Keywords: Nassau New York, depreciation schedule, detailed description, types Nassau New York Depreciation Schedule is a document used to track the estimated depreciation of assets over time in the Nassau County, New York region. It is an essential tool for businesses, organizations, and individuals to calculate the reduction in the value of their properties and assets as they age or become obsolete. There are various types of Nassau New York Depreciation Schedules designed to cater to different asset categories and industries. Some common types include: 1. Straight-Line Depreciation Schedule: This is the most straightforward and widely used method, wherein the asset's value is depreciated equally over its estimated useful life. 2. Declining Balance Depreciation Schedule: This method assumes that the asset's value declines more rapidly in the early years and slows down as it ages. It allows for higher depreciation expenses during the asset's initial years. 3. Sum-of-the-Years'-Digits Depreciation Schedule: This method assigns higher depreciation expenses to the earlier years and lesser depreciation expenses to the later years. It takes into account the assumption that the asset's productivity or usage is higher in the initial years. 4. Units of Production Depreciation Schedule: This method is employed when the asset's value reduction depends on the number of units it produces or the actual usage. It calculates depreciation on a per-unit basis. 5. Special Depreciation Schedules: In addition to these commonly used methods, Nassau New York may have specialized depreciation schedules for particular sectors or industries. These schedules take into consideration the unique characteristics and circumstances of specific assets. The Nassau New York Depreciation Schedule helps individuals and organizations in planning their finances, budgeting for asset replacements, and making informed decisions regarding purchases, sales, or leases. It also plays a crucial role in ensuring accurate financial reporting, tax calculations, and compliance with accounting standards. It is important to consult with financial professionals, accountants, or tax advisors familiar with the specific requirements of Nassau County, New York, to ensure the accurate and appropriate application of the correct depreciation schedule for your assets.

Nassau New York Depreciation Schedule

Description

How to fill out Nassau New York Depreciation Schedule?

