San Diego, California is a vibrant city known for its beautiful beaches, warm climate, and an active lifestyle. Living in San Diego comes with a set of yearly