Los Angeles, California Payroll Deduction — Special Services: A Comprehensive Guide If you're working in Los Angeles, California, you may have come across the term "payroll deduction — special services." This guide aims to provide a detailed description of what this concept entails, including its purpose, benefits, and various types available in Los Angeles, California. Payroll deduction — special services refers to a system that allows employees to have specific payments deducted directly from their paychecks. These services are designed to make a variety of payments more convenient and efficient for employees and employers alike. By utilizing this system, employees can effortlessly contribute to different programs or services without the hassle of handling paper checks or making individual payments. Some key features and benefits of Los Angeles, California payroll deduction — special services include: 1. Convenience: Payroll deduction — special services streamline the payment process by deducting funds automatically from an employee's paycheck. This eliminates the need for manual transactions, saving time for both parties. 2. Flexibility: These services offer employees the flexibility to choose among various types of deductions, tailoring them to their specific needs. This ranges from insurance premiums, retirement contributions, health savings account (HSA) contributions, charity donations, and more. 3. Accessibility: Los Angeles, California payroll deduction — special services are easily accessible to employees in both the public and private sectors, ensuring broad inclusion and availability. 4. Cost-effective: By automating the deduction process, companies can save time and resources, reducing administrative costs associated with manual payment handling. Now, let's delve into the different types of Los Angeles, California payroll deduction — special services: 1. Retirement Contributions: Employees can opt for payroll deductions towards their retirement plans, such as 401(k) or 403(b) accounts. These deductions can be done pre-tax, allowing employees to save on income taxes and build their retirement savings simultaneously. 2. Health and Wellness Programs: Employees may choose to utilize payroll deductions for various health-related programs, including health insurance premiums, flexible spending accounts (FSA's), Has, or gym membership fees. 3. Charitable Contributions: Many organizations offer employees the opportunity to make charitable donations effortlessly through payroll deductions. Employees can support their preferred charitable causes and nonprofits by designating a specific amount to be deducted from each paycheck. 4. Union Dues: Employees who are part of a labor union can opt for payroll deductions towards union dues. These deductions are often essential for collectively working towards employee rights and benefits. 5. Loan Repayments: In certain cases, employees may have the option to set up payroll deductions for loan repayments, such as student loans or company-provided loans. This ensures regular and timely loan payments without the hassle of individual transfers. In conclusion, Los Angeles, California payroll deduction — special services offer a convenient and flexible way for employees to manage various payments directly from their paychecks. Whether it's contributing to retirement accounts, supporting charities, or managing loan repayments, these services provide numerous benefits for both employees and employers. By utilizing this system, individuals in Los Angeles can easily handle their financial obligations, ensuring a smoother and more efficient payment experience.

Los Angeles California Payroll Deduction - Special Services

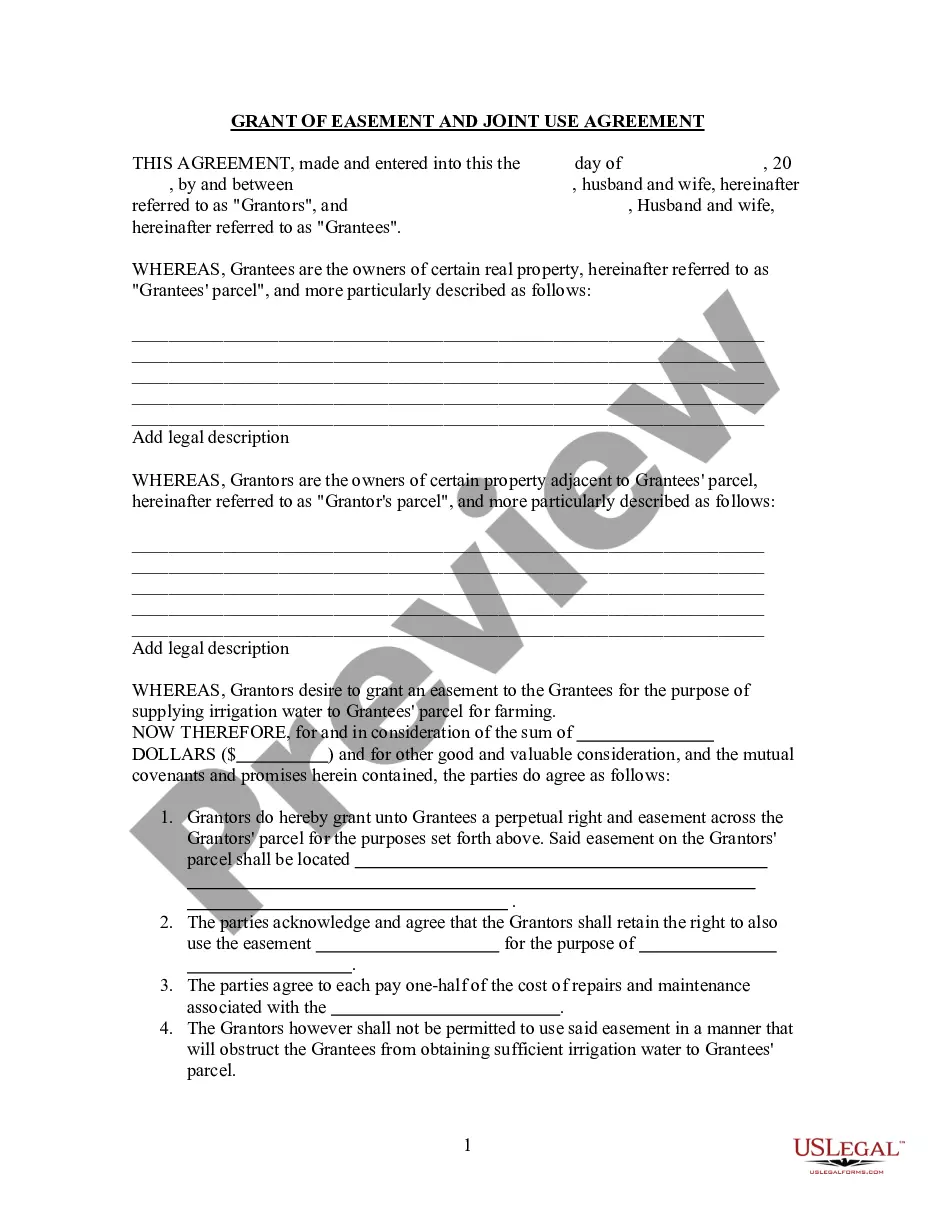

Description

How to fill out Los Angeles California Payroll Deduction - Special Services?

Creating paperwork, like Los Angeles Payroll Deduction - Special Services, to manage your legal matters is a tough and time-consumming process. Many cases require an attorney’s involvement, which also makes this task not really affordable. However, you can consider your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents created for different scenarios and life situations. We ensure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Los Angeles Payroll Deduction - Special Services template. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Los Angeles Payroll Deduction - Special Services:

- Ensure that your template is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Los Angeles Payroll Deduction - Special Services isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin utilizing our service and get the document.

- Everything looks good on your side? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is good to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!