Bexar Texas Payroll Deduction — Special Services is a convenient and efficient way for employees to manage their finances and make payments directly from their wages. This payroll deduction service is designed to support various special services offered in Bexar, Texas, providing employees with a hassle-free method of accessing and utilizing these services. One type of Bexar Texas Payroll Deduction — Special Service is the healthcare deduction option. With this service, employees can choose to have a portion of their wages deducted to cover medical expenses, dental care, vision care, or any other eligible healthcare costs. This helps ensure that employees always have the necessary funds available for medical treatments or preventive care. Another type of Bexar Texas Payroll Deduction — Special Service is the retirement savings deduction. This service allows employees to contribute a portion of their wages towards a retirement fund, such as a 401(k) plan or an IRA. By automating these deductions through payroll, employees can effortlessly save for their future and build a secure financial foundation. Additionally, Bexar Texas Payroll Deduction — Special Services can include deduction options for various employee benefits. These can range from contributions to flexible spending accounts (FSA's) to cover eligible healthcare expenses or dependent care costs, to deductions for commuter benefits, such as transit passes or parking expenses. By utilizing these payroll deductions, employees can maximize the benefits offered by their employer and save on taxes. Furthermore, Bexar Texas Payroll Deduction — Special Services may also extend to loan repayments, allowing employees to conveniently deduct payments for personal or educational loans directly from their wages. This simplifies the loan repayment process, ensuring timely and consistent payments while budgeting effectively. In summary, Bexar Texas Payroll Deduction — Special Services offers employees a range of convenient payroll deduction options to manage their finances effectively. These services include deductions for healthcare expenses, retirement savings, employee benefits, and loan repayments. By taking advantage of these special services, employees can streamline their financial responsibilities, save for the future, and access important services without hassle.

Bexar Texas Payroll Deduction - Special Services

Description

How to fill out Bexar Texas Payroll Deduction - Special Services?

Whether you plan to start your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business case. All files are grouped by state and area of use, so opting for a copy like Bexar Payroll Deduction - Special Services is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Bexar Payroll Deduction - Special Services. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

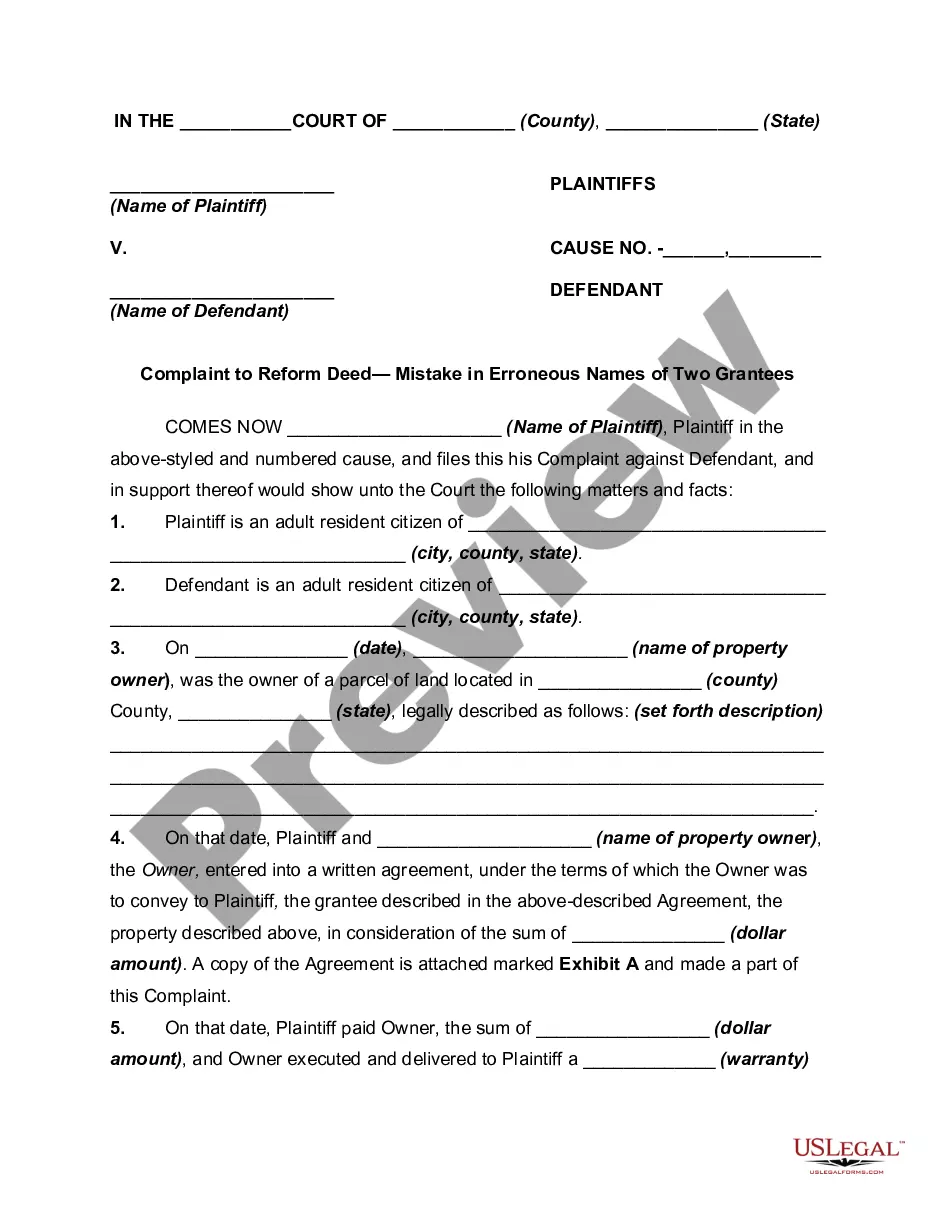

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Bexar Payroll Deduction - Special Services in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!