The Wake North Carolina Job Expense Record is a crucial document used by individuals or companies in Wake County, North Carolina to track and record their job-related expenses. This record serves as a comprehensive and organized record-keeping tool for managing and documenting various expenses incurred during the course of employment. By maintaining an accurate and detailed expense record, individuals can ensure proper reimbursement, tax deductions, and financial tracking. The Wake North Carolina Job Expense Record covers a wide range of job-related expenses such as travel, meals, lodging, transportation, supplies, equipment, and other miscellaneous expenses necessary for the performance of job duties. To provide a clearer understanding, let's explore some different types of expense records that fall under this category: 1. Travel Expenses: This record encompasses expenses associated with business-related travel, including airfare, train or bus tickets, rental cars, taxi or ride-share services, and mileage charges. It also includes accommodation costs, such as hotel stays. 2. Meals and Entertainment Expenses: This category includes expenses incurred for client meetings, business lunches, and other entertainment activities directly related to job responsibilities. It incorporates receipts for meals, beverages, gratuities, and other entertainment expenses. 3. Transportation Expenses: This record documents expenses related to local transportation used for job purposes. It includes costs associated with fuel, parking fees, tolls, public transportation fares, and even transportation-related apps or services. 4. Supplies and Equipment Expenses: This section records expenses for purchasing work-related supplies and equipment necessary for fulfilling job responsibilities. These may include office supplies, software, computer hardware, specialized tools, uniforms, and safety equipment. 5. Home Office Expenses: For individuals who work remotely or have a home-based office, this record accounts for expenses associated with maintaining and utilizing a dedicated workspace. It includes costs for utilities (such as electricity and internet), office furniture, repairs, cleaning and maintenance, and even a portion of rent or mortgage payments. 6. Miscellaneous Expenses: This category captures any other job-related expenses that do not fit into the aforementioned categories. It may include dues for professional memberships, subscriptions, training or certification fees, professional services fees (like legal or accounting services), or any other necessary expenses incurred during the course of employment. In summary, the Wake North Carolina Job Expense Record is an essential tool for individuals and companies operating in Wake County. By meticulously tracking and documenting various job-related expenses, individuals can ensure accurate reporting for reimbursement, tax deductions, financial planning, and compliance purposes.

Wake North Carolina Job Expense Record

Description

How to fill out Wake North Carolina Job Expense Record?

