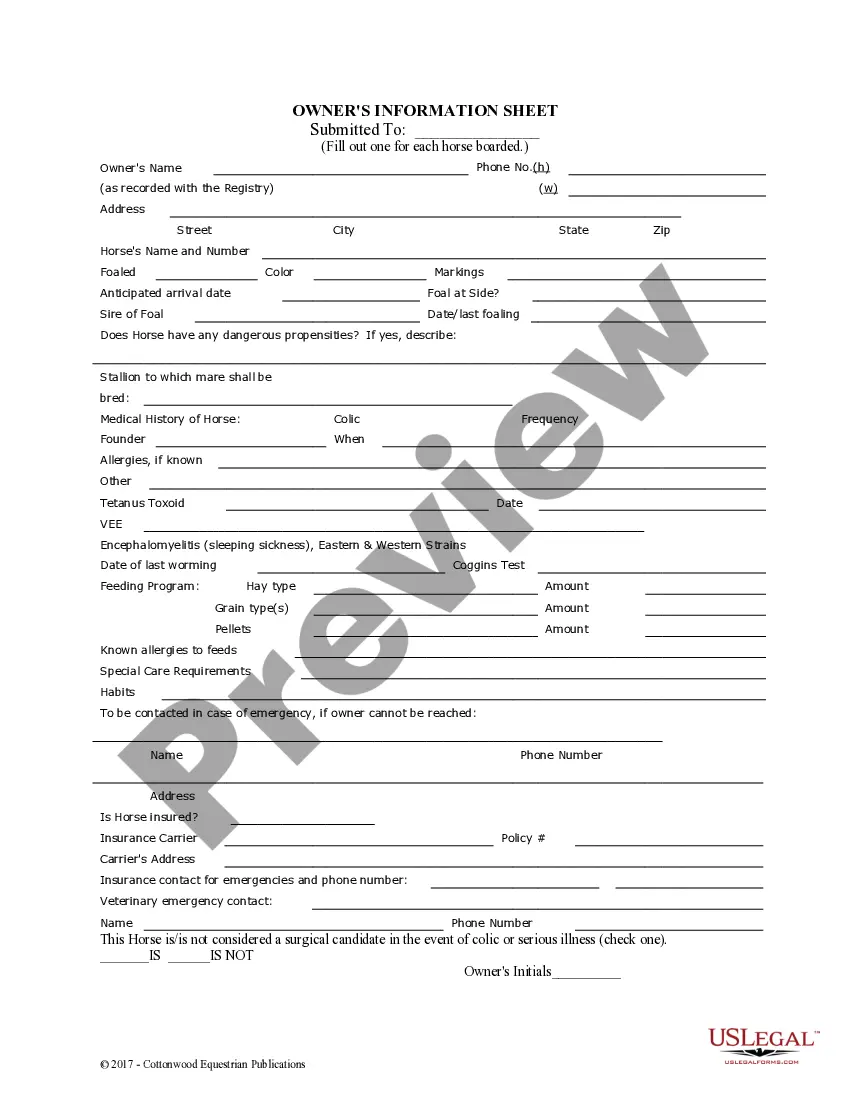

The Nassau New York Domestic Partnership Dependent Certification Form is an official document used to establish the eligibility of dependents in same-sex domestic partnerships for certain benefits and privileges in Nassau County, New York. This form allows an individual to verify the dependency status of their partner's dependent(s) and access various benefits, such as healthcare coverage and financial assistance. The Nassau New York Domestic Partnership Dependent Certification Form serves as proof of the domestic partnership and is vital in obtaining the desired benefits. The form typically requires detailed information about the domestic partners, including their full names, addresses, and contact information. Additionally, the form may require information regarding the dependent(s), such as their names, dates of birth, and social security numbers. It is important to note that there may be different types or versions of the Nassau New York Domestic Partnership Dependent Certification Form. These variations could depend on the specific benefits or privileges being sought or any recent revisions made to the form. Sample variations could include: 1. Nassau New York Domestic Partnership Dependent Certification Form — Healthcare Benefits: This form is tailored specifically for partners seeking healthcare benefits for their dependents, such as medical, dental, or vision coverage. It may require additional information related to healthcare providers, insurance coverage, and any necessary authorizations. 2. Nassau New York Domestic Partnership Dependent Certification Form — Financial Assistance: This form is intended for partners who are seeking financial assistance or aid for their dependents, such as scholarships, grants, or other financial support programs. It may require information about the dependent's educational institution, financial details, and any supporting documentation. 3. Nassau New York Domestic Partnership Dependent Certification Form — Tax Purposes: This particular form is designed to help partners establish their eligibility to claim dependents on their tax returns. It may include specific tax-related information, such as dependent's income, expenses, and relevant tax identification numbers. These variations of the Nassau New York Domestic Partnership Dependent Certification Form aim to cater to the specific needs of individuals seeking different types of benefits for their domestic partners' dependents. It is essential to review the requirements and instructions provided with the form carefully to ensure accurate completion and submission.

Nassau New York Domestic Partnership Dependent Certification Form

Description

How to fill out Nassau New York Domestic Partnership Dependent Certification Form?

Whether you intend to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Nassau Domestic Partnership Dependent Certification Form is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to obtain the Nassau Domestic Partnership Dependent Certification Form. Adhere to the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Domestic Partnership Dependent Certification Form in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!