Travis Texas Depreciation Schedule refers to a document or record used by businesses, individuals, and tax authorities in Travis County, Texas, to calculate and track the depreciation of their assets over time for tax and accounting purposes. This schedule outlines the gradual decrease in value of an asset due to factors such as wear and tear, obsolescence, or deterioration. The Travis Texas Depreciation Schedule is an essential tool for businesses and individuals to accurately determine the value of their assets and calculate the corresponding depreciation expenses for tax deductions. By following the guidelines set by the Internal Revenue Service (IRS) in conjunction with Travis County regulations, taxpayers can effectively manage their tax liabilities and ensure compliance with tax laws. There are various types of depreciation schedules utilized in Travis County, Texas, depending on the specific depreciation method chosen by the taxpayer. Some commonly used depreciation methods include: 1. Straight-Line Depreciation: This method allocates an equal amount of depreciation expense over the useful life of an asset. It assumes that the asset depreciates at a steady rate each year. 2. Declining Balance Method: Also known as accelerated depreciation, this method allows for a larger depreciation expense in the earlier years of an asset's life and gradually reduces the depreciation amount over time. It is suitable for assets that experience higher levels of wear and tear in the initial years. 3. Sum-of-Years'-Digits Method: This depreciation method involves assigning higher depreciation values to early years and lower values to later years. It is based on the assumption that assets are more productive in the initial years and experience a decline in productivity over time. 4. Units of Production Method: This method calculates depreciation based on the actual usage or production of an asset. It allocates higher depreciation expenses during periods of high usage and lower expenses during periods of low usage. Taxpayers in Travis County, Texas, must select the appropriate depreciation method and utilize the Travis Texas Depreciation Schedule correctly to accurately report their asset values and depreciation expenses on their tax returns. It is important to consult with a qualified tax professional or utilize certified accounting software to ensure compliance with IRS regulations and Travis County guidelines. In conclusion, the Travis Texas Depreciation Schedule is a crucial tool for businesses and individuals in Travis County, Texas, to calculate and track the depreciation of their assets accurately. By considering factors such as wear and tear, obsolescence, and deterioration, taxpayers can determine the appropriate depreciation method and maintain compliance with tax laws.

Travis Texas Depreciation Schedule

Description

How to fill out Travis Texas Depreciation Schedule?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Travis Depreciation Schedule, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Consequently, if you need the current version of the Travis Depreciation Schedule, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Travis Depreciation Schedule:

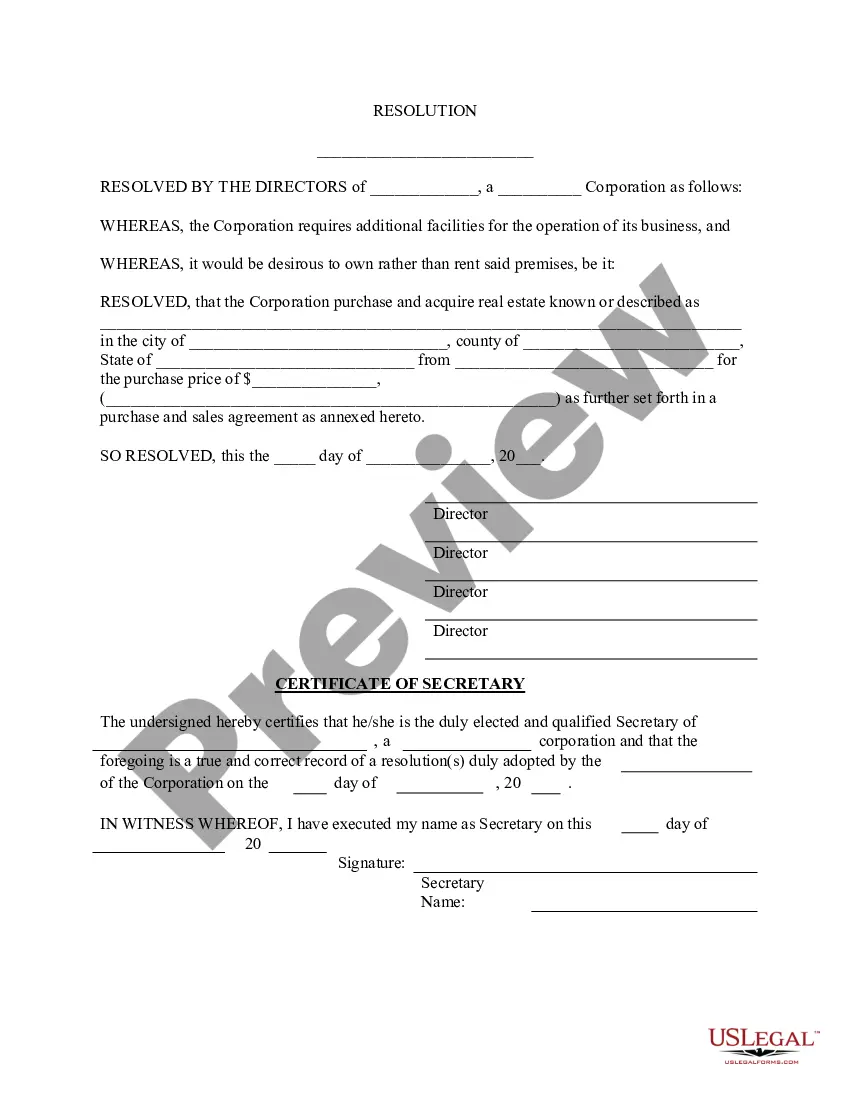

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Travis Depreciation Schedule and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!