The Hennepin Minnesota Depreciation Schedule is a comprehensive document that outlines the specific rates at which assets lose their value over time in Hennepin County, Minnesota. It serves as a vital tool for individuals and businesses to accurately calculate the depreciation expenses associated with their assets for accounting and tax purposes. The Hennepin Minnesota Depreciation Schedule encompasses various types of assets, including real estate, vehicles, machinery, equipment, and furniture. Each asset category has its own distinct depreciation rates based on factors such as the asset's useful life, salvage value, and method of depreciation employed. For real estate, Hennepin County utilizes two primary types of depreciation schedules: straight-line and accelerated. The straight-line method divides the cost of the property minus any salvage value equally over its estimated useful life. Accelerated methods, such as the Modified Accelerated Cost Recovery System (MARS), allocate the property's cost unevenly over a predetermined schedule, allowing for larger deductions in the early years of ownership. When it comes to vehicles, the Hennepin Minnesota Depreciation Schedule recognizes that cars and trucks have different depreciation rates. The schedule takes into account factors such as the vehicle's make, model, age, and mileage to determine the depreciation percentages applicable each year. Machinery and equipment are also subject to unique depreciation rates outlined in the Hennepin Minnesota Depreciation Schedule. The schedule considers factors such as the asset's condition, functional obsolescence, and anticipated technological advancements to determine the appropriate depreciation rates to be applied in the calculation. Lastly, furniture and fixtures in Hennepin County are subject to their own depreciation schedules. These schedules factor in the expected wear and tear of different types of furniture and fixtures, such as desks, chairs, shelves, and lighting fixtures, over their useful life. In summary, the Hennepin Minnesota Depreciation Schedule is an essential resource for individuals and businesses in Hennepin County when calculating asset depreciation for taxation and accounting purposes. With distinct schedules for real estate, vehicles, machinery, and furniture, it ensures accurate and compliant depreciation calculations to properly reflect the diminishing value of assets over time.

Hennepin Minnesota Depreciation Schedule

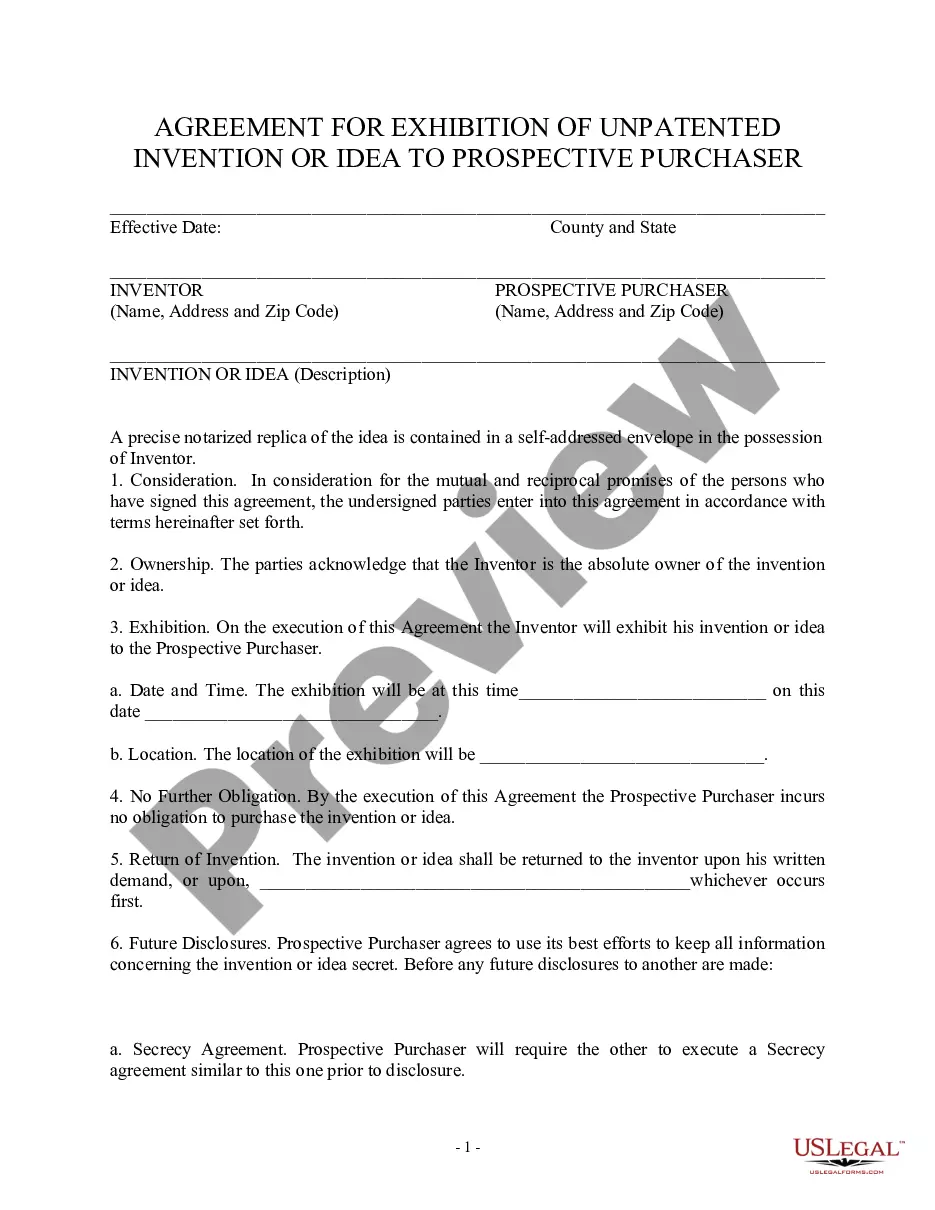

Description

How to fill out Hennepin Minnesota Depreciation Schedule?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Hennepin Depreciation Schedule is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to get the Hennepin Depreciation Schedule. Adhere to the guide below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Hennepin Depreciation Schedule in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!