Keywords: Riverside California, Depreciation Schedule, types Title: Understand Riverside California's Depreciation Schedule: Overview and Different Types Explained Introduction: Riverside, California, has its own depreciation schedule that outlines the estimated lifespan of various assets and determines the allowable depreciation deductions for tax purposes. This schedule ensures fair and accurate taxation while providing businesses and individuals with a method to recover the cost of assets over time. In this article, we will delve into what Riverside California's Depreciation Schedule entails and explore its different types. 1. Straight-Line Depreciation: One common type of depreciation included in Riverside California's schedule is straight-line depreciation. This method allocates an equal amount of depreciation expense across the useful life of an asset. For example, if a piece of equipment is expected to last 10 years, the annual depreciation expense would be equal, considering the initial cost and residual value. 2. Accelerated Depreciation: While not explicitly named, Riverside California might also follow accelerated depreciation methods like the Modified Accelerated Cost Recovery System (MARS) used at the federal level. Accelerated depreciation allows higher deductions in the early years of an asset's life and lower deductions in later years. This strategy aims to incentivize investments and allows businesses to recover costs more quickly. 3. Special Depreciation: There might be instances where Riverside California incorporates special depreciation allowances specific to certain industries or assets. These allowances are designed to encourage investment in targeted sectors or boost economic growth. Examples could include additional deductions for energy-efficient equipment or investments in environmentally friendly infrastructure. 4. Land and Leasehold Improvements: Riverside California's Depreciation Schedule also considers land and leasehold improvements. While land itself is generally not subject to depreciation, improvements made to it such as landscaping, parking lots, or fences may be depreciable. Leasehold improvements, which are alterations made by a tenant to leased property, may also fall under depreciable assets, subject to certain conditions. Conclusion: Riverside California's Depreciation Schedule outlines the guidelines and methods used to calculate depreciation deductions in order to ensure fairness and accuracy in tax reporting. Alongside commonly used straight-line depreciation, there may be a focus on accelerating deductions or introducing special allowances depending on specific circumstances or industries. It is crucial for businesses and individuals in Riverside to familiarize themselves with these schedules to optimize tax planning and compliance.

