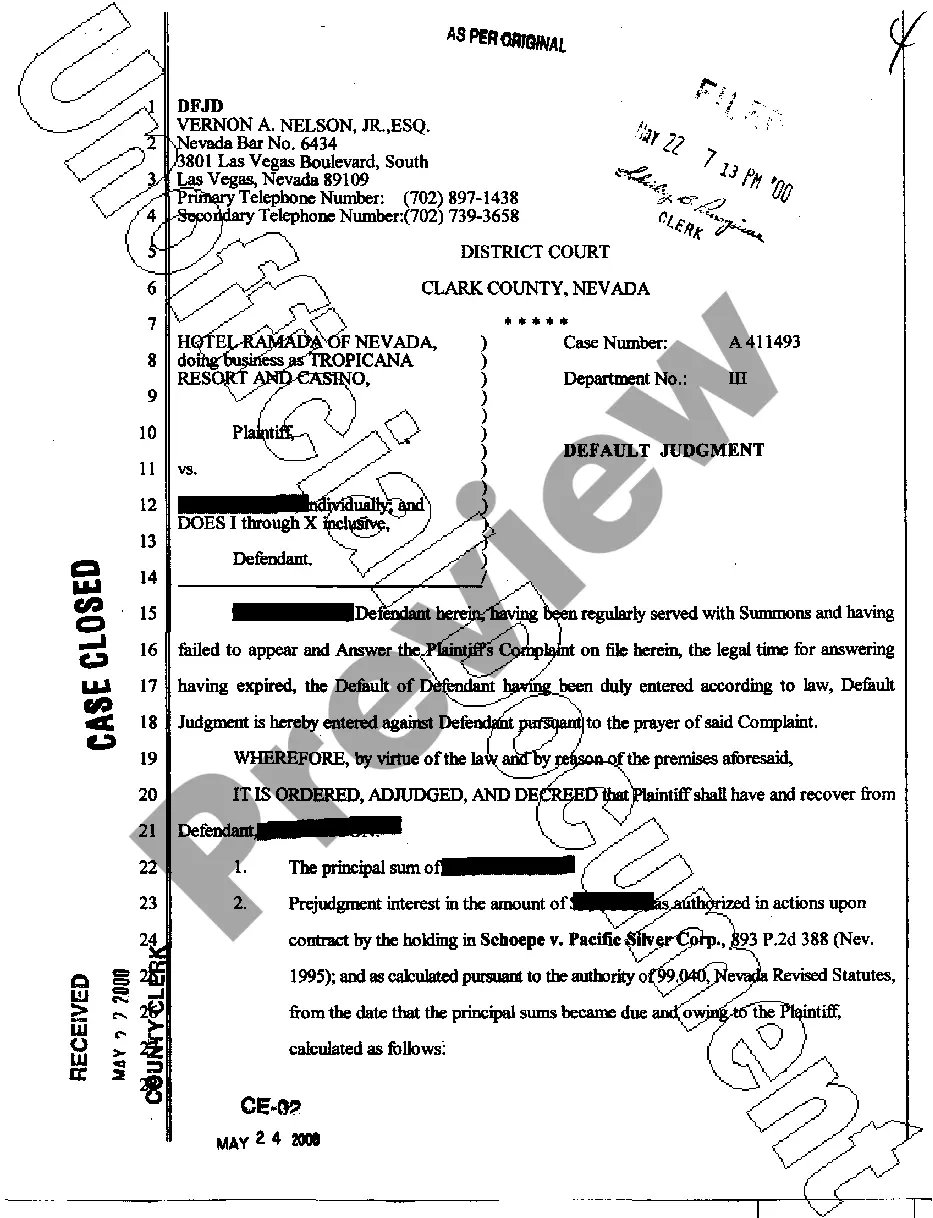

Cook Illinois Fixed Asset Removal Form is a document utilized by the Cook Illinois Corporation to record and authorize the removal of fixed assets from their inventory. Fixed assets, also known as capital assets, are long-term assets held by the company for production, rental, or administrative purposes. These assets can include machinery, equipment, vehicles, furniture, buildings, and land. The Cook Illinois Fixed Asset Removal Form serves as a vital tool in accurately documenting and maintaining an up-to-date inventory of the company's fixed assets. By utilizing the form, Cook Illinois can track the movement and disposal of assets, ensuring proper control and accountability. This form includes various sections requiring relevant information such as the asset's identification number, description, and location. Cook Illinois may use a barcode or unique identification system to assign an identification number for each asset, making it easier to track them throughout their lifecycle. Additionally, the Fixed Asset Removal Form specifies the reason for removal, whether it be due to transfer to another department, sale, donation, or disposal. This information assists in determining the appropriate course of action, as well as accounting for any changes in the company's asset base for financial reporting purposes. Cook Illinois may have different types of Fixed Asset Removal Forms depending on the nature of the removal. For instance, they may have separate forms for interdepartmental transfers, sales to external parties, donations to charitable organizations, or disposal due to obsolescence or damages. Ensuring the accuracy and completeness of Cook Illinois' fixed asset inventory is crucial for efficient financial management and compliance with internal control regulations. The Fixed Asset Removal Form aids in streamlining the asset tracking process, reducing the risk of misplacement or unauthorized removal, and facilitating effective decision-making regarding the company's asset portfolio. In conclusion, Cook Illinois Fixed Asset Removal Form is an essential document used by the company to track and authorize the removal of fixed assets from their inventory. It helps maintain accurate records, enhances accountability, and enables effective management of the company's asset base. Different types of Cook Illinois Fixed Asset Removal Forms may exist based on the specific reasons for removal, ensuring comprehensive documentation of all asset movements.

