Allegheny Pennsylvania Depreciation Schedule is a financial document that outlines the rate at which assets used in a business or rental property lose value over time within Allegheny County, Pennsylvania. It is a crucial tool used by individuals, businesses, and organizations to keep track of the depreciation of their assets for tax and accounting purposes. The Allegheny Pennsylvania Depreciation Schedule ensures that the depreciation of assets is calculated accurately and in accordance with local regulations and guidelines. By following this schedule, individuals and businesses can determine the value of their assets, the portion of the cost to allocate as an expense over a specific period, and the resulting tax benefits. There are different types of Allegheny Pennsylvania Depreciation Schedules, such as: 1. Straight-Line Depreciation Schedule: This is the most commonly used depreciation method, which evenly spreads the cost of an asset over its useful life. It involves dividing the initial cost of the asset by its estimated useful life to calculate an equal expense for each accounting period. 2. Declining Balance Depreciation Schedule: This method allocates higher depreciation expenses in the initial years and lower expenses in the later years of an asset's useful life. It is a preferred method for assets that experience higher wear and tear in the early years, such as machinery or vehicles. 3. Sum-of-the-Years Digits Depreciation Schedule: This method calculates depreciation based on a fraction of the asset's useful life. The fraction is derived from adding the digits of the useful life (e.g., for an asset with a useful life of five years, the fraction would be 1/15, calculated by adding 1+2+3+4+5). This method assigns more significant depreciation in the early years. 4. Units of Production Depreciation Schedule: This method is used when an asset's depreciation is directly related to its usage or production output. It calculates depreciation based on the number of units produced or hours of usage rather than time. 5. Special Depreciation Schedules: Certain assets may have special depreciation schedules based on specific tax regulations or industry standards. For example, the IRS might specify unique depreciation rules for assets such as buildings, vehicles, or equipment used in certain sectors. In conclusion, the Allegheny Pennsylvania Depreciation Schedule is a detailed financial tool that helps individuals and businesses accurately calculate and record the depreciation of their assets over time. By utilizing various depreciation methods, such as straight-line, declining balance, sum-of-the-years digits, units of production, and special schedules, Allegheny County residents can ensure compliance with tax regulations and maximize financial benefits related to depreciation.

Allegheny Pennsylvania Depreciation Schedule

Description

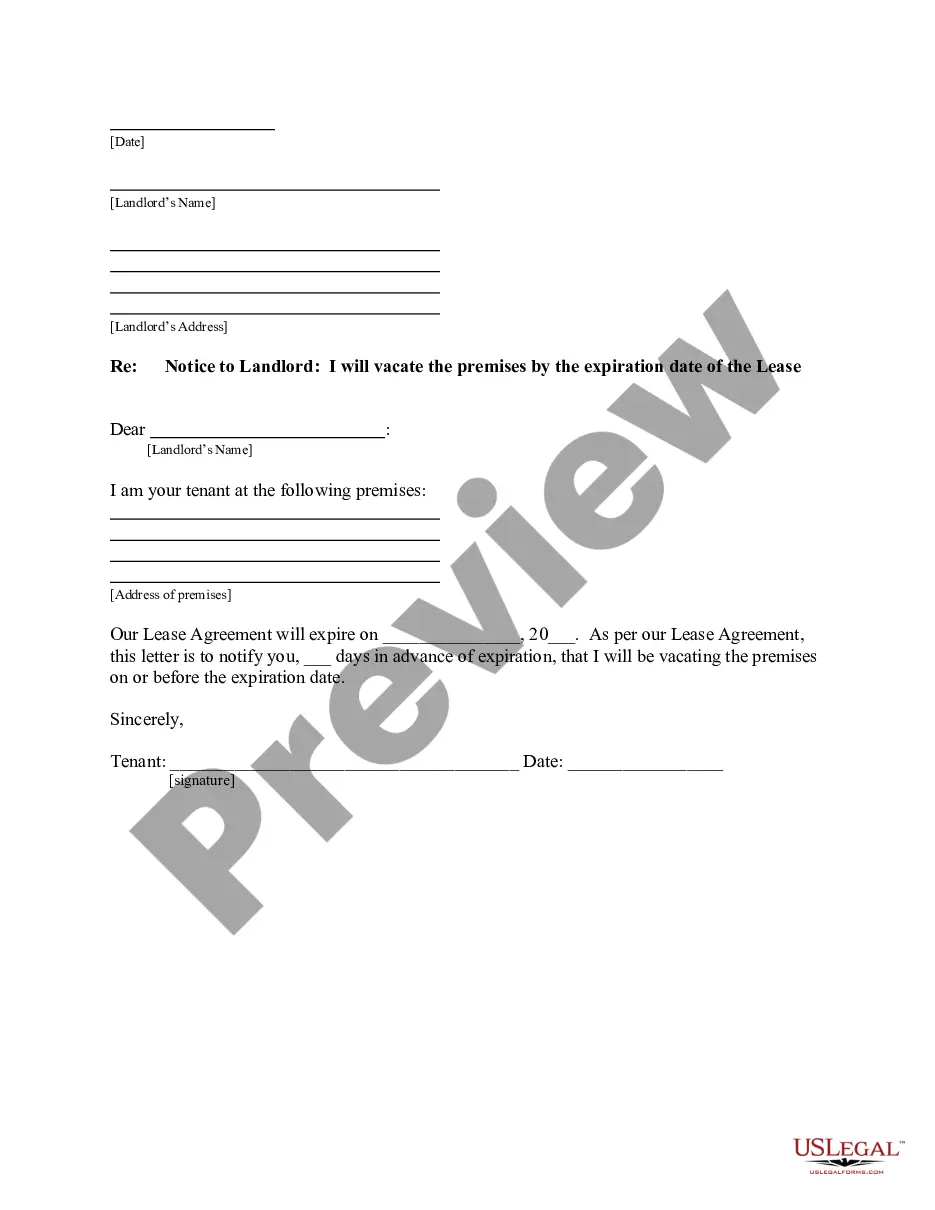

How to fill out Allegheny Pennsylvania Depreciation Schedule?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Allegheny Depreciation Schedule, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different types ranging from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching process less frustrating. You can also find detailed resources and guides on the website to make any tasks associated with document completion simple.

Here's how to locate and download Allegheny Depreciation Schedule.

- Take a look at the document's preview and outline (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the legality of some documents.

- Check the similar forms or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment method, and purchase Allegheny Depreciation Schedule.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Allegheny Depreciation Schedule, log in to your account, and download it. Needless to say, our website can’t replace a lawyer completely. If you have to deal with an exceptionally difficult situation, we advise getting an attorney to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!