Riverside California Depreciation Schedule

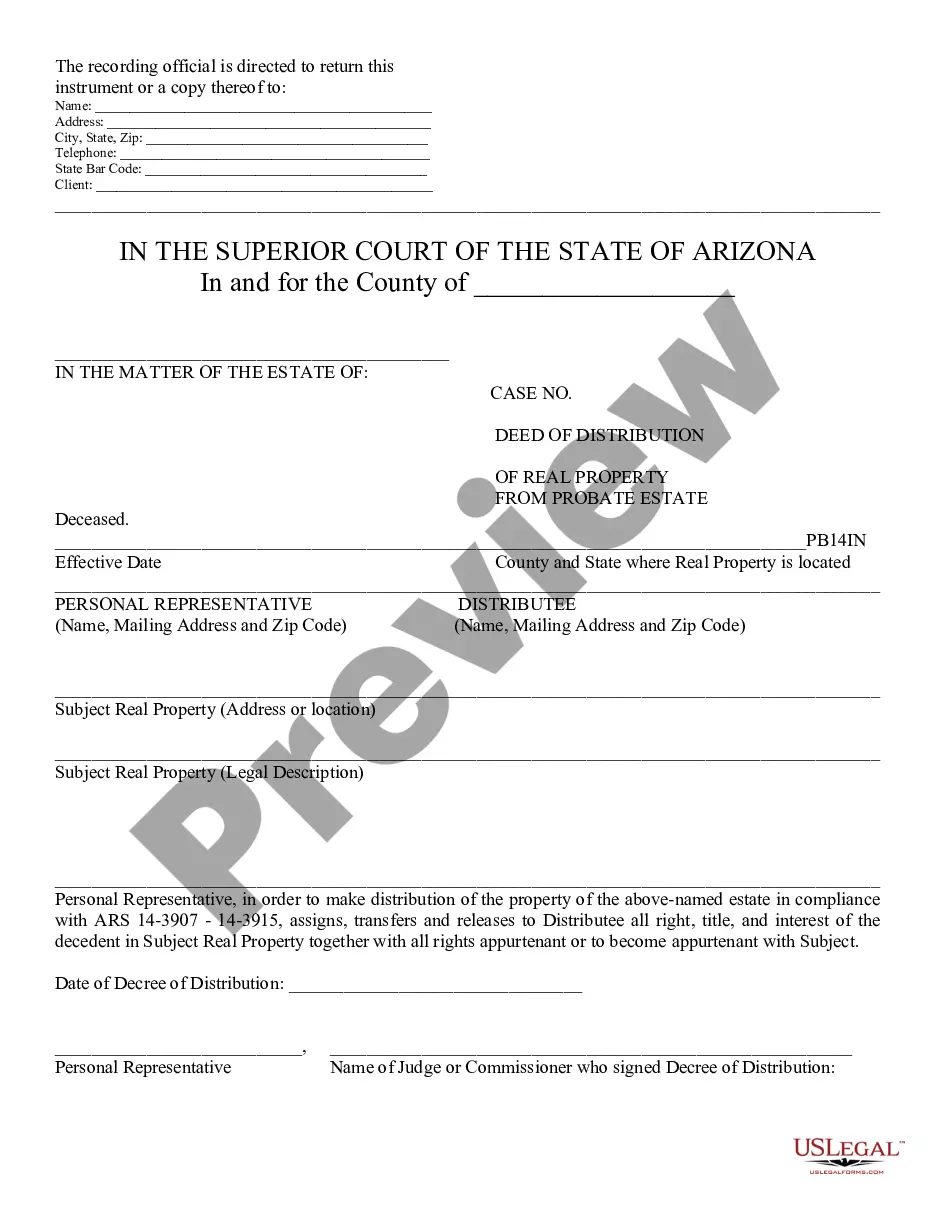

Description

How to fill out Riverside California Depreciation Schedule?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Riverside Depreciation Schedule, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Riverside Depreciation Schedule from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Riverside Depreciation Schedule:

