Clark Nevada Job Expense Record is a comprehensive document used by individuals or organizations in Clark County, Nevada, to maintain a detailed record of job-related expenses. It is crucial for both employees and employers to accurately keep track of these expenses for tax and reimbursement purposes. The Clark Nevada Job Expense Record is specifically tailored for individuals working in Clark County and provides a structured template for documenting various types of job-related expenses. It allows employees to track and record expenses incurred during business-related activities, such as travel, meal expenses, supplies, equipment, mileage, and other necessary expenditures. This record is especially vital for individuals who are not reimbursed for job-related expenses by their employers, as it serves as proof for claiming tax deductions at the end of the year. By maintaining a detailed and organized record, employees can ensure they don't overlook any deductible expenses and accurately report them when filing their income tax returns. There may be several types of Clark Nevada Job Expense Records depending on the specific industries or professions. Some common types of records may include: 1. Construction Job Expense Record: This type of record is specifically designed for individuals working in the construction industry, allowing them to track expenses related to materials, equipment rentals, subcontractor fees, permits, and other construction-related costs. 2. Sales Job Expense Record: Sales professionals can utilize this type of record to track expenses incurred during client meetings, business travel, sales presentations, marketing materials, client entertainment, and any other necessary sales-related expenditures. 3. Healthcare Job Expense Record: Healthcare professionals, such as doctors, nurses, or therapists, can keep a detailed account of expenses related to continuing education courses, professional certifications, medical textbooks, medical equipment, travel expenses for medical conferences, and other essential healthcare-related expenses. 4. Freelancer/Independent Contractor Job Expense Record: This type of record is suitable for individuals working as freelancers or independent contractors across various industries. It allows them to track expenses related to their specific line of work, such as tools, software subscriptions, advertising expenses, home office deductions, and other professional expenses. Overall, the Clark Nevada Job Expense Record is a valuable tool for individuals in Clark County, Nevada, to maintain a comprehensive record of job-related expenses. It ensures accurate reporting, facilitates tax deductions, and helps employees maintain a clear overview of their work-related expenditure, contributing to financial planning and accountability.

Clark Nevada Job Expense Record

Description

How to fill out Clark Nevada Job Expense Record?

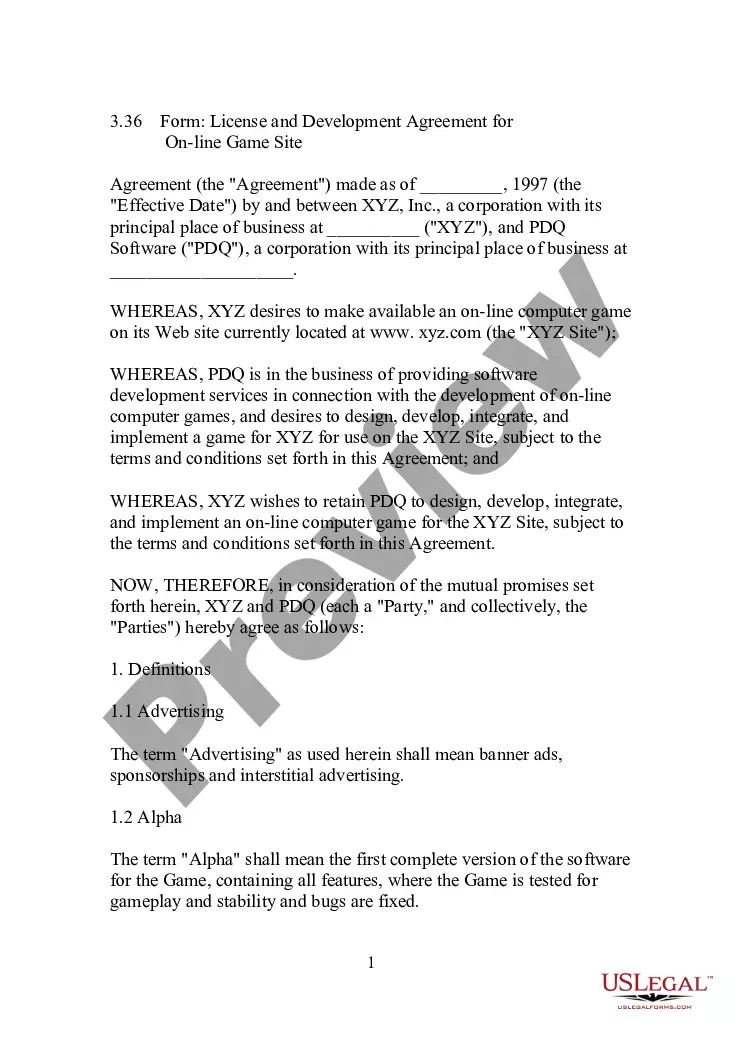

Do you need to quickly draft a legally-binding Clark Job Expense Record or maybe any other document to manage your personal or corporate affairs? You can select one of the two options: hire a legal advisor to draft a valid document for you or create it completely on your own. The good news is, there's another option - US Legal Forms. It will help you get neatly written legal papers without paying sky-high fees for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific document templates, including Clark Job Expense Record and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- To start with, carefully verify if the Clark Job Expense Record is tailored to your state's or county's laws.

- If the document has a desciption, make sure to check what it's suitable for.

- Start the searching process again if the form isn’t what you were seeking by using the search box in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Clark Job Expense Record template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Moreover, the templates we provide are updated by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!