Contra Costa California Yearly Expenses encompass a variety of expenditures that residents and individuals living in Contra Costa County have to consider. These expenses are essential to maintain a comfortable lifestyle and cover various aspects of daily living, including housing, transportation, utilities, healthcare, groceries, and more. Here is a detailed description of some key Contra Costa California Yearly Expenses: 1. Housing Expenses: Contra Costa County offers a range of housing options, including rental apartments, condominiums, and single-family homes. Yearly housing expenses may include rent or mortgage payments, property taxes, homeowners' insurance, and maintenance costs. 2. Transportation Expenses: Commuting is a necessary expense for many, and Contra Costa County provides an extensive transportation system. Yearly transportation expenses may involve fuel costs, car insurance premiums, vehicle maintenance and repairs, public transportation fares, and parking fees. 3. Utilities: Utility expenses are crucial for households, including electricity, gas, water, and sewage. Yearly utility expenses can vary based on the size of the residence and individual usage. 4. Healthcare Expenses: Ensuring proper healthcare coverage is vital. Yearly healthcare expenses may include health insurance premiums, deductibles, co-payments, prescription medications, and medical services not covered by insurance. 5. Groceries and Household Items: Expenses on groceries and household items contribute significantly to yearly budgets. Costs may include food, personal care products, cleaning supplies, and other essential items needed for daily life. 6. Education Expenses: Families with children may incur education expenses, including tuition fees, school supplies, extracurricular activities, and after-school care programs. 7. Entertainment and Recreation: Engaging in entertainment activities and recreation is essential for a well-rounded lifestyle. Yearly expenses in this category may include dining out, attending movies or concerts, gym memberships, sports activities, and cultural events. 8. Personal Care and Clothing Expenses: Personal care items like toiletries, haircuts, and regular clothing purchases should also be considered while planning yearly expenses. 9. Taxes: Contra Costa California residents are subject to various taxes, such as income tax, property tax, sales tax, and vehicle registration fees. These expenses should be considered while estimating yearly costs. 10. Miscellaneous Expenses: It's important to allocate a portion of the budget for unexpected or miscellaneous expenses like home repairs, vehicle emergencies, legal services, or other unforeseen circumstances. By considering these various Contra Costa California Yearly Expenses, individuals can effectively plan their budgets and ensure financial stability in this region.

Contra Costa California Yearly Expenses

Description

How to fill out Contra Costa California Yearly Expenses?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, finding a Contra Costa Yearly Expenses meeting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Aside from the Contra Costa Yearly Expenses, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Contra Costa Yearly Expenses:

- Examine the content of the page you’re on.

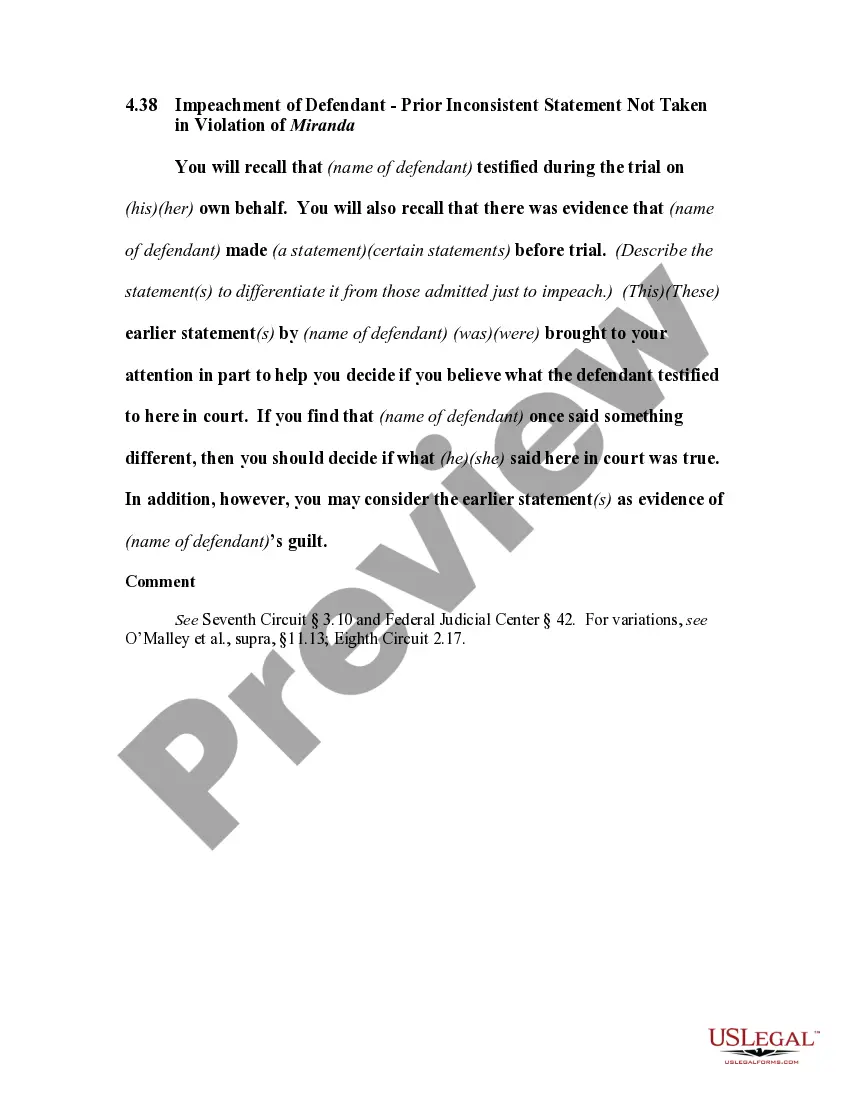

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Contra Costa Yearly Expenses.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!