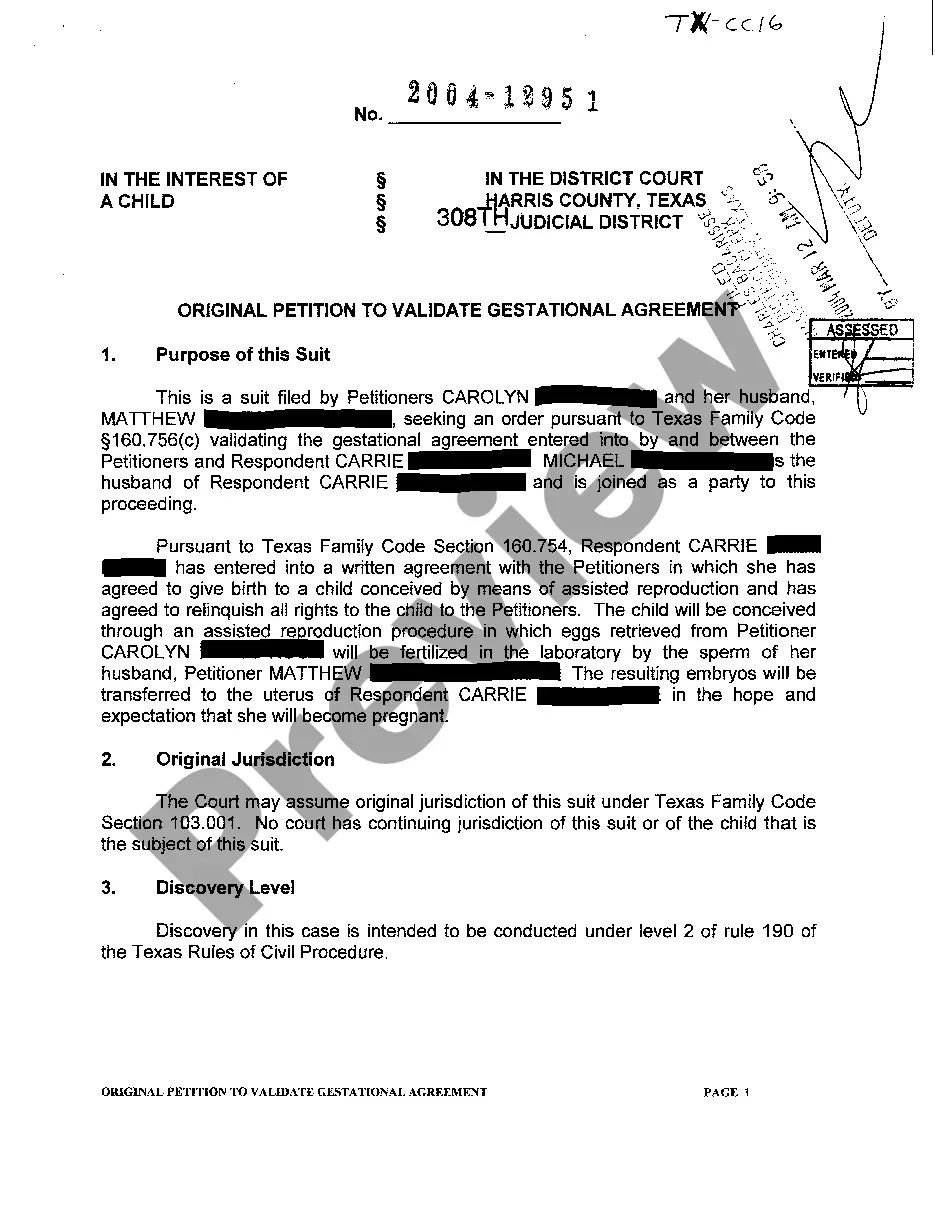

The Travis Texas Domestic Partnership Dependent Certification Form is an official document used in Travis County, Texas, to register and certify dependents in a domestic partnership. This form requires detailed information about the individuals involved in the partnership, as well as their dependent(s). It serves as an important legal record to establish the rights and benefits of the domestic partnership and ensure the eligibility of the dependents for various entitlements and privileges. The Travis Texas Domestic Partnership Dependent Certification Form seeks key details about the domestic partnership, such as the names of both partners, their contact information, and the start date of their partnership. The form also requires the disclosure of information about the dependent(s), including their full name, date of birth, and the nature of the relationship they share with the partners. By completing and submitting this form, domestic partners can verify the dependent status of their children or other qualifying individuals. This certification allows the domestic partnership to gain legal recognition, enabling the dependent(s) to access a range of benefits and protections, including healthcare coverage, inheritance rights, and parental rights. It's important to note that there are no specific variations or types of Travis Texas Domestic Partnership Dependent Certification Form. However, depending on the jurisdiction, there may be variations in the format, requirements, and specific terminology used in similar documents. Therefore, it is crucial to refer to the official Travis County government website or relevant government agencies for the most up-to-date and accurate version of the form. In conclusion, the Travis Texas Domestic Partnership Dependent Certification Form plays a significant role in legally establishing and recognizing domestic partnerships and their dependents in Travis County, Texas. It ensures that the rights and benefits entitled to domestic partners and their dependents are properly documented and protected.

Travis Texas Domestic Partnership Dependent Certification Form

Description

How to fill out Travis Texas Domestic Partnership Dependent Certification Form?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any personal or business purpose utilized in your county, including the Travis Domestic Partnership Dependent Certification Form.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Travis Domestic Partnership Dependent Certification Form will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Travis Domestic Partnership Dependent Certification Form:

- Ensure you have opened the right page with your regional form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Travis Domestic Partnership Dependent Certification Form on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

Steps for Filing a Domestic Partnership Agreement Official copy of the applicant's birth certificate; Driver's license or state-issued identification card; Approved document issued by Texas or another state, the United States, or a foreign government (i.e., passport, visa, military identification, etc.).

