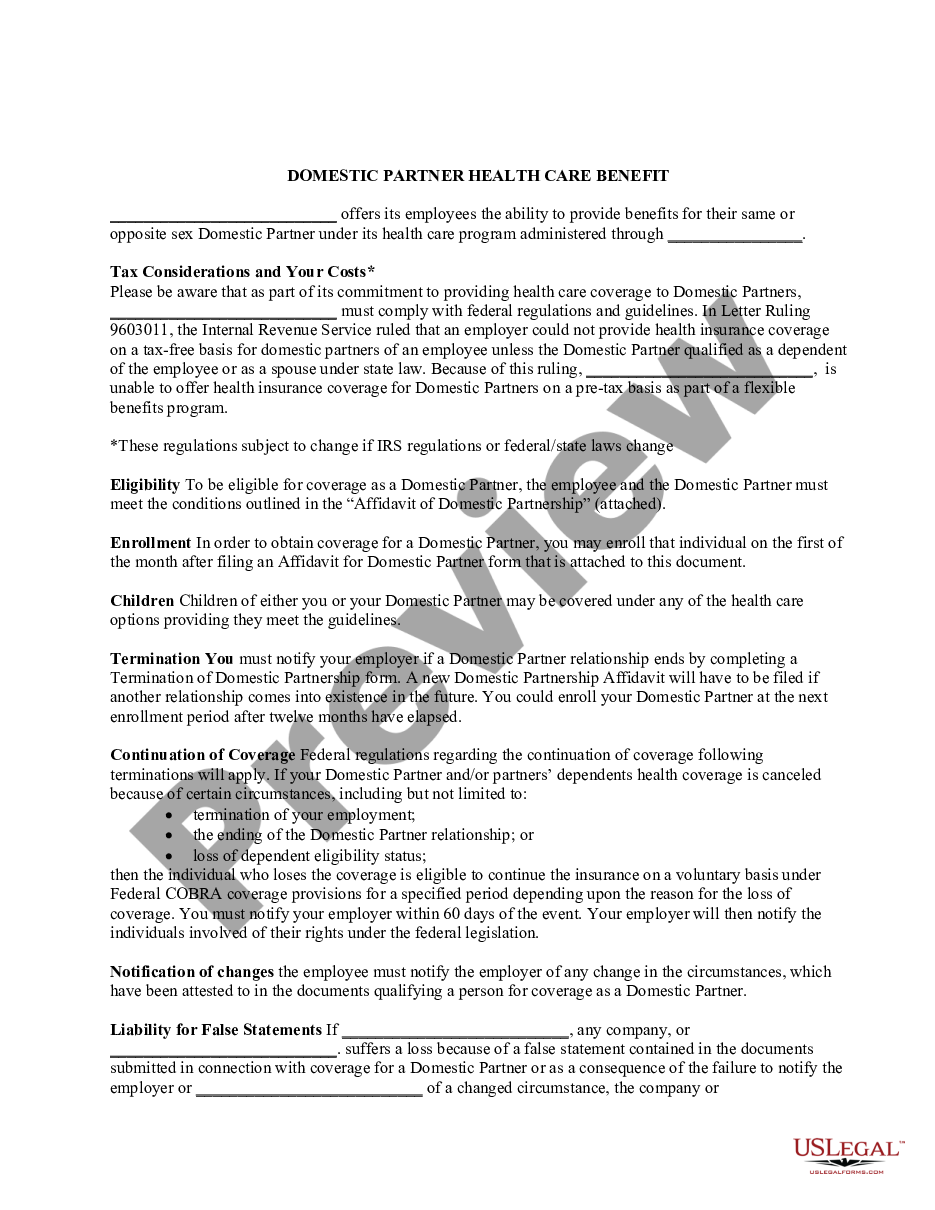

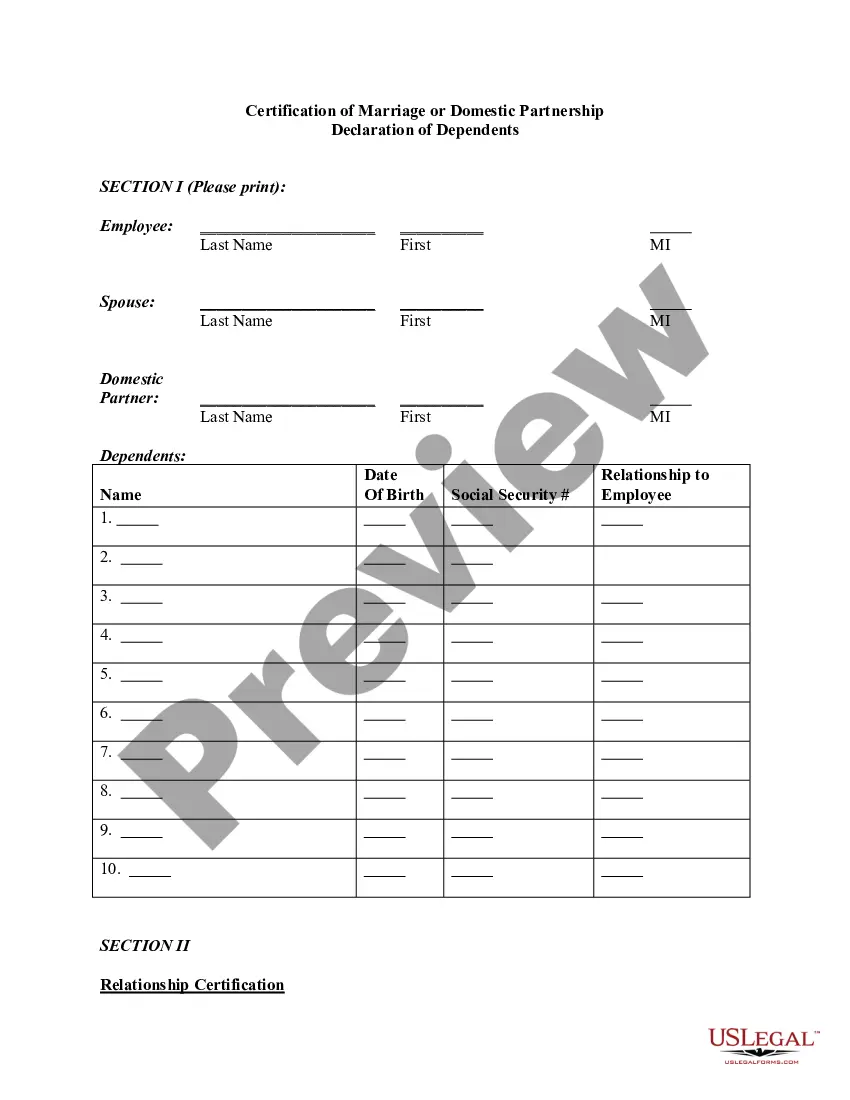

Montgomery Maryland Domestic Partnership Dependent Certification Form

Description

How to fill out Domestic Partnership Dependent Certification Form?

Generating legal documents is essential in our contemporary society.

Nevertheless, it isn’t always necessary to consult a specialist to draft some of them from the ground up, including the Montgomery Domestic Partnership Dependent Certification Form, with a service like US Legal Forms.

US Legal Forms boasts over 85,000 templates to choose from across various categories, such as living wills, real estate documents, and divorce filings. All forms are categorized according to their respective state, simplifying the search process.

If you are already a subscriber to US Legal Forms, locate the appropriate Montgomery Domestic Partnership Dependent Certification Form, Log In to your account, and download it.

Certainly, our website cannot entirely replace an attorney. If you are facing a particularly complex situation, we suggest consulting a lawyer to review your document prior to signing and filing it. With over 25 years in the industry, US Legal Forms has established itself as a preferred source for a wide variety of legal documents for millions of clients. Join them today and conveniently obtain your state-compliant paperwork!

- Review the document’s preview and description (if available) to gain fundamental insights into what you will receive after downloading the document.

- Make sure that the document you select is tailored to your state/county/area, as local laws may influence the validity of certain documents.

- Explore related document templates or initiate a fresh search to locate the correct document.

- Click Buy now and create your account. If you already possess an account, choose to Log In.

- Select the pricing plan, followed by your desired payment option, and acquire the Montgomery Domestic Partnership Dependent Certification Form.

- Opt to save the form template in any of the available formats.

- Navigate to the My documents section to re-download the document.

Form popularity

FAQ

Yes. In order to cover your legal spouse with tax-preferred coverage (using a pre-tax deduction and without any additional income imputed to you for the State subsidy), your marriage must be legally recognized in the State of Maryland and your spouse must be of the opposite gender.

Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.

The State of Maryland made a domestic partnership available as an alternative to marriage in 2008. A domestic partnership is a committed type of relationship that involves two individuals who are residing together but are not married. In the United States, many states recognize domestic partnerships.

Domestic partners are two persons, each aged 18 or older, who have chosen to live together in a committed relationship, who are not legally allowed to marry in the state in which they reside, and who have agreed to be jointly responsible for living expenses incurred during the domestic partnership.

You must have paid more than half of your partner's living expenses during the calendar year for which you want to claim that person as a dependent. When calculating the total amount of support, you must include money and support that you and other people provided as well as the individual's own funds.

As defined in Maryland statute, a domestic partnership means a relationship between two people (opposite sex or same sex) who are at least 18 years old, are not related to one another, are not married or in a civil union or domestic partnership with someone else, and agree to be in a relationship of mutual

To qualify as a dependent, your partner must receive more than half of his or her support from you. If your partner is a dependent, you might also be eligible for other favorable tax treatment. If you think that your partner might be your dependent under federal law, consult a tax professional.

Visit to file the statement of registration as a Virginia registered limited liability partnership in real time.

Couples who wish to become domestic partners must provide two pieces of documentation evidence of their bond; examples may include proof of joint liability for a mortgage, lease, or loan, a joint checking account, a life insurance policy where a partner is the beneficiary, or a relationship or cohabitation contract.

Yes. Because each registered domestic partner is taxed on half the combined community income earned by the partners, each is entitled to a credit for half of the income tax withheld on the combined wages.