A Bexar Texas Depreciation Schedule refers to a document that outlines the depreciation of assets within the Bexar County in Texas. It is used to record the reduction in value of tangible assets over time, typically for taxation and financial reporting purposes. This schedule serves as a reference for individuals, businesses, and government entities to track the decline in the worth of their assets in Bexar County. The Bexar Texas Depreciation Schedule follows the guidelines and regulations set by the Texas Property Tax Code. It takes into account various factors such as the useful life of an asset, its condition, and obsolescence, among others. The schedule helps determine the accurate value of assets for property tax assessments, insurance claims, and financial statements. There are different types of Bexar Texas Depreciation Schedules, each specific to the asset being depreciated. Some common types include: 1. Bexar Texas Property Depreciation Schedule: This type of schedule focuses on the depreciation of real estate properties, including commercial buildings, residential properties, and land improvements. It considers factors such as wear and tear, market conditions, and the useful life of the property. 2. Bexar Texas Vehicle Depreciation Schedule: This schedule is used to calculate the depreciation of vehicles, including cars, trucks, motorcycles, and recreational vehicles. It takes into account factors such as mileage, age, condition, and market value fluctuations. 3. Bexar Texas Equipment Depreciation Schedule: This type of schedule is applicable to depreciating equipment, such as machinery, computers, office furniture, and manufacturing tools. It considers factors such as technological advancements, wear and tear, and market value changes. 4. Bexar Texas Asset Depreciation Schedule: This schedule covers a wide range of assets, including but not limited to, machinery, buildings, vehicles, office equipment, and furniture. It provides a comprehensive overview of the depreciation of all assets owned within Bexar County. In conclusion, a Bexar Texas Depreciation Schedule is an essential document for accurately assessing the value of assets within the county. It ensures fair taxation, proper financial reporting, and insurance claim assessments. The different types of depreciation schedules cater to specific asset categories, allowing for accurate valuation and tracking of asset depreciation.

Bexar Texas Depreciation Schedule

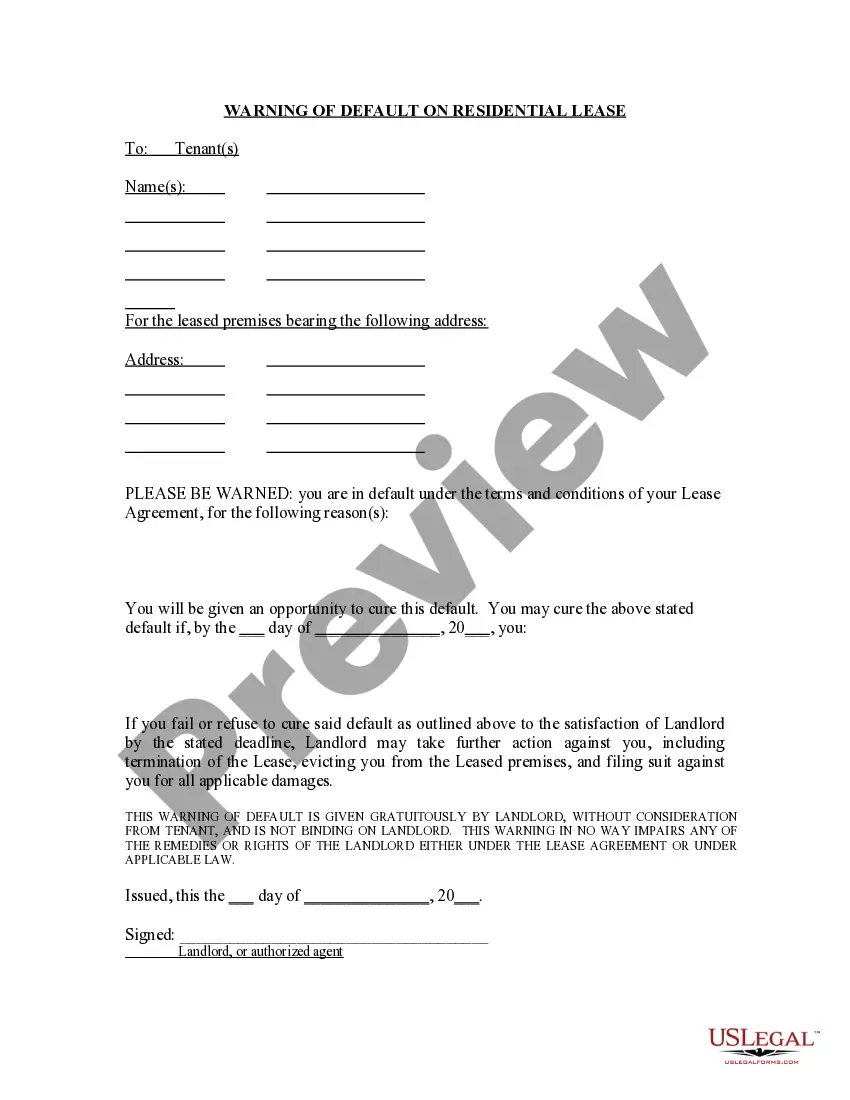

Description

How to fill out Bexar Texas Depreciation Schedule?

Do you need to quickly draft a legally-binding Bexar Depreciation Schedule or maybe any other document to manage your own or corporate matters? You can select one of the two options: contact a professional to draft a valid paper for you or draft it completely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get professionally written legal documents without paying sky-high fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant document templates, including Bexar Depreciation Schedule and form packages. We offer documents for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- First and foremost, carefully verify if the Bexar Depreciation Schedule is adapted to your state's or county's regulations.

- In case the document has a desciption, make sure to verify what it's intended for.

- Start the search again if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Bexar Depreciation Schedule template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Additionally, the templates we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!