San Antonio Texas is a vibrant city known for its rich history, diverse cultural heritage, and charming attractions. When it comes to businesses, the concept of depreciation plays a crucial role in financial planning. A San Antonio Texas Depreciation Schedule refers to a comprehensive document that outlines the expected depreciation of various assets over their useful lives within the city. The San Antonio Texas Depreciation Schedule helps businesses determine the depreciation expenses for reporting taxes accurately and budgeting accordingly. It is an important tool for both small and large enterprises to monitor and allocate their resources efficiently. By adhering to this schedule, businesses can estimate the decrease in value of their assets over time due to wear and tear, usage, or obsolescence. There are several types of depreciation schedules commonly used in San Antonio Texas: 1. Straight-Line Depreciation Schedule: This method allocates an equal amount of depreciation expense over an asset's useful life, assuming equal wear and tear each year. It is the simplest and most commonly used type of schedule. 2. Declining Balance Depreciation Schedule: This method allows for larger depreciation expenses initially, gradually decreasing over time. It is ideal for assets that tend to lose their value more quickly during the early years of their useful life. 3. Sum of the Years' Digits Depreciation Schedule: This schedule allocates depreciation expenses based on a fraction of the total years of an asset's useful life. The fraction is determined by adding the digits of the useful life together. 4. Units of Production Depreciation Schedule: This type of schedule calculates depreciation based on the actual usage or production output of the asset. The more an asset is utilized, the higher the depreciation expense will be. 5. Group Depreciation Schedule: This schedule applies to businesses that have similar assets with similar useful lives. It allows for a simplified approach to calculating depreciation by grouping assets together. Businesses in San Antonio Texas must comply with the relevant tax laws and guidelines when preparing their depreciation schedules. It is essential to consult with accounting professionals who can provide expertise on accurately estimating depreciation expenses for various assets, including buildings, vehicles, machinery, and equipment. In conclusion, a San Antonio Texas Depreciation Schedule is a valuable financial tool that helps businesses estimate and allocate depreciation expenses for tax reporting and financial planning purposes. By using various depreciation methods such as straight-line, declining balance, sum of the years' digits, units of production, and group depreciation, businesses can anticipate and manage asset devaluation effectively.

San Antonio Texas Depreciation Schedule

Description

How to fill out San Antonio Texas Depreciation Schedule?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the San Antonio Depreciation Schedule, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the San Antonio Depreciation Schedule from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the San Antonio Depreciation Schedule:

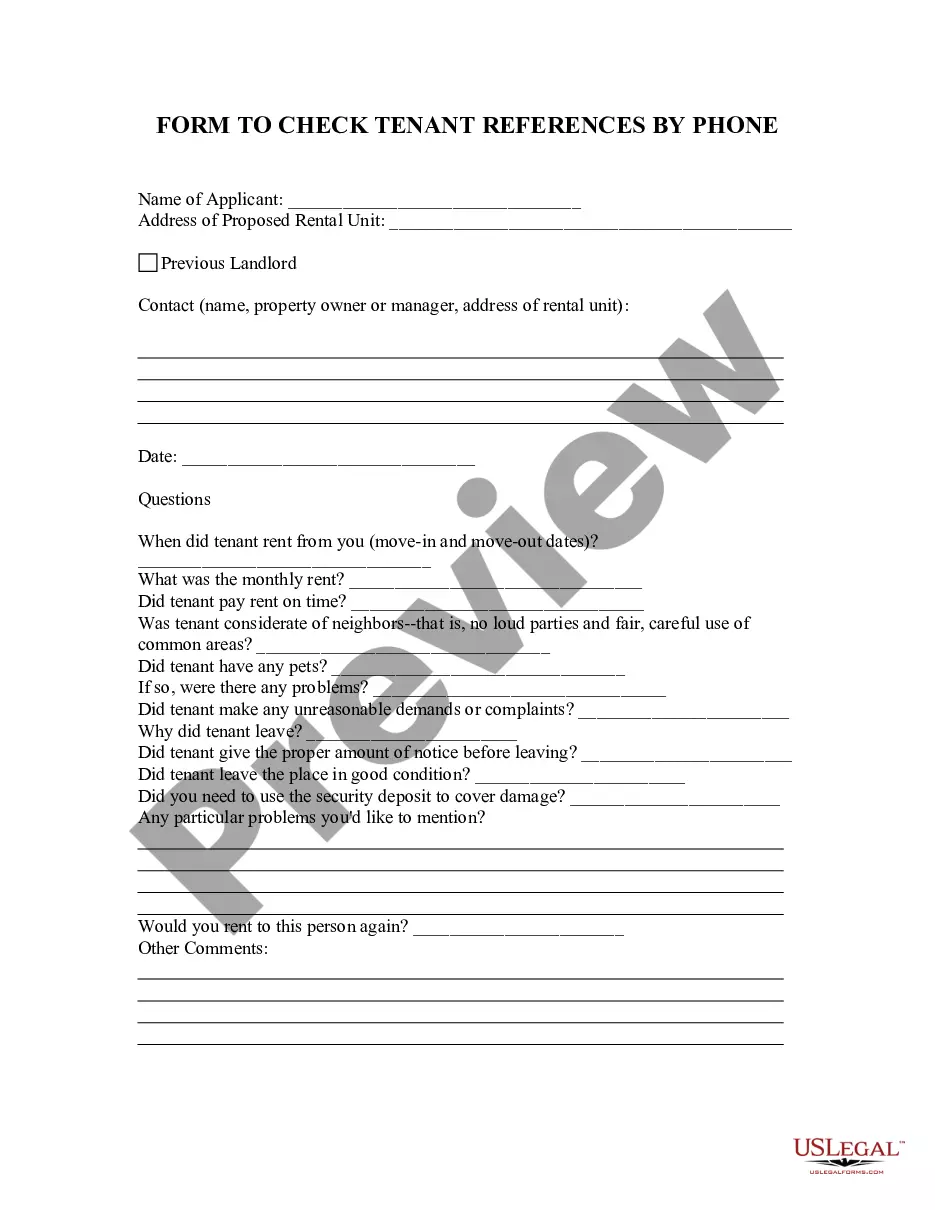

- Examine the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!