Bexar Texas Purchase Invoice is a document used in Bexar County, Texas, to record and track the purchase transactions made by individuals or businesses. The invoice contains essential details related to the purchase, including the item or service description, quantity, unit price, and total amount owed. It serves as proof of the agreement between the buyer and the seller, ensuring a transparent and accurate record of the transaction. The Bexar Texas Purchase Invoice is crucial for both parties involved in the purchase, as it helps in maintaining financial records, inventory management, and tax compliance. It provides a systematic approach to track purchases and ensures that accurate financial information is recorded for future reference or audits. There are several types of Bexar Texas Purchase Invoices that may vary depending on the nature of the transaction or industry-specific requirements. Some common types of purchase invoices include: 1. Standard Purchase Invoice: This type of invoice is used for regular purchase transactions, where the buyer is purchasing goods or services from a supplier or vendor. 2. Recurring Purchase Invoice: This type of invoice is generated for repeated purchases of the same goods or services. It is commonly used for subscription-based services or ongoing contracts. 3. Proforma Purchase Invoice: A proforma invoice is often used before the actual purchase. It provides detailed information about the goods or services, including the price, terms, and conditions. Proforma invoices are typically used for customs or prepayment purposes. 4. Credit Memo: A credit memo is issued when there is a need to provide a refund or credit to the buyer. It is used to rectify any errors in the original purchase invoice, such as incorrect pricing, damaged goods, or returned items. 5. Electronic Purchase Invoice: With the growing trend of digitization, electronic purchase invoices are becoming increasingly popular. These invoices are created, sent, and received electronically, streamlining the purchasing process and reducing paper consumption. Bexar Texas Purchase Invoice plays a critical role in maintaining accurate financial records, ensuring compliance with tax regulations, and facilitating smooth business operations. By documenting all purchase transactions, it provides transparency and clarity to the buyer and seller, establishing a reliable and trustworthy business relationship.

Bexar Texas Purchase Invoice

Description

How to fill out Bexar Texas Purchase Invoice?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Bexar Purchase Invoice, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Bexar Purchase Invoice from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Bexar Purchase Invoice:

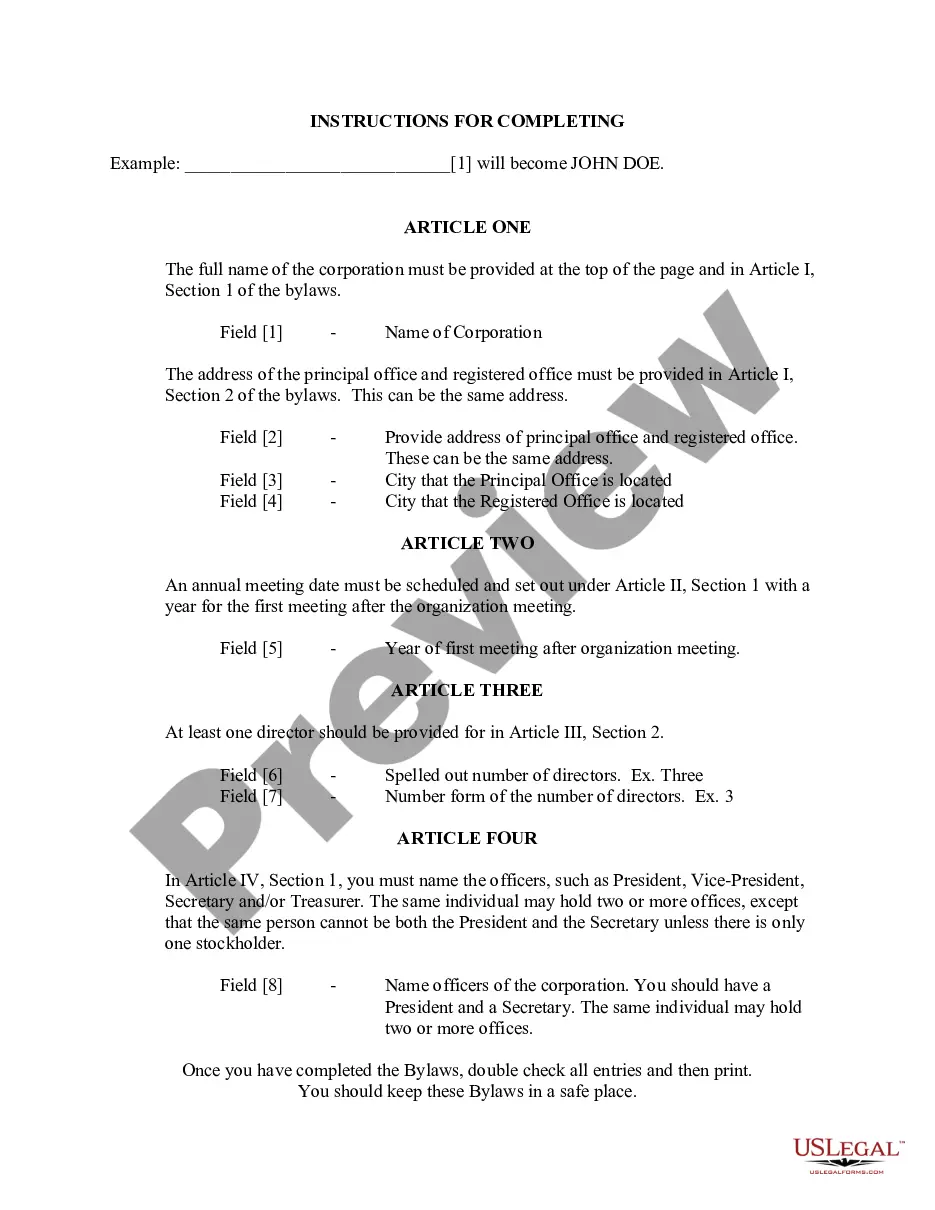

- Examine the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!