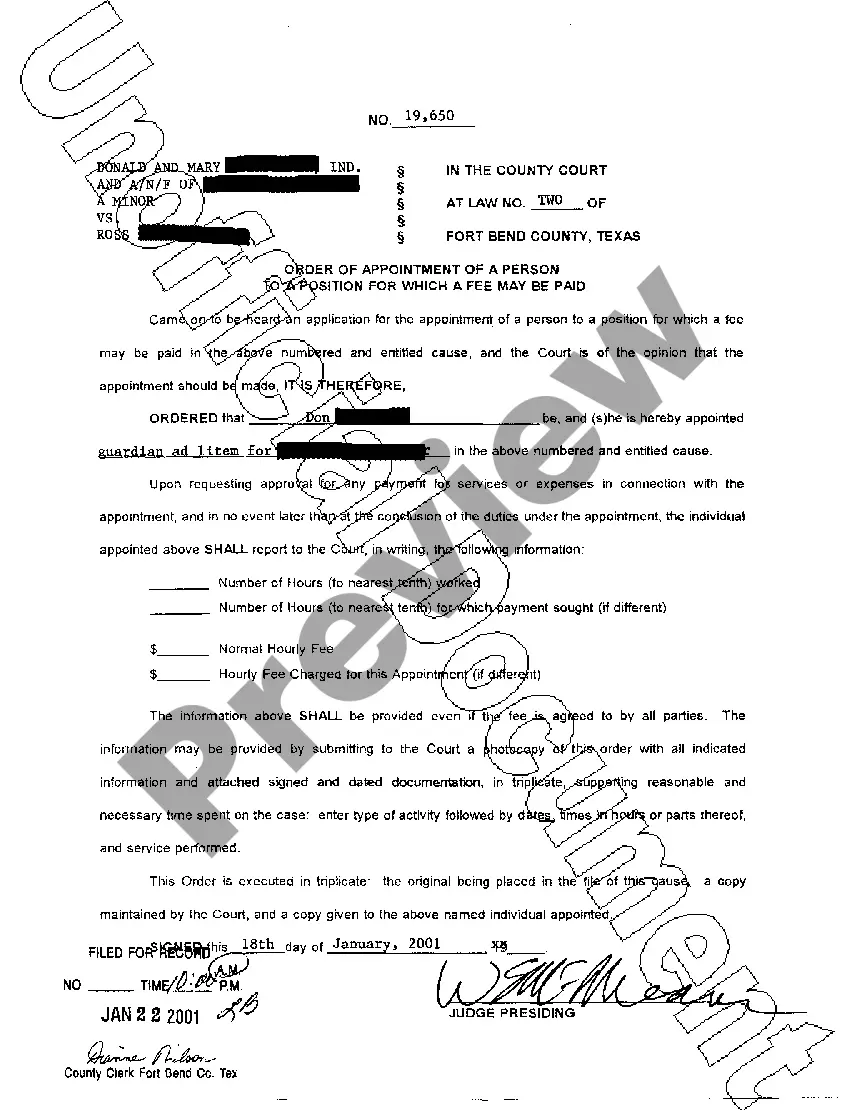

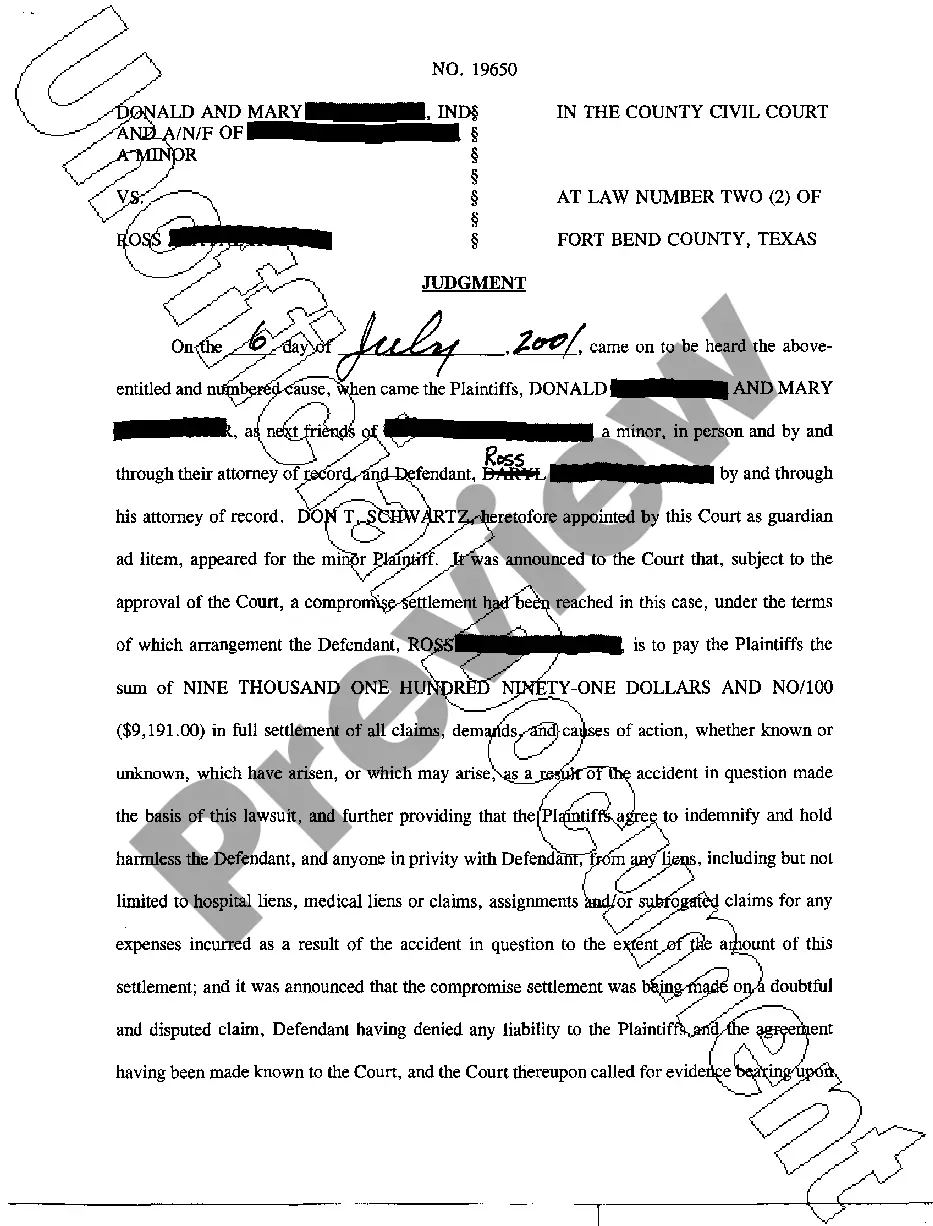

- Examine the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!