Nassau, New York Yearly Expenses: Understanding the Costs and Budgeting Essentials In order to effectively plan for your financial future in Nassau, New York, it is crucial to have a comprehensive understanding of the various yearly expenses associated with living in this vibrant town. Whether you are a resident or considering a move to Nassau, it is essential to be aware of the key expenses that you need to allocate your budget to. This article will delve into the primary types of yearly expenses in Nassau, New York, and provide detailed information to help you plan your finances accordingly. 1. Housing Expenses: Nassau offers a variety of housing options, from apartments to single-family homes. These expenses typically include rent or mortgage payments, property taxes, homeowners' insurance, and maintenance costs. 2. Utility Bills: Included in the yearly expenses would be monthly bill payments for electricity, heating, water, and garbage. It is important to factor these costs while preparing your yearly budget. 3. Transportation Costs: Transportation expenses encompass fuel costs, car insurance, vehicle maintenance, and potentially monthly payments if financing a vehicle. Nassau is well-connected by roads, making it essential to allocate funds for commuting purposes. 4. Healthcare Expenses: Healthcare costs are an important consideration for residents of Nassau. These expenses include health insurance premiums, co-pays, prescribed medications, and routine check-ups. Depending on personal circumstances, individuals may also need to factor in dental and vision care expenses. 5. Education and Childcare: If you have school-aged children, it is crucial to include education expenses such as tuition fees, book costs, uniforms, and extracurricular activities. Additionally, childcare expenses, like daycare or after-school programs, should be included in your yearly budget. 6. Food and Groceries: Food expenses include grocery purchases, dining-out, and any specialty items. Budgeting for meals and snacks is important to ensure you have ample funds to satisfy your dietary needs. 7. Entertainment and Recreation: This category covers expenses related to leisure activities, such as movie tickets, museum admissions, gym memberships, or recreational club fees. 8. Personal Care Expenses: Haircuts, salon visits, grooming supplies, and personal care products all fall into this category. Allocating funds towards these routine expenses is vital for personal hygiene and grooming. 9. Taxes: Residents of Nassau are required to pay various taxes, including state income tax, local property taxes, and potentially sales taxes. It is important to be aware of these obligations and plan accordingly. By recognizing and categorizing these different types of yearly expenses, individuals can create a comprehensive budget plan that addresses all aspects of living in Nassau, New York. Proper budgeting and financial planning will enable residents to effectively manage their finances and live a comfortable life in this beautiful locality.