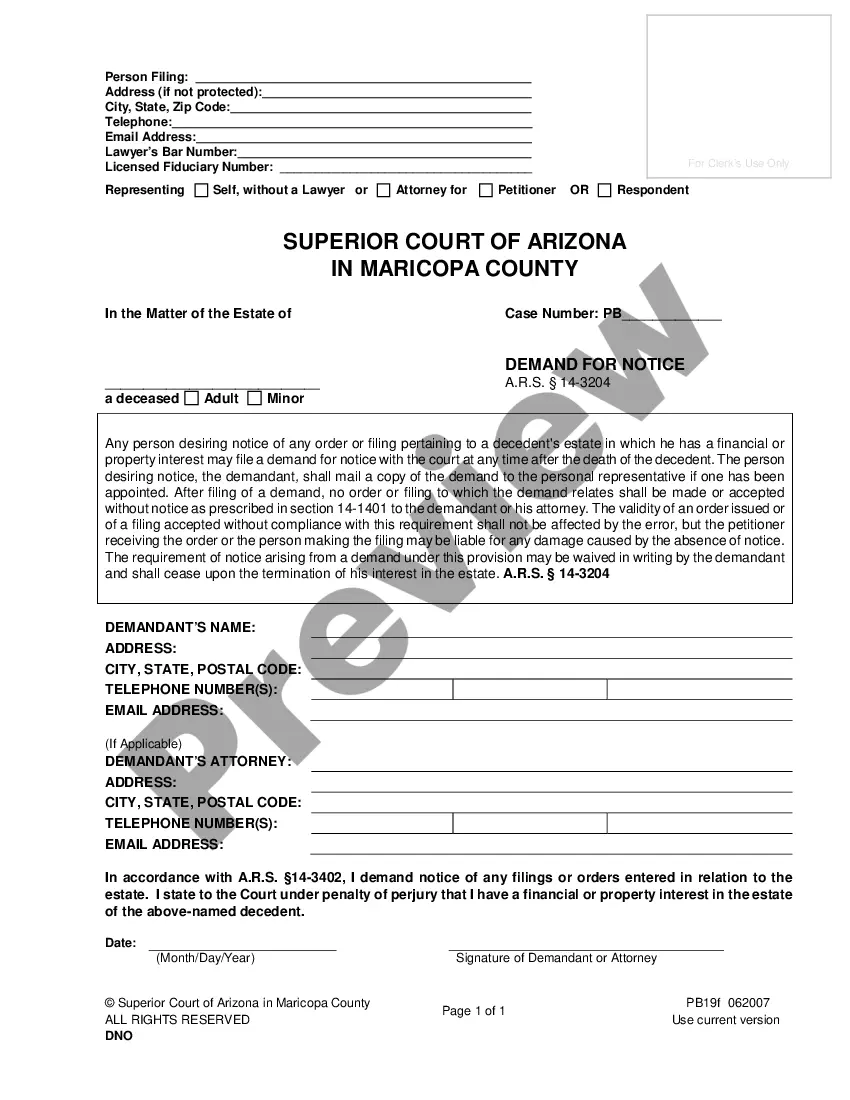

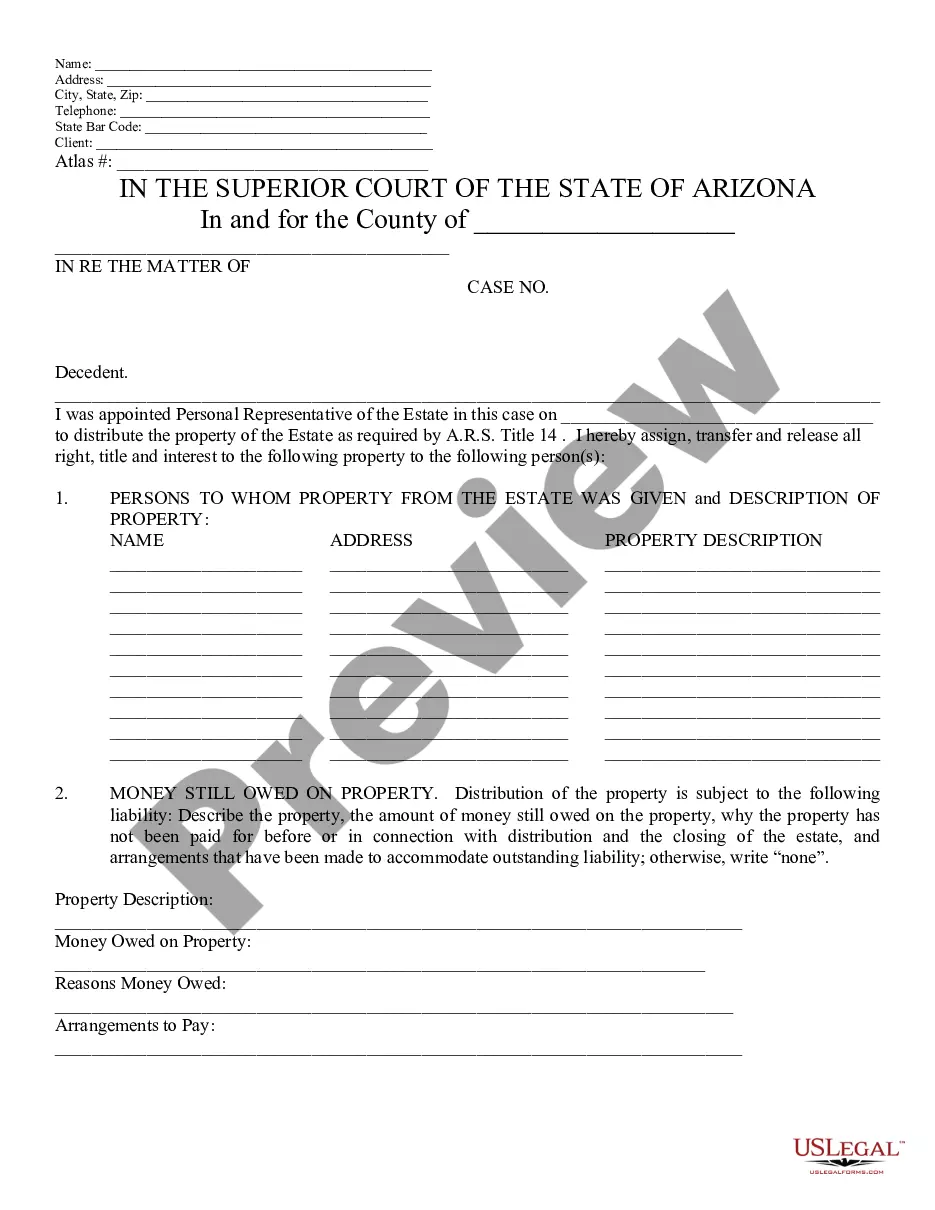

