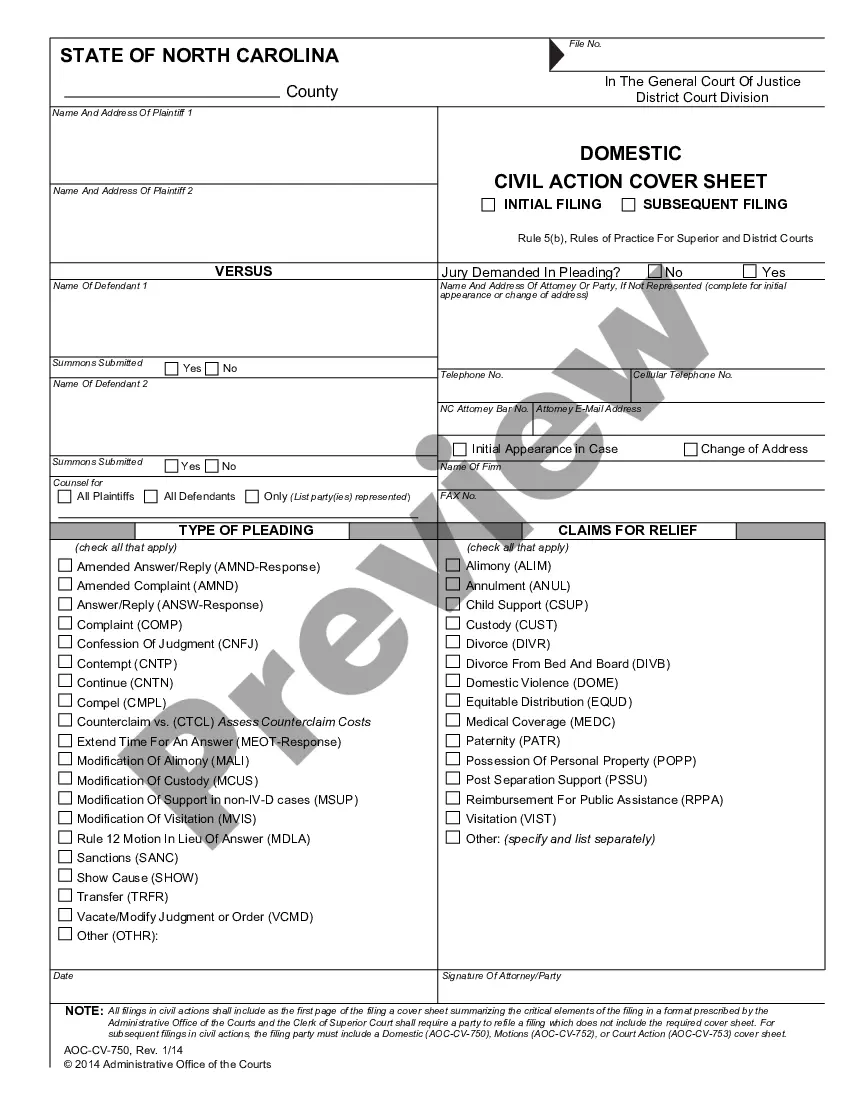

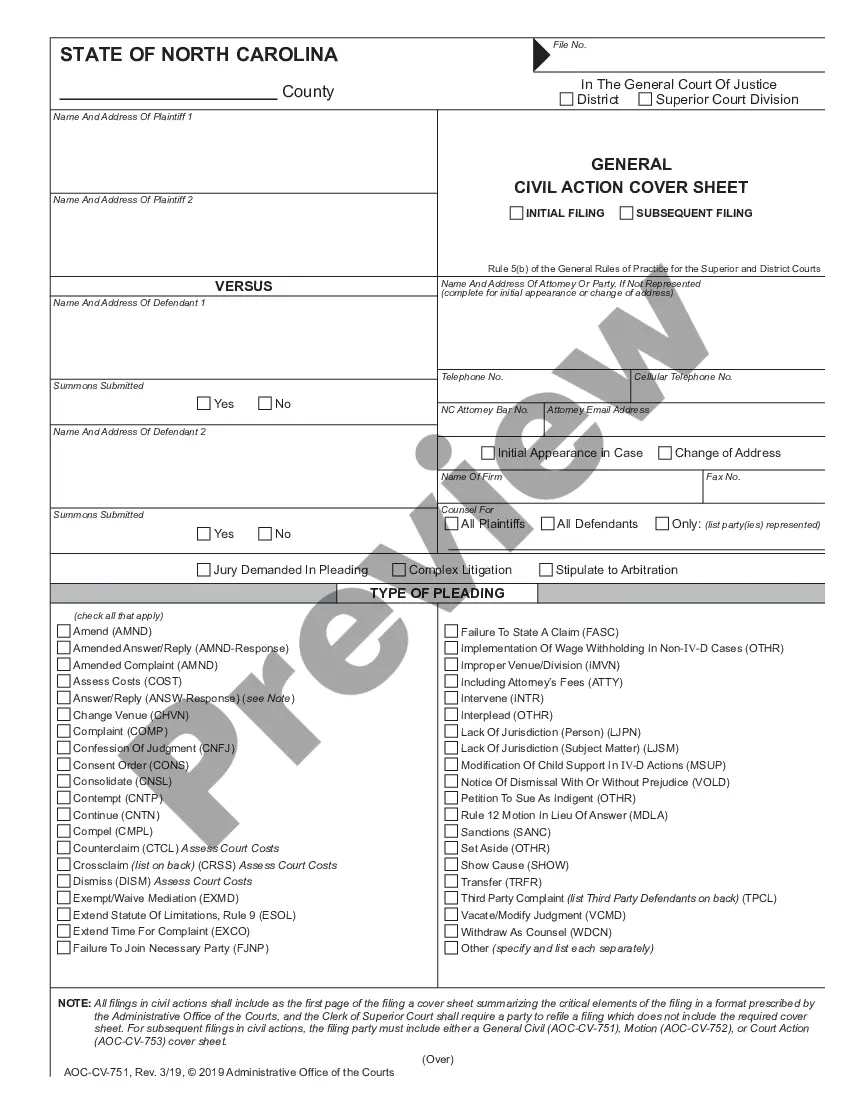

Maricopa Arizona Depreciation Schedule refers to a document that outlines the expected depreciation rates for various assets within the town of Maricopa, located in Arizona, United States. A depreciation schedule is essential for financial planning purposes as it helps individuals, businesses, and organizations estimate the reduction in value of their assets over time. The Maricopa Arizona Depreciation Schedule is commonly used by property owners, investors, accountants, and tax professionals to determine the fair market value of assets for tax assessment, insurance purposes, or financial reporting. It provides a systematic breakdown of the expected depreciation rates for different categories of assets. There are several types of Maricopa Arizona Depreciation Schedules, each specific to different asset categories: 1. Residential Property Depreciation Schedule: This schedule provides guidelines for estimating the depreciation of residential properties such as houses, apartments, and condominiums within Maricopa. It takes into consideration factors such as age, condition, location, and market trends to determine the depreciation rate. 2. Commercial Property Depreciation Schedule: This schedule focuses on estimating the depreciation of commercial properties like office buildings, retail spaces, warehouses, and industrial complexes in Maricopa. It considers factors such as building size, construction quality, economic factors, and demand to determine the applicable depreciation rate. 3. Vehicle Depreciation Schedule: This schedule is specific to vehicles, including cars, trucks, motorcycles, and recreational vehicles, registered within the town of Maricopa. It offers guidance on determining the depreciation rate based on factors such as make, model, age, mileage, and condition. 4. Equipment and Machinery Depreciation Schedule: This type of schedule pertains to the depreciation of various equipment and machinery used by businesses and industries in Maricopa. It considers factors such as useful life, maintenance, technological advancements, and market demand to establish the depreciation rate. Maricopa Arizona Depreciation Schedule plays a crucial role in financial planning, ensuring accurate asset valuation, tax reporting, insurance coverage, and budgeting. It helps businesses and individuals allocate resources effectively, monitor asset depreciation, and make informed decisions regarding repairs, replacements, or investments. It is important to consult a qualified appraiser, tax professional, or accountant who specializes in Maricopa Arizona Depreciation Schedule to ensure compliance with applicable regulations, accurate asset valuation, and optimal financial planning.

Maricopa Arizona Depreciation Schedule

Description

How to fill out Maricopa Arizona Depreciation Schedule?

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Maricopa Depreciation Schedule is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to obtain the Maricopa Depreciation Schedule. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Depreciation Schedule in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!