Nassau New York Yearly Expenses

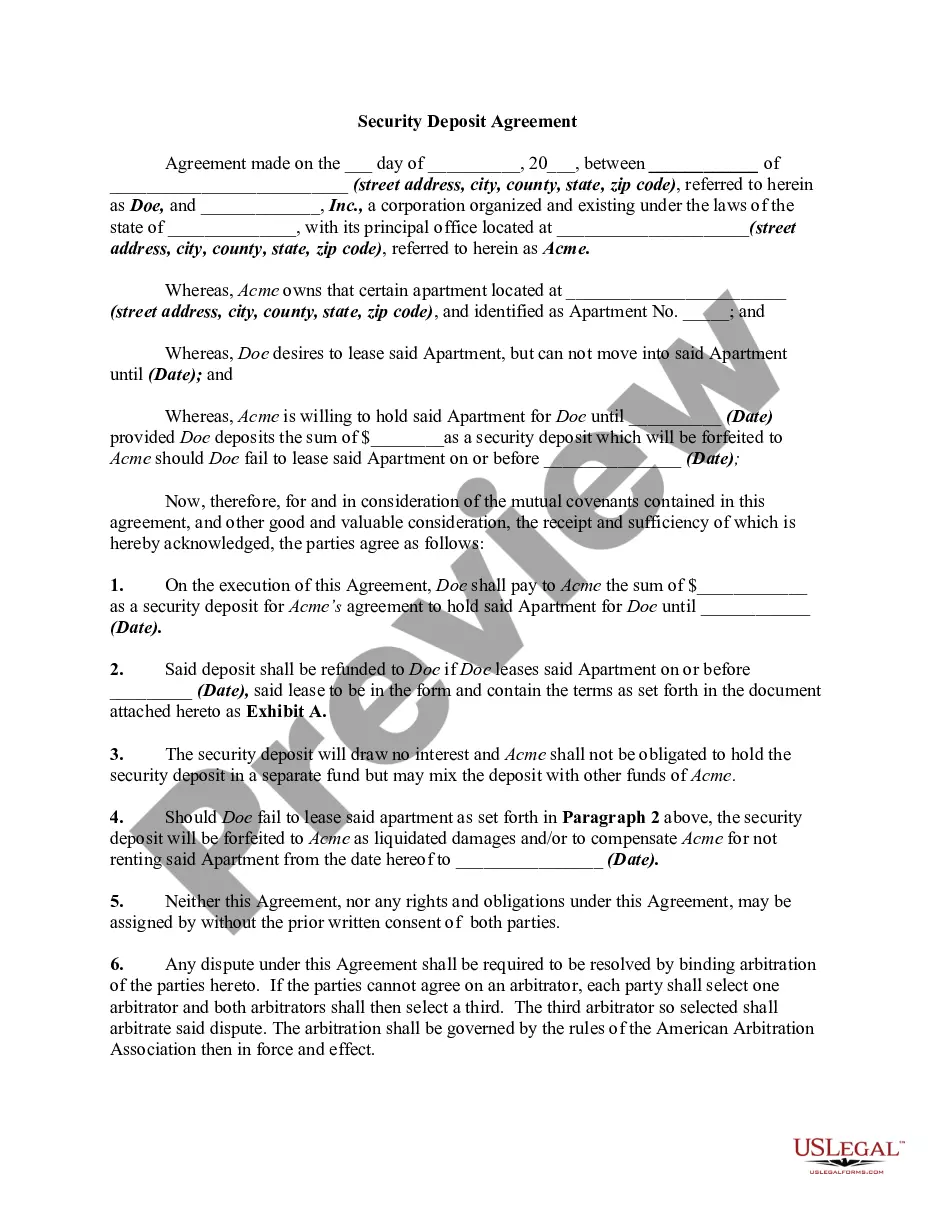

Description

How to fill out Nassau New York Yearly Expenses?