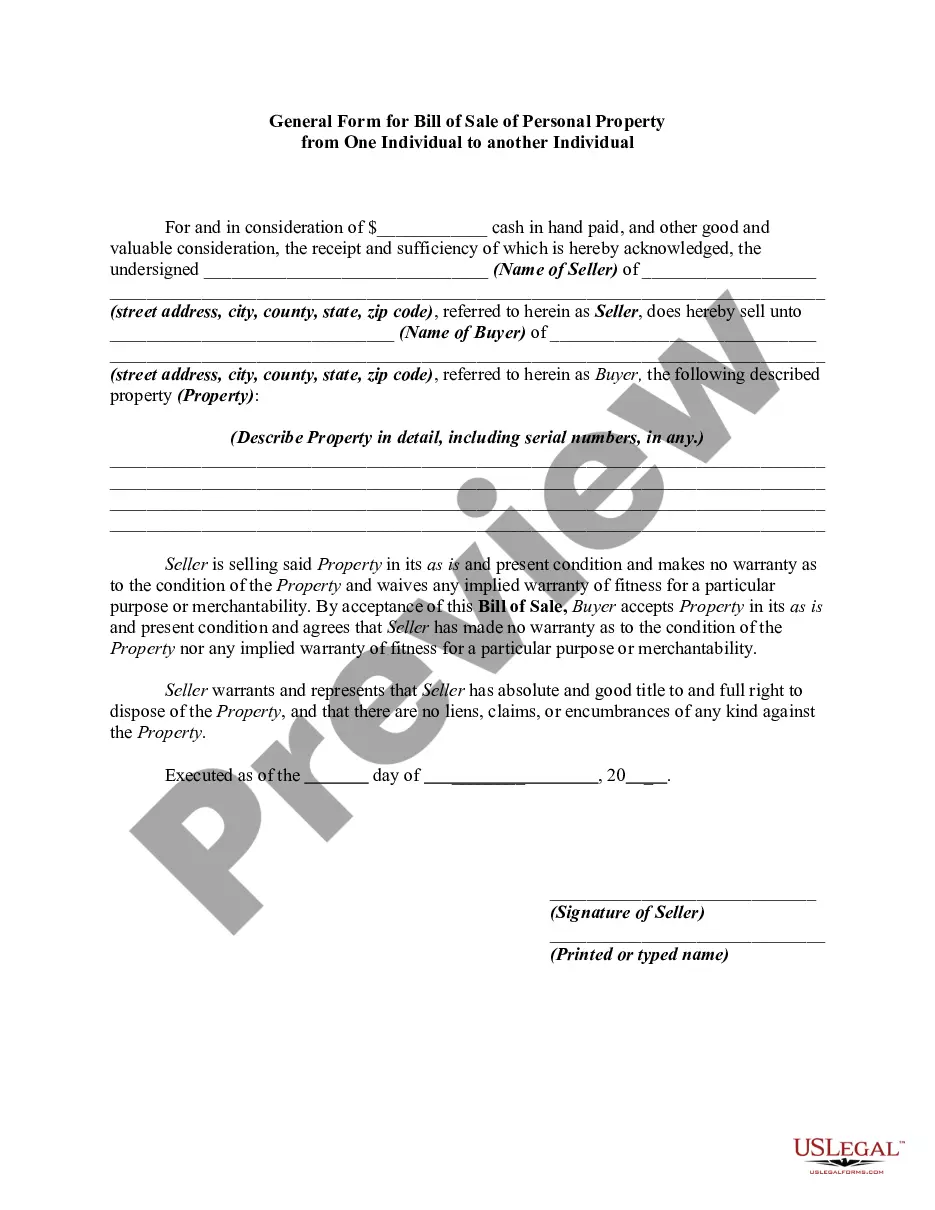

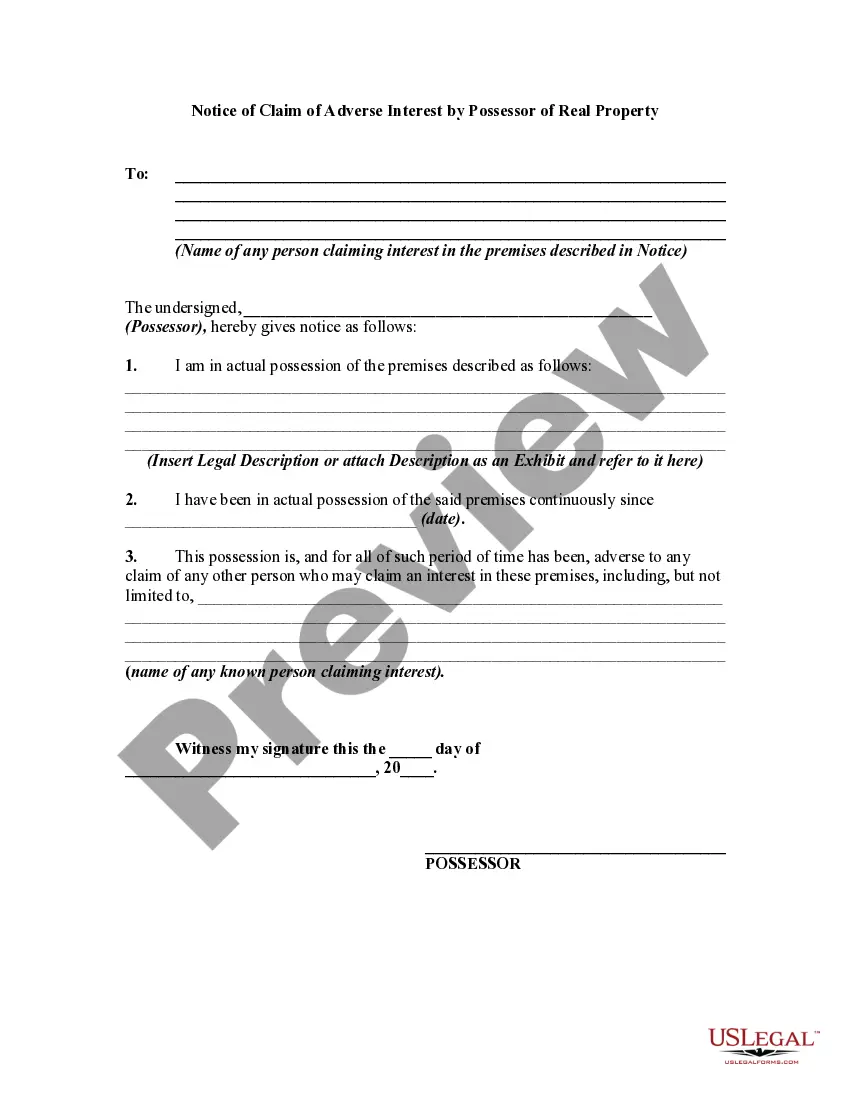

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life situation, finding a Wake Job Expense Record suiting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. Apart from the Wake Job Expense Record, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Wake Job Expense Record:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Wake Job Expense Record.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!