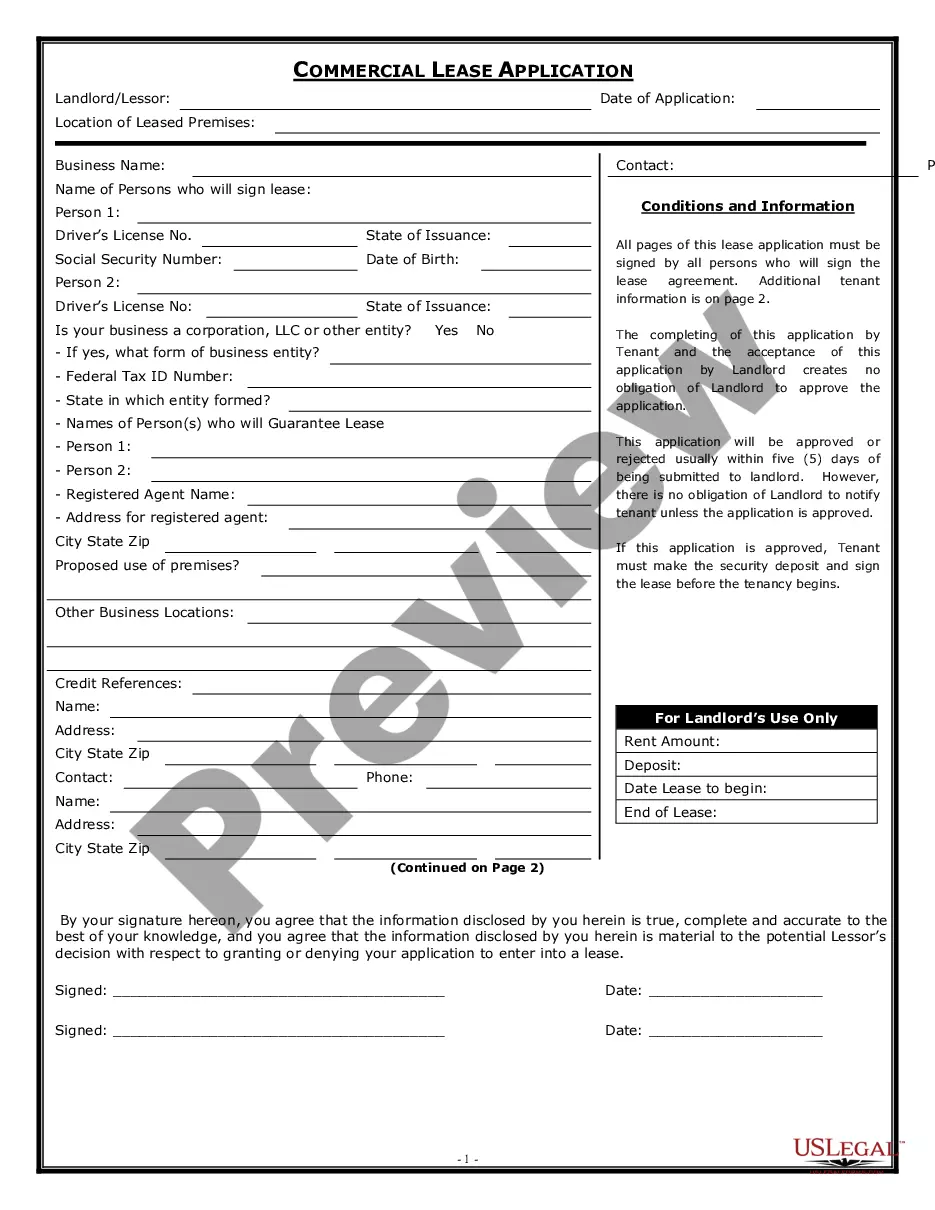

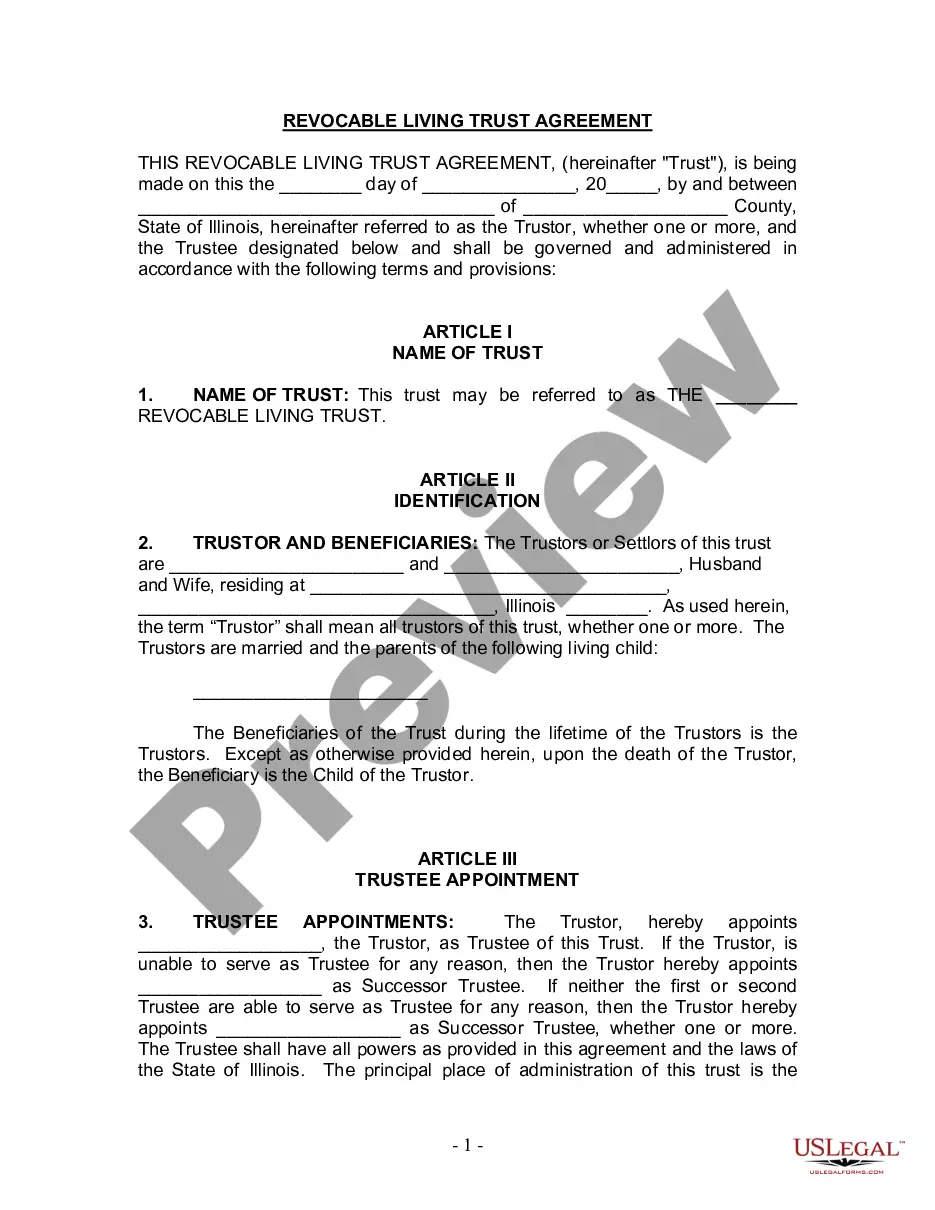

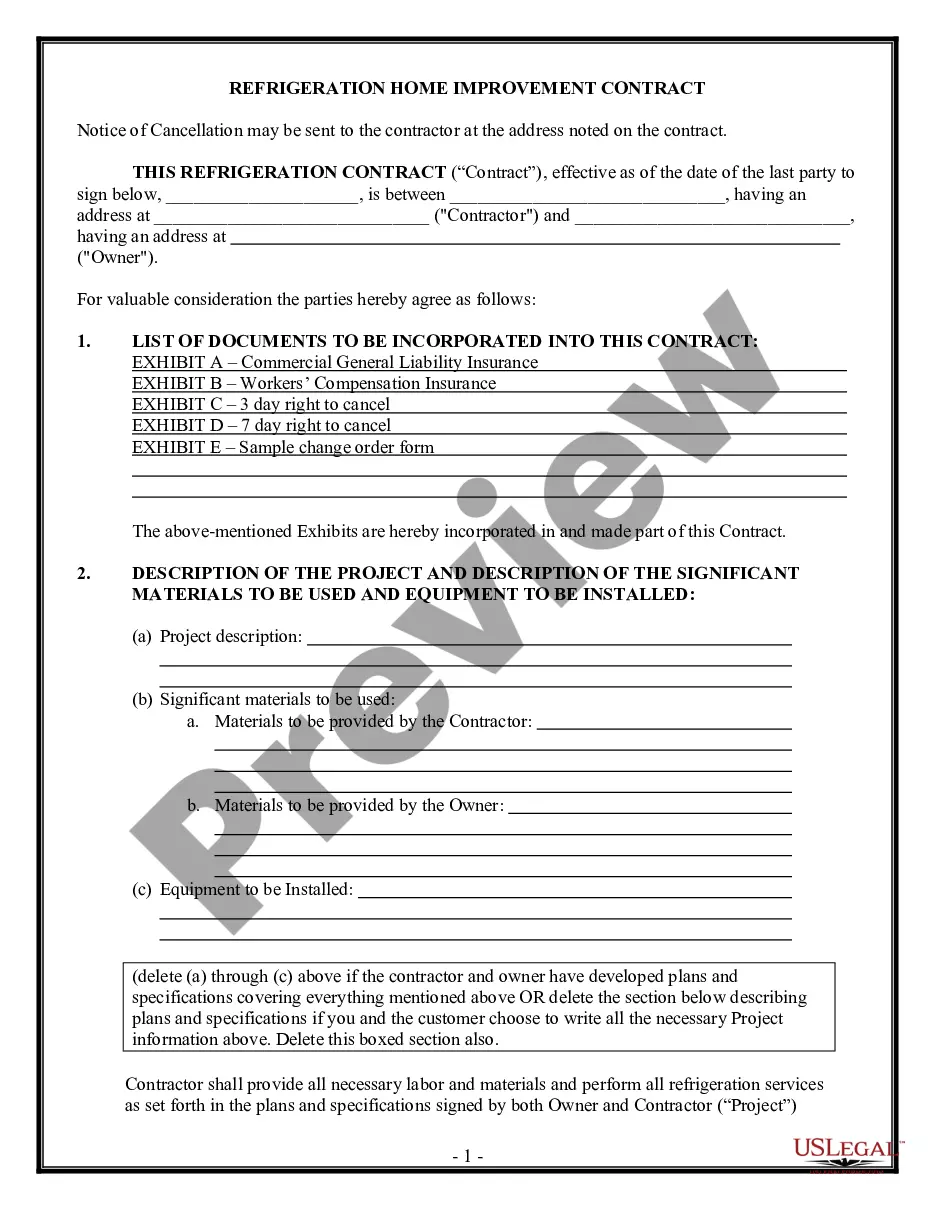

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from scratch, including Nassau Depreciation Schedule, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any activities associated with paperwork execution simple.

Here's how to locate and download Nassau Depreciation Schedule.

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Check the similar forms or start the search over to find the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment method, and buy Nassau Depreciation Schedule.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Nassau Depreciation Schedule, log in to your account, and download it. Needless to say, our website can’t replace an attorney entirely. If you have to cope with an extremely challenging case, we recommend using the services of a lawyer to examine your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and get your state-compliant paperwork effortlessly!