Cook Illinois Fixed Asset Removal Form

Description

How to fill out Cook Illinois Fixed Asset Removal Form?

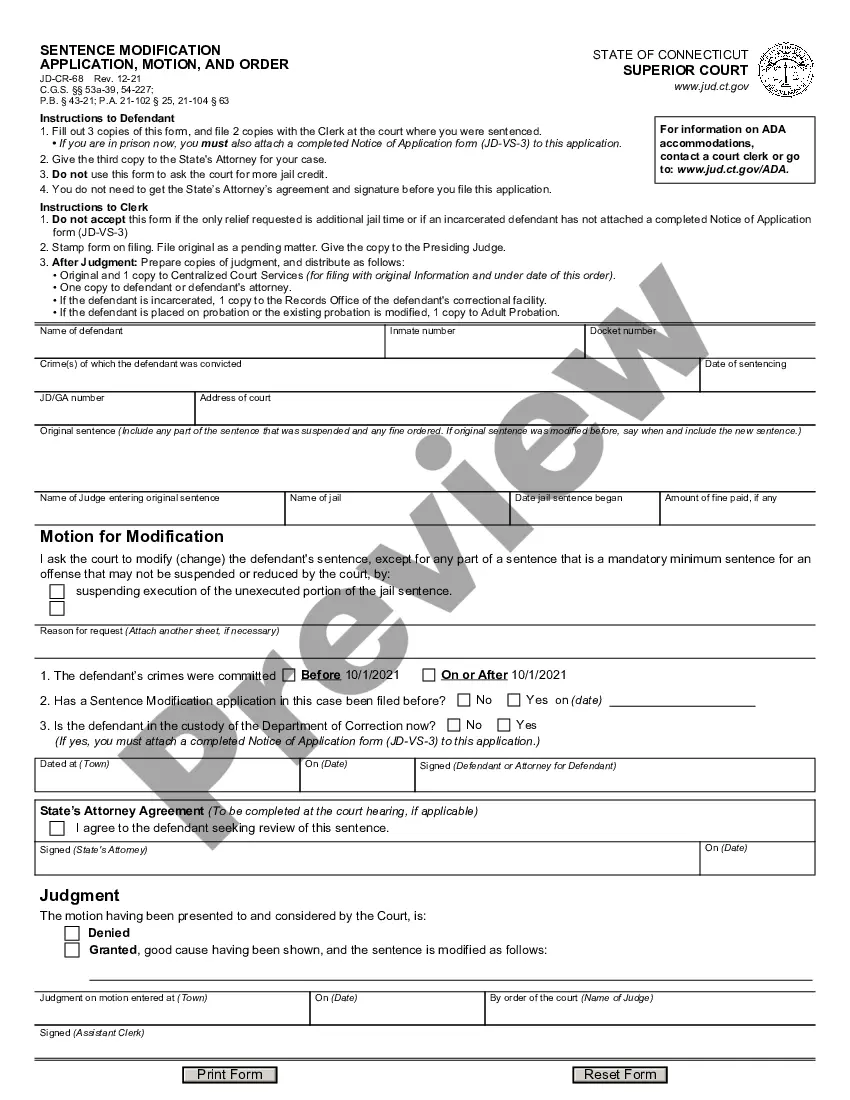

How much time does it typically take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, locating a Cook Fixed Asset Removal Form suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. Apart from the Cook Fixed Asset Removal Form, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Cook Fixed Asset Removal Form:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Cook Fixed Asset Removal Form.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

