Nassau New York Purchase Invoice

Description

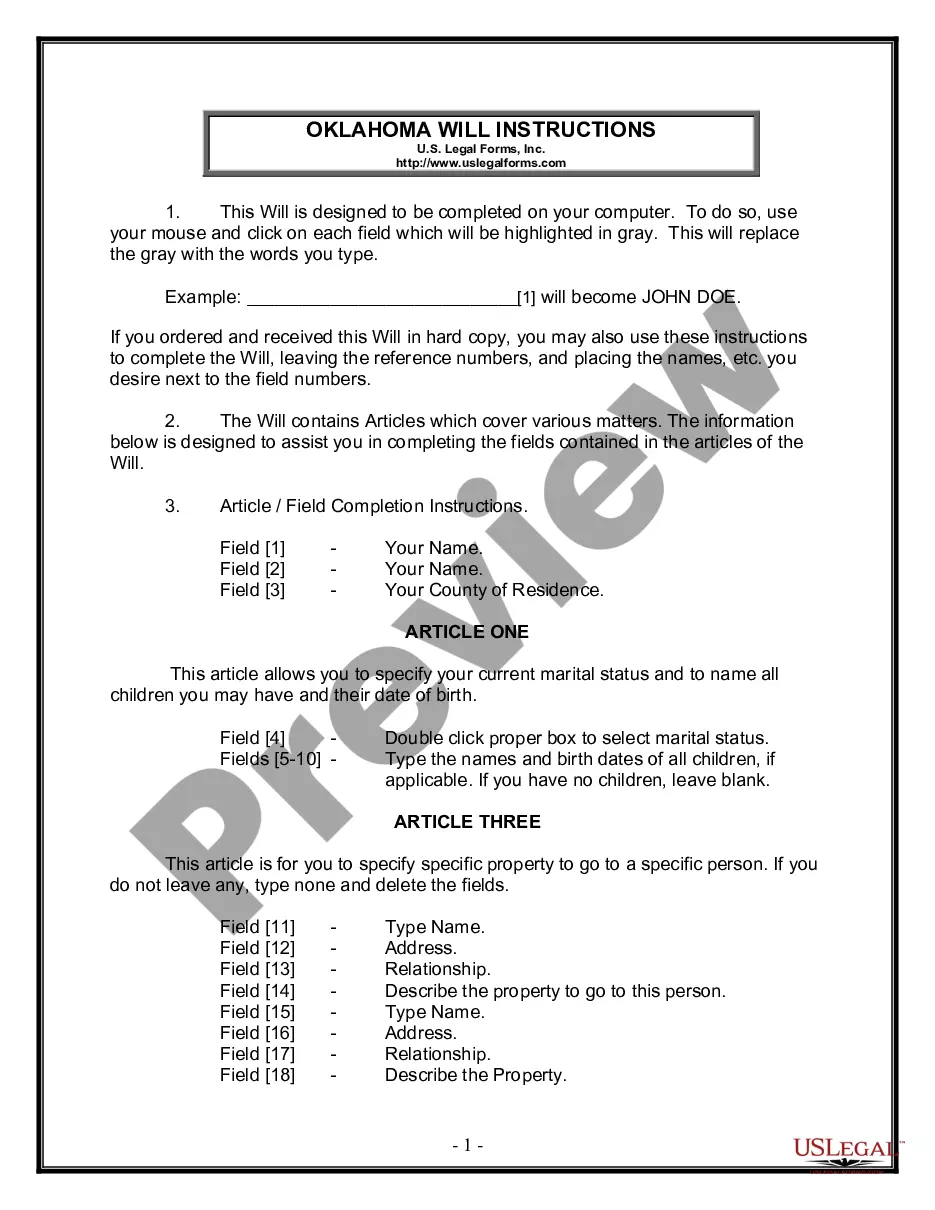

How to fill out Nassau New York Purchase Invoice?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Nassau Purchase Invoice, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Therefore, if you need the current version of the Nassau Purchase Invoice, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Nassau Purchase Invoice:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Nassau Purchase Invoice and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Property records are public. People may use these records to get background information on purchases, mortgages, asset searches and other legal and financial transactions.

Recording Fees 5 Boroughs, Westchester and Outer CountiesDeed and RP-5217 NYC Filing Fee (Residential)310Subordination Agreement125Nassau CountyDeed and RP-5217 NYC Filing Fee (Residential)60029 more rows

Check Your Local Assessor's Office On your local tax assessor's official website, you may be able to look up property tax records and find the property owner by their address. You can learn who owns the home as well as how much property tax they pay. This is a great way to find out who owns a property for free.

If you still want a copy of your deed for purposes other than selling your home, such as establishing residency, for example, you can always obtain a copy from your county clerk's office. In New York City, you can obtain a copy from the city's ACRIS website.

The Nassau County Treasurer's Office has resumed limited in person access. Where possible, it is recommended that delinquent 2021 taxes be paid online at . There is a $1.00 service-charge or you may pay by credit card for a 2.3% bank charge.

If you do not receive a tax bill in November, you may print one from our website or contact our office to request a copy be mailed to you. Taxes may be paid online, in person at one of our offices, or by mail (Postmark does apply on current tax payments).

You can search for property records and property ownership information online, in person, or over the phone with a 311 representative. Property owners of all boroughs except Staten Island can visit ACRIS. To search documents for Staten Island property, visit the Richmond County Clerk's website.

A Notary Public is available in the Office of the Nassau County Clerk. - File the original completed name change petition with the Court Information Center of the Supreme Court, Room 240. Make sure that the index number is written on the proposed name change order and on each page requiring the same.

View Tax Bills Online General and School Tax Bills may be viewed online in the Receiver of Taxes Payment Center. Using your Parcel ID (school district, section, block, and lot numbers) or tax bill number, you may search for your current General and School Tax Bills.

How do I find out who currently owns a property in Nassau County? Property information is available online at US Land Records page or come to the County Clerk's Office (Room B-1) to obtain that information. Information cannot be given over the phone or via email.

Interesting Questions

More info

The value of all the items sold will be reported as taxable sales. The Suffolk County Sheriffs Office has adopted a tax law which requires the use of an approved vendor card on all purchases made and received within Suffolk County. Use Tax is imposed on the purchase of all the following items (unless exempt by statute). Any item for domestic use that is purchased after January 1, 1992.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.