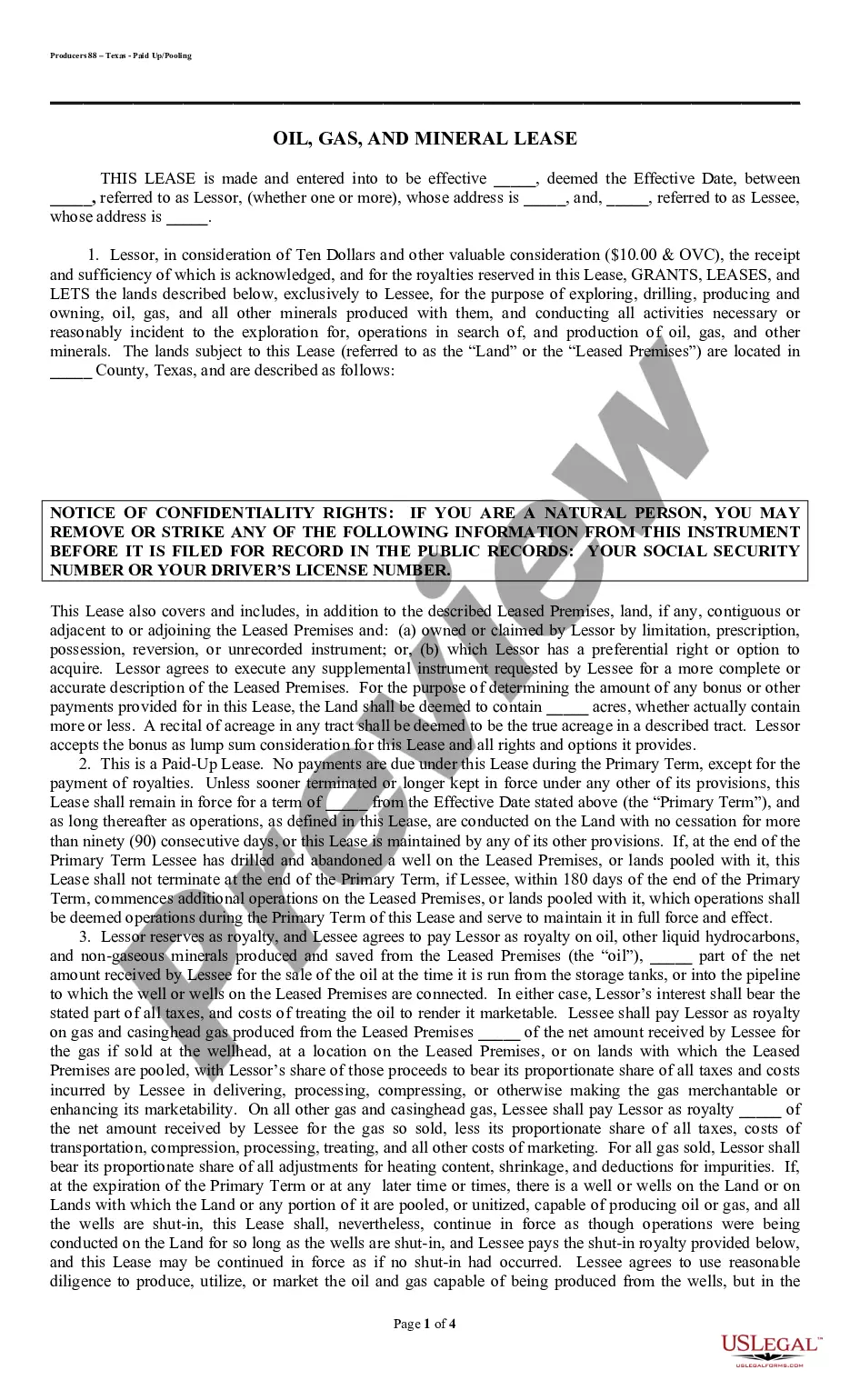

The Fulton Georgia Fair Credit Act Disclosure Notice is an important document provided by lenders to consumers in Fulton, Georgia. This notice is designed to inform borrowers about their credit rights and explain the regulations imposed by the Fair Credit Act, which is a federal law enacted to protect consumers from unfair lending practices. Keywords: Fulton Georgia, Fair Credit Act Disclosure Notice, lenders, consumers, credit rights, regulations, Fair Credit Act, federal law, unfair lending practices. Different types of Fulton Georgia Fair Credit Act Disclosure Notices can include: 1. Mortgage Loans Disclosure Notice: This type of disclosure notice specifically targets individuals seeking mortgage loans in Fulton, Georgia. It outlines the borrowers' rights, interest rates, loan terms, fees, and any other relevant information related to the mortgage lending process. 2. Auto Loans Disclosure Notice: Tailored for individuals who are applying for auto loans, this disclosure notice provides details about their rights when entering into an auto loan agreement. It highlights interest rates, repayment schedules, penalties for late payments, and other factors that may affect the terms of the loan. 3. Credit Card Disclosure Notice: This type of disclosure notice is aimed at individuals who are applying for a credit card in Fulton, Georgia. It explains the terms and conditions associated with the credit card, including interest rates, annual fees, late payment charges, grace periods, and other important details. 4. Personal Loans Disclosure Notice: Borrowers considering personal loans in Fulton, Georgia may receive this type of disclosure notice. It delineates the rights and obligations of both the borrower and the lender, including interest rates, repayment schedules, prepayment penalties, and other terms associated with personal loans. 5. Student Loans Disclosure Notice: Geared towards students and their families, this disclosure notice provides specific information about student loan agreements. It educates borrowers about the terms, interest rates, repayment options, deferment, and forbearance opportunities, as well as the consequences of defaulting on the loan. 6. Business Loans Disclosure Notice: Entrepreneurs and business owners seeking loans in Fulton, Georgia may receive a business loans disclosure notice. This notice outlines the terms, interest rates, loan amounts, repayment options, collateral requirements, and any other relevant details pertaining to business loans. In conclusion, the Fulton Georgia Fair Credit Act Disclosure Notice is a vital document for consumers seeking credit in Fulton, Georgia. Various types of disclosure notices cater to different credit needs, such as mortgage loans, auto loans, credit cards, personal loans, student loans, and business loans. These notices are intended to ensure transparency and protect borrowers from unfair lending practices.

Fulton Georgia Fair Credit Act Disclosure Notice

Description

How to fill out Fulton Georgia Fair Credit Act Disclosure Notice?

Preparing legal documentation can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Fulton Fair Credit Act Disclosure Notice, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Therefore, if you need the latest version of the Fulton Fair Credit Act Disclosure Notice, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Fulton Fair Credit Act Disclosure Notice:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Fulton Fair Credit Act Disclosure Notice and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!