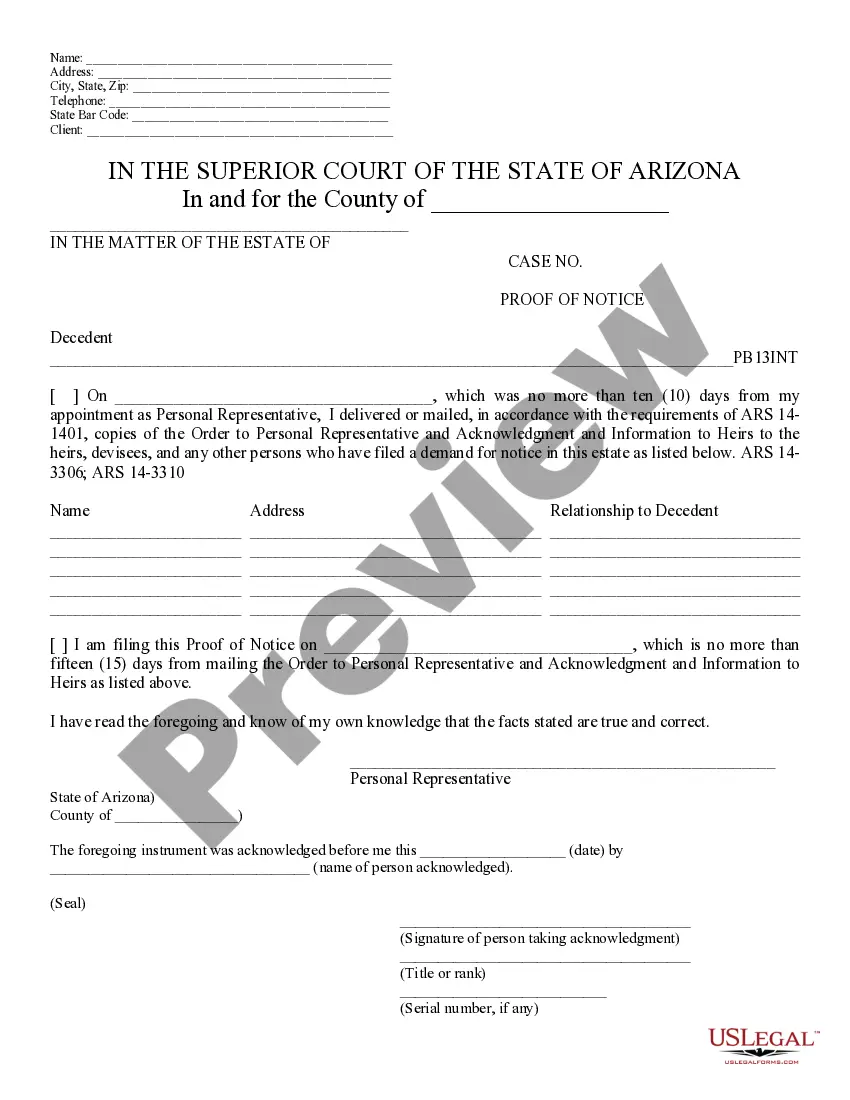

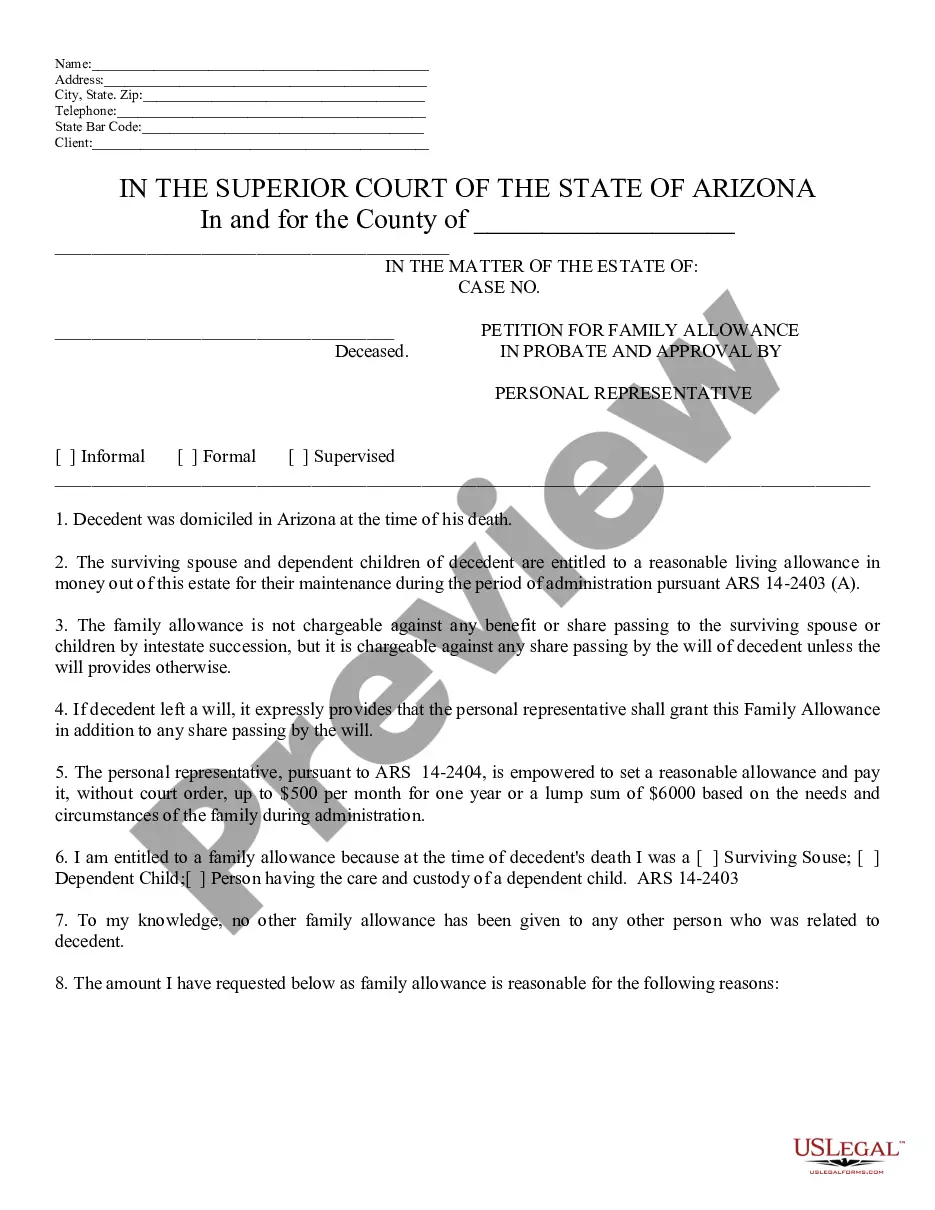

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!