Yes. Because each registered domestic partner is taxed on half the combined community income earned by the partners, each is entitled to a credit for half of the income tax withheld on the combined wages.

A domestic partner can be broadly defined as an unrelated and unmarried person who shares common living quarters with an employee and lives in a committed, intimate relationship that is not legally defined as marriage by the state in which the partners reside.

The IRS doesn't recognize domestic partners or civil unions as a marriage. This means that on your federal return, you should file as single, head of household, or qualifying widow(er).

Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.

The state Constitution prohibits government entities from recognizing domestic partnerships and offering insurance benefits to those couples, Texas Attorney General Greg Abbott wrote in an opinion on Monday.

Common law marriages are recognized for federal income tax purposes if they are recognized by the state in which the taxpayers reside. If the taxpayers later move to a state which does not recognize common law marriages, they are still considered married for federal income tax purposes.

"Declaration of Domestic Partnership." A "Declaration of Domestic Partnership" is a statement signed under penalty of perjury. By signing it, the two people swear that they meet the requirements of the definition of domestic partnership when they sign the statement. Each must provide a mailing address.

A domestic partnership agreement is a legal agreement but it is not a marriage, a common-law marriage, or a civil union. Texas does not currently recognize any of these unions.

A registered domestic partnership provides a couple the same rights, protections, and benefits as a married couple in the State of California. The Federal Government does not recognize domestic partnerships and therefore the benefits for the domestic partner become a reportable or taxable income for the employee.

Interesting Questions

More info

Your legal step-parent or legal guardian, including steps or steps that result from your marriage;; •. Your biological or adoptive parent or foster parent; •. A grandparent or parent; •. A son, daughter, stepbrother or step-sister whose relationship to you is established in a court order or by law; •. Any other child of which you are the legal parent or in which you have legal custodianship; and •. Any parent, grandparent, adult child, grandchild, brother or sister who is under your legal custody and control and who is legally related to you. 2. The amount of benefits payable is based upon each person's combined annual household income before all other taxes are included. • Your weekly and daily meal allowances, as well as other benefits; and • Medical cover during hospitalization and disability. There are several ways to qualify for Domestic Partner Dental Benefit. You must show that both of the following apply to you: •.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.