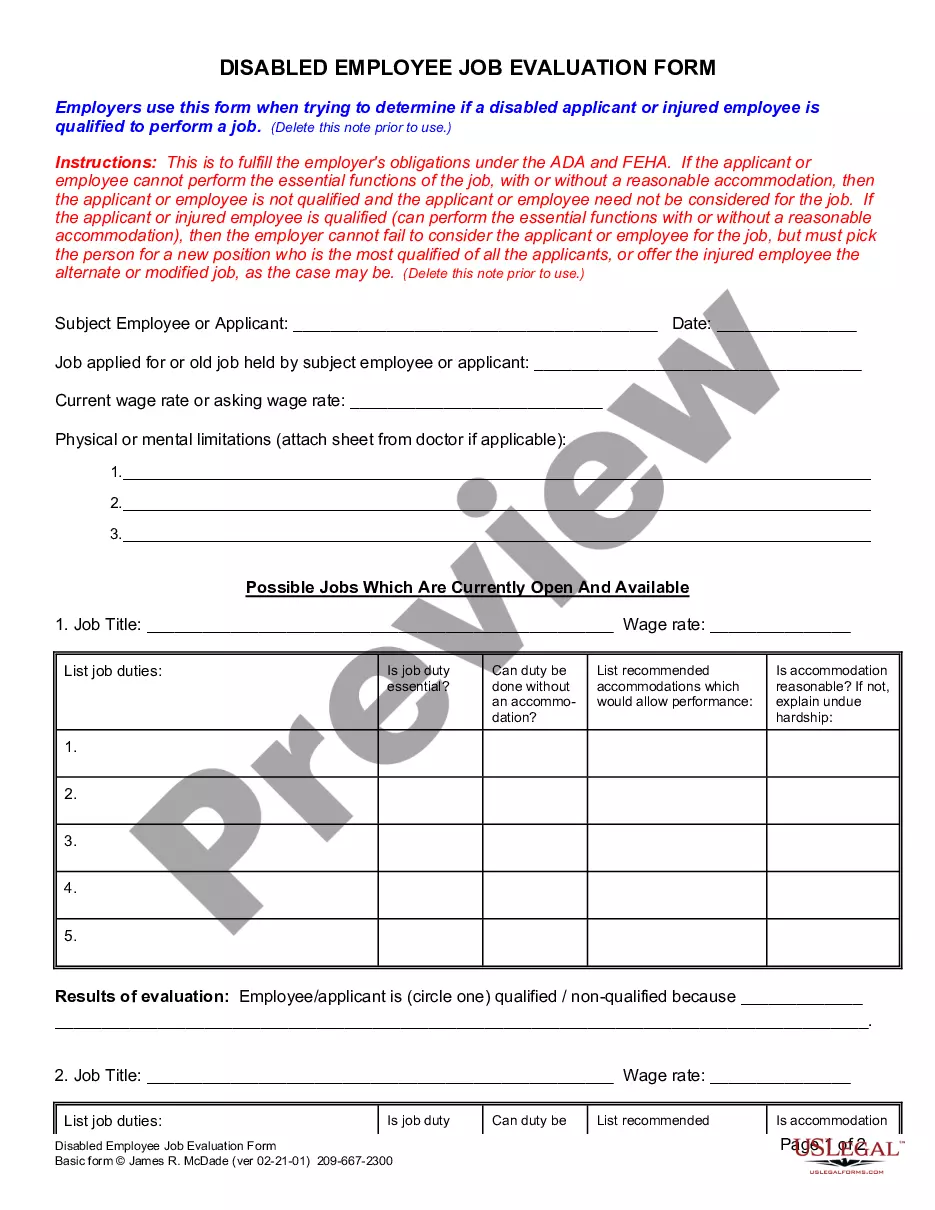

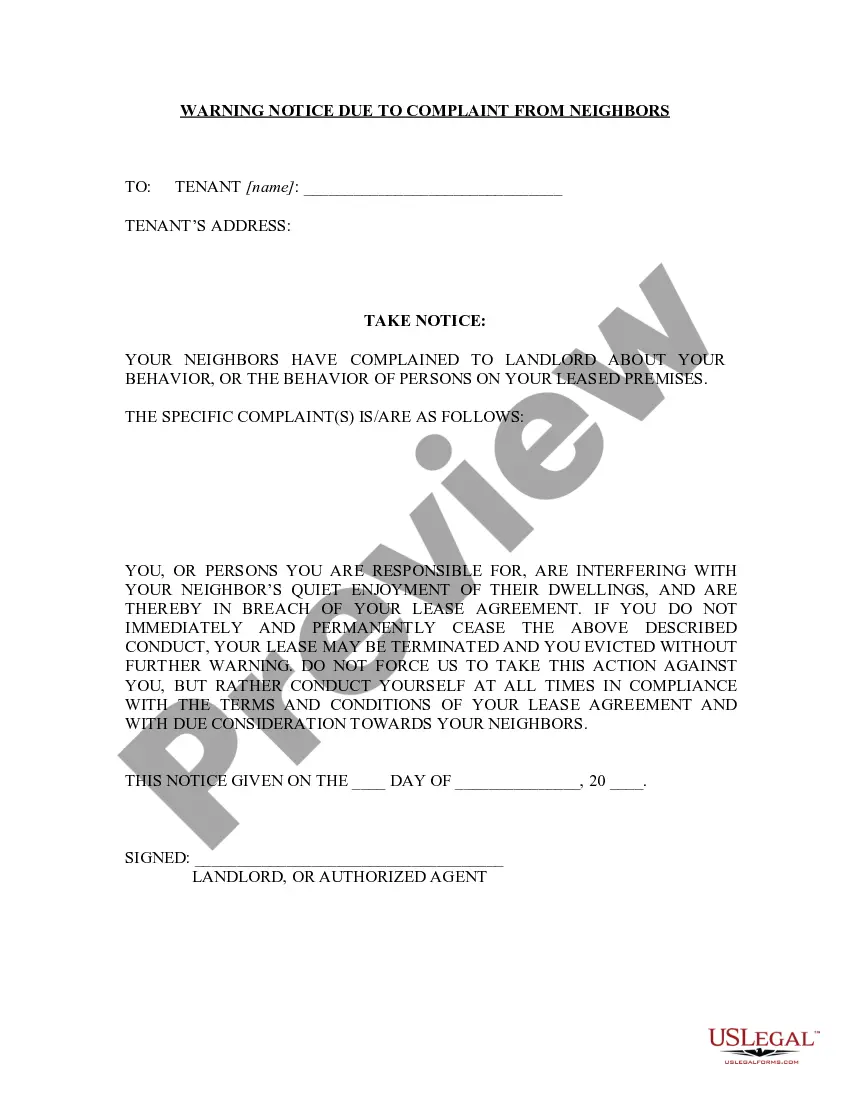

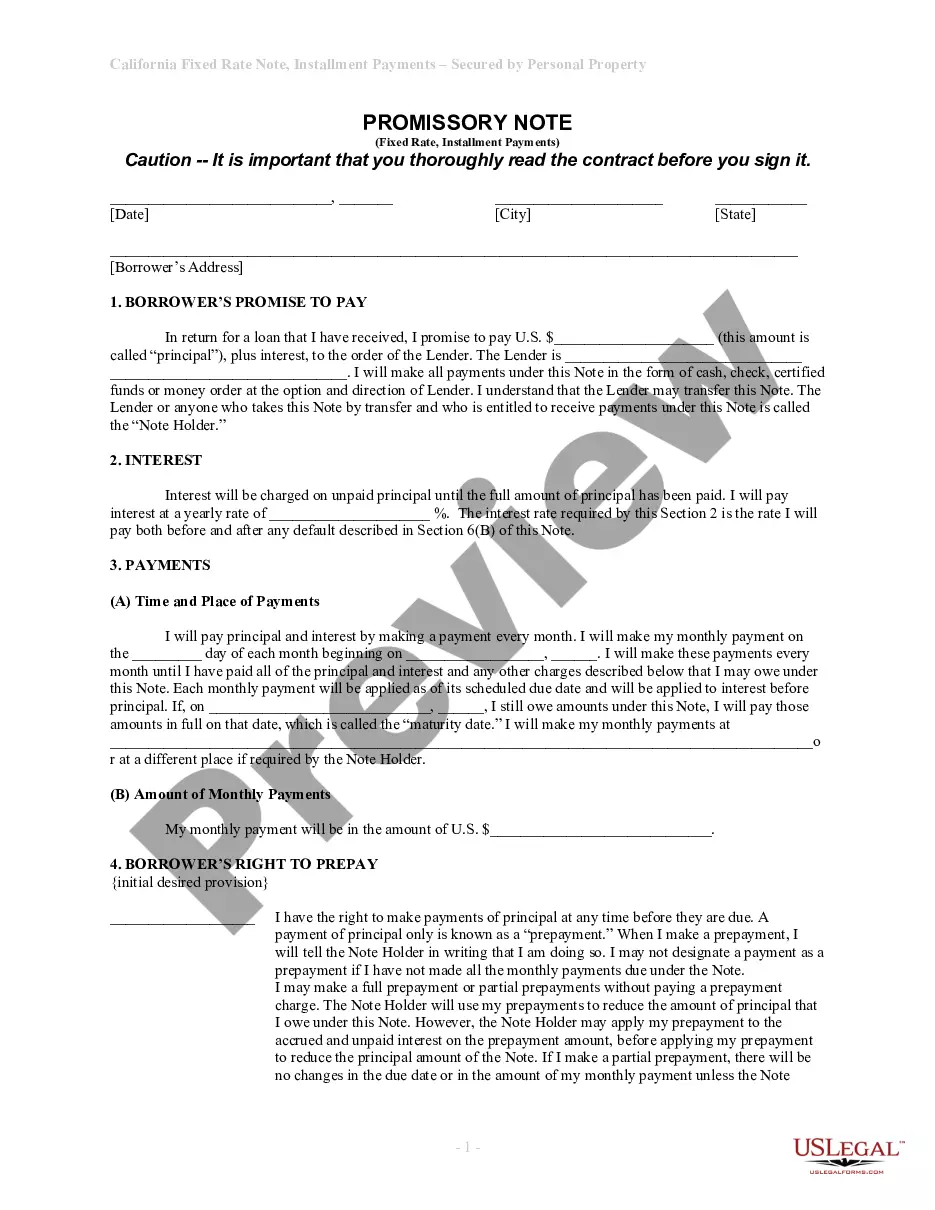

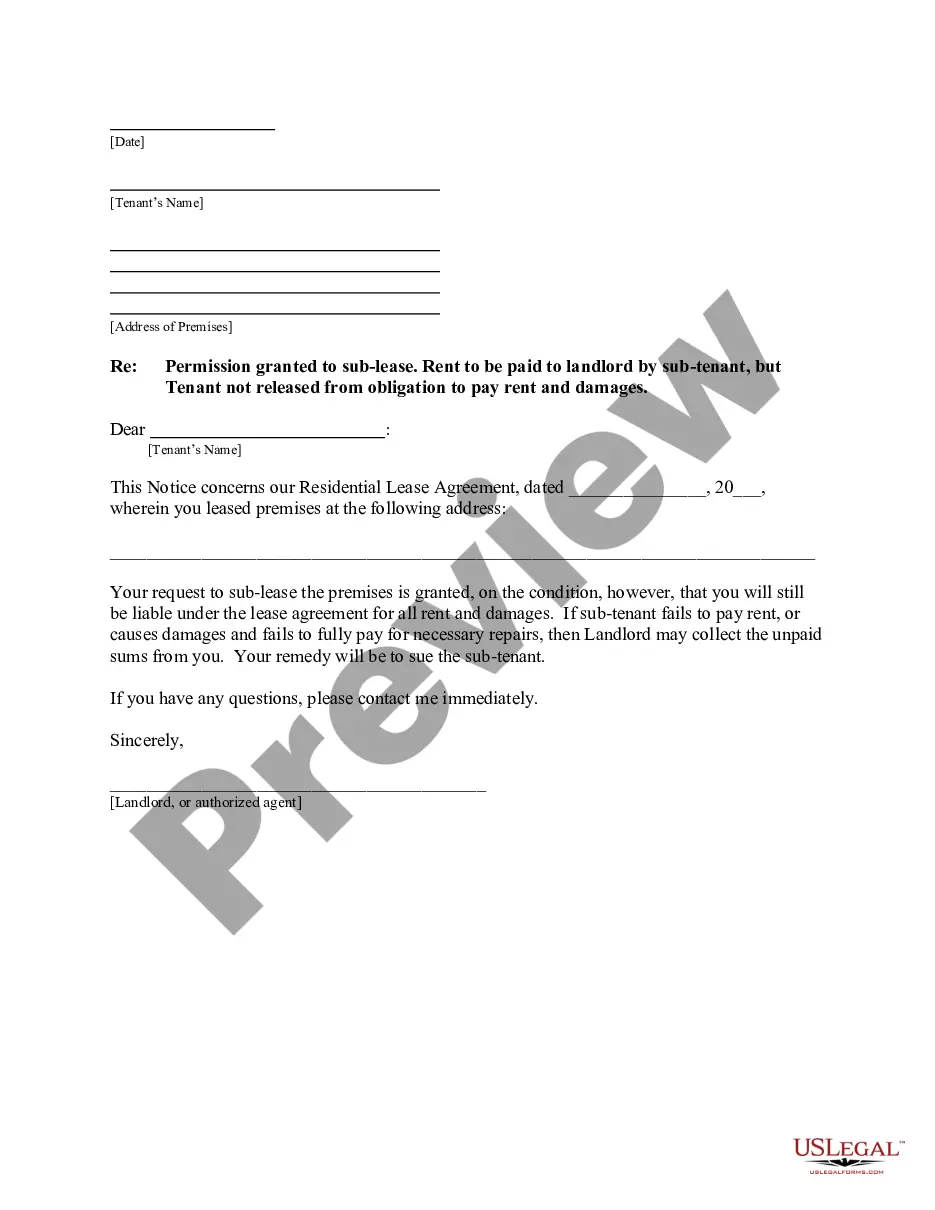

Do you need to quickly create a legally-binding Nassau Yearly Expenses or probably any other form to take control of your own or corporate affairs? You can select one of the two options: hire a legal advisor to write a valid document for you or draft it completely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive neatly written legal documents without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant form templates, including Nassau Yearly Expenses and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, carefully verify if the Nassau Yearly Expenses is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's intended for.

- Start the search over if the template isn’t what you were looking for by using the search box in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Nassau Yearly Expenses template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the paperwork we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!