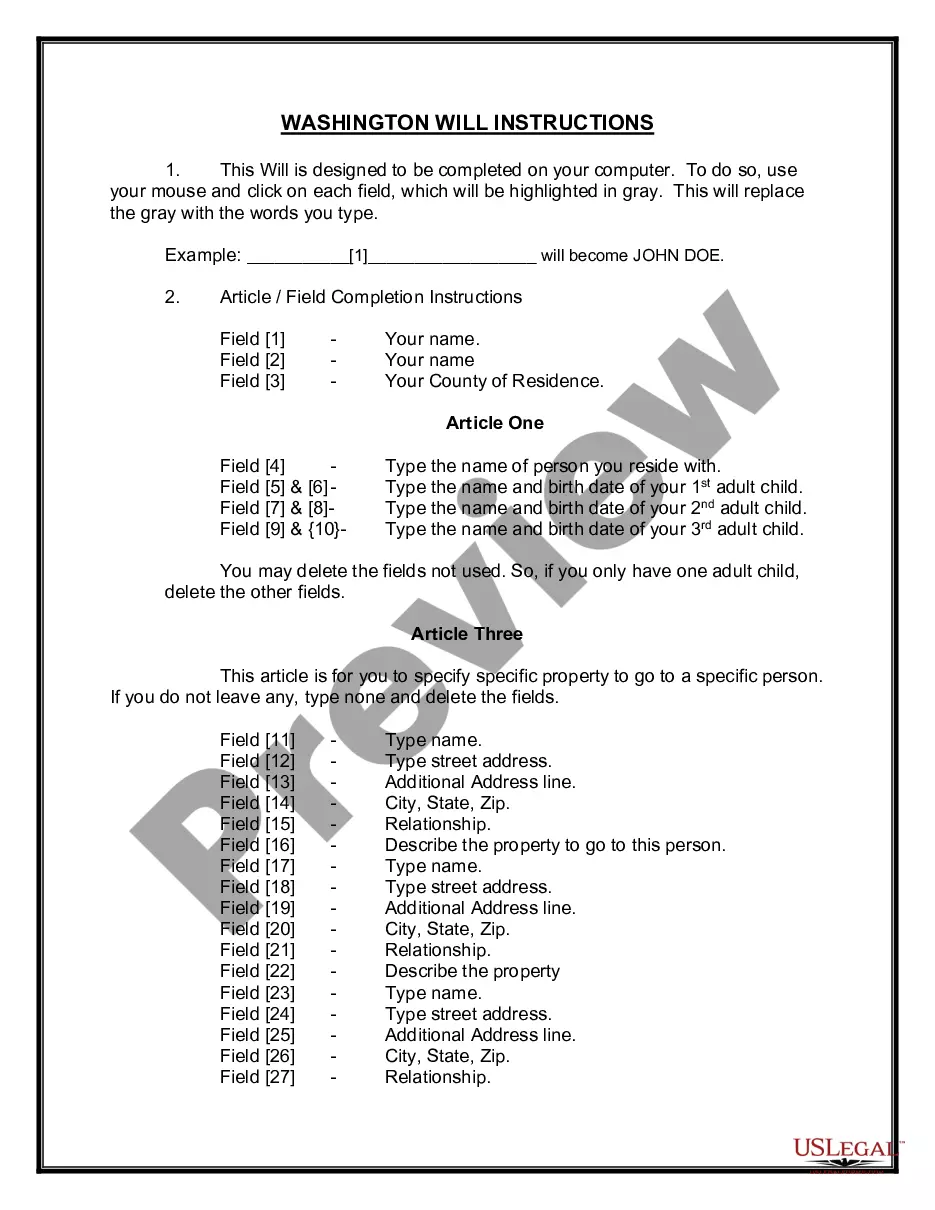

Resolution Highlight the asset(s) that is to be deleted. You can hold the Ctrl key and click individual asset to select multiple assets or use the Shift key to select a block of assets. Select the Asset menu. Select Delete Assets.

In the Accounting menu, select Advanced, then click Fixed assets. Select the status tab for the asset you want to delete. Click the asset number to open the asset details. Click Options, then click Delete.

In the Accounting menu, select Advanced, then click Fixed assets. Select the status tab for the asset you want to delete. Click the asset number to open the asset details. Click Options, then click Delete.... Fixed assets. Manage fixed assets. Delete fixed assets.

Go to Fixed Assets > Setup > Delete Assets. In the Delete Invalid Assets page, you can add the assets to delete through the Asset Details sublist or through CSV import. To add assets through the Asset Details list: From the Asset Details list, select the asset ID or name that you want to delete, and then click Add.

Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation and accumulated impairment losses from balance sheet, recording receipt of cash and recognizing any resulting gain or loss in income statement.

Related Courses. A fixed asset is written off when it is determined that there is no further use for the asset, or if the asset is sold off or otherwise disposed of.

The Fixed Asset Disposal Form Template is used to document the disposal of old or faulty equipment. Include information such as the name of the person who authorized the disposal, the method of disposal as well as details about costs in case the asset was sold.

:12 Asset Disposal - YouTube YouTube Start of suggested clip End of suggested clip The accumulated depreciation of the asset to asset disposal in other words my total depreciationMoreThe accumulated depreciation of the asset to asset disposal in other words my total depreciation that has been written off on the asset that I'm disposing. Again by means of a journal entry I'm

A fixed asset is written off when it is decided that there is no further use of the asset or when they are confirmed as losses. It means that assets would not be able to generate any economic benefit or value to the company. The value of those assets is only at salvage or scrap value.

ASSET DISPOSAL FORM. Page 1. FORM FD14.0906. THIS FORM IS USED TO DOCUMENT THE DISPOSAL OF BOTH MAJOR ASSETS AND MINOR EQUIPMENT.