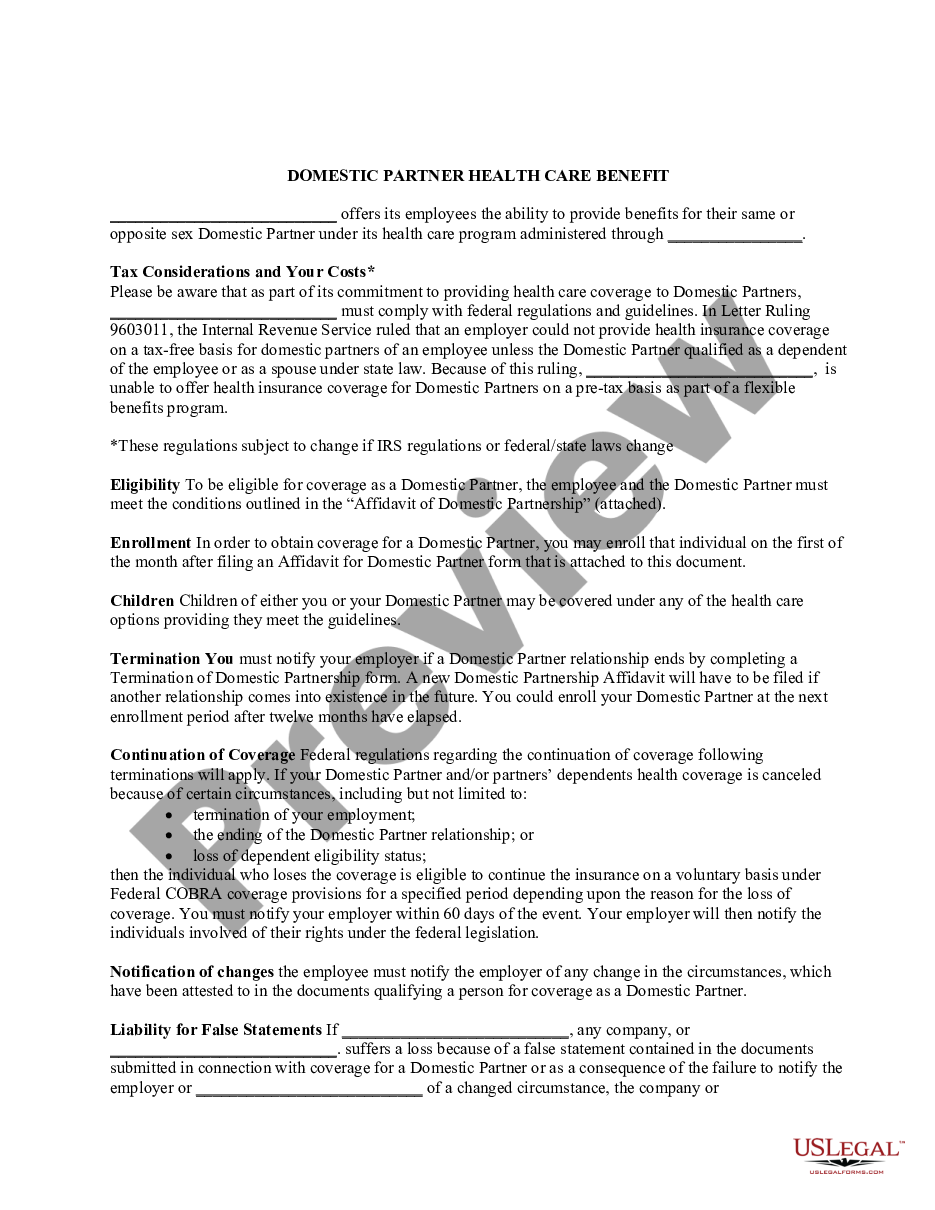

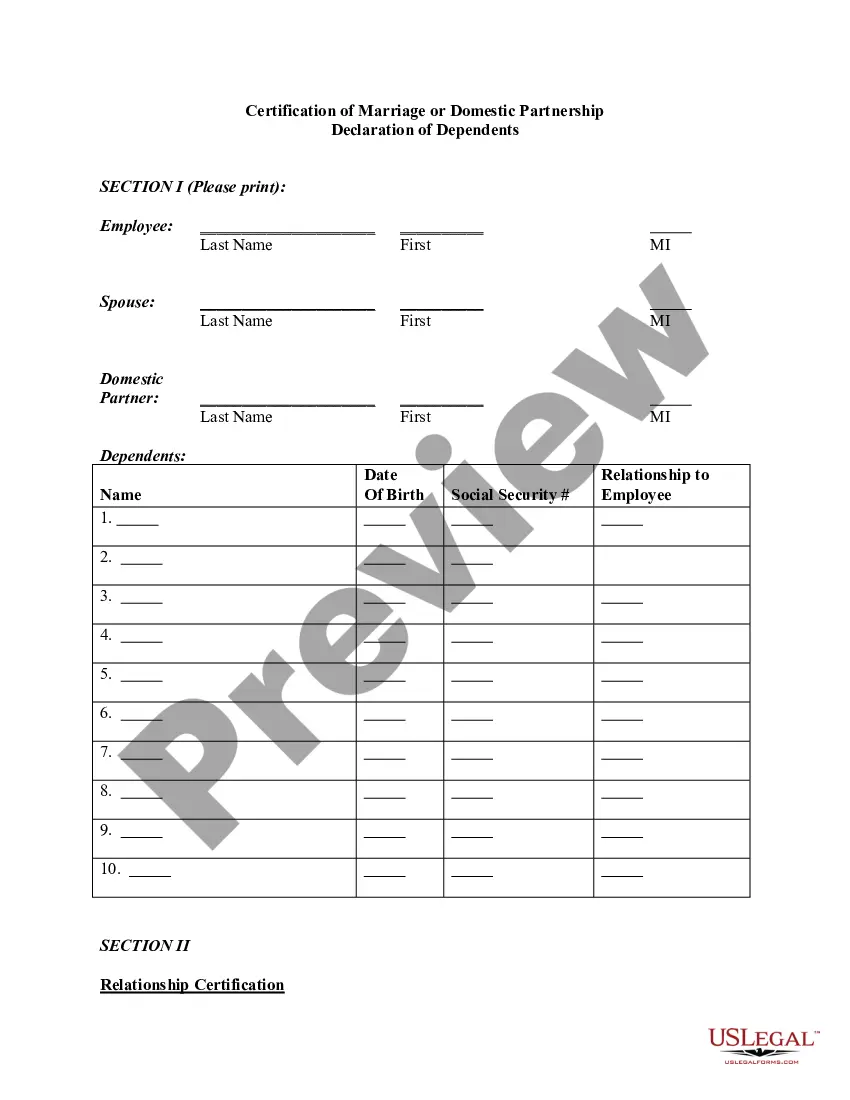

Miami-Dade Florida Domestic Partnership Dependent Certification Form

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-153EM

Format:

Word;

Rich Text

Instant download

Description

Employees may use this form to determine their tax liability status for domestic partnership benefits.