Maricopa Arizona Payroll Deduction — Special Services is a convenient service offered to employees residing or working in Maricopa, Arizona. This payroll deduction program allows individuals to allocate a specific portion of their salary towards various special services or benefits. By opting for this service, employees can conveniently automate their payments and enjoy the perks and advantages associated with these services without much hassle. There are several types of Maricopa Arizona Payroll Deduction — Special Services available, catering to different needs and preferences. Some commonly offered special services include: 1. Health Insurance: Health insurance is a crucial benefit for individuals, ensuring access to quality healthcare facilities and coverage for medical expenses. Through Maricopa Arizona Payroll Deduction — Special Services, employees can choose to allocate a portion of their salary towards health insurance premiums, granting them peace of mind and financial security in case of medical emergencies. 2. Retirement Plans: Planning for retirement is essential, and Maricopa Arizona Payroll Deduction — Special Services also offer options for employees to set aside a portion of their earnings towards retirement plans. This allows individuals to save and invest for their future while enjoying potential tax benefits and employer-matched contributions. 3. Flexible Spending Accounts (FSA): A Flexible Spending Account offers employees the opportunity to set aside pre-tax dollars to cover eligible healthcare expenses or dependent care costs. Maricopa Arizona Payroll Deduction — Special Services allow individuals to opt for FSA contributions, ensuring access to tax advantages and increasing their disposable income. 4. Education Savings Plans: Education is a significant aspect of an individual's life or their dependent's life. Maricopa Arizona Payroll Deduction — Special Services provide options for employees to allocate portions of their salary towards educational savings plans. These funds can be used to finance college tuition, books, and other educational expenses, easing the financial burden and making education more accessible. 5. Charitable Contributions: Maricopa Arizona Payroll Deduction — Special Services also include the option to donate a portion of an employee's earnings to charitable organizations or community initiatives. By participating in these deductions, individuals can support causes dear to their hearts, contribute to their community's betterment, and potentially claim tax deductions. Maricopa Arizona Payroll Deduction — Special Services offer individuals the opportunity to manage their finances effectively and plan for a secure future. By leveraging these services, employees can enjoy the convenience of automatic deductions, tax advantages, and contribute to personal and community development with ease.

Maricopa Arizona Payroll Deduction - Special Services

Description

How to fill out Maricopa Arizona Payroll Deduction - Special Services?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Maricopa Payroll Deduction - Special Services, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any activities associated with paperwork completion straightforward.

Here's how to find and download Maricopa Payroll Deduction - Special Services.

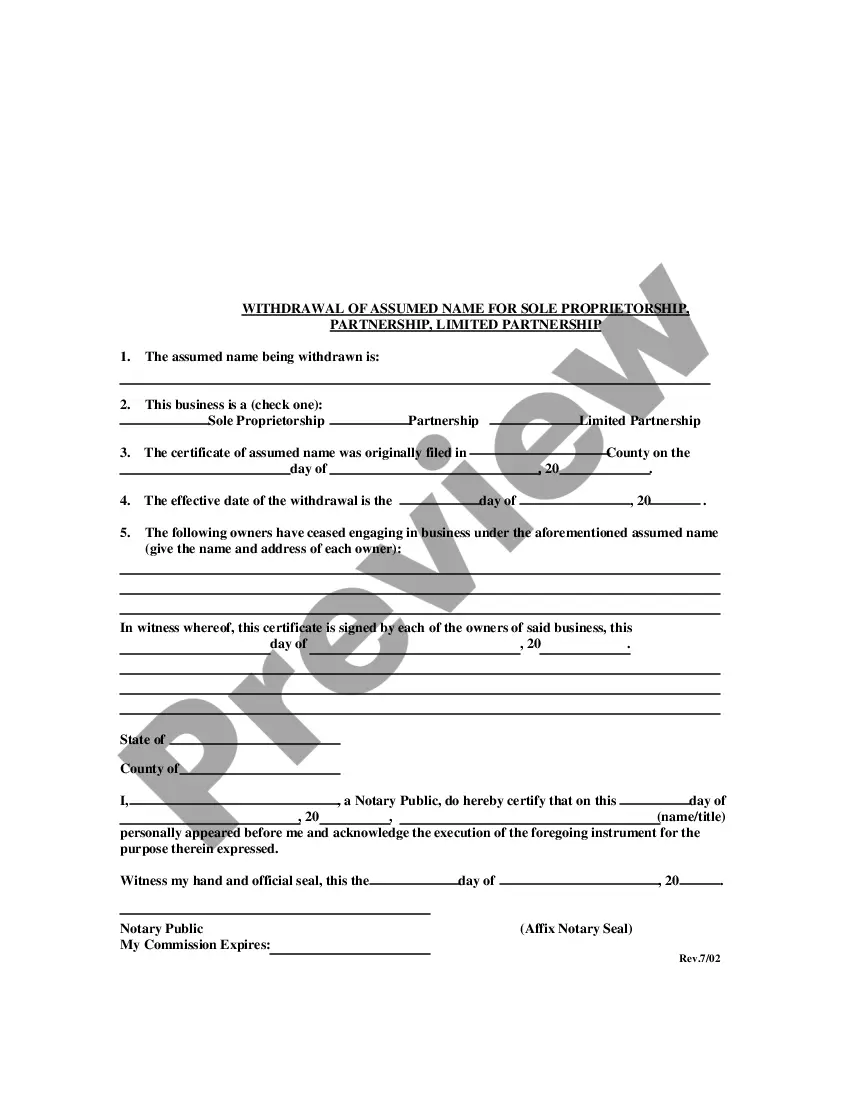

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can impact the validity of some records.

- Examine the related forms or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment method, and buy Maricopa Payroll Deduction - Special Services.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Maricopa Payroll Deduction - Special Services, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you have to cope with an extremely challenging situation, we advise using the services of a lawyer to check your form before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Join them today and purchase your state-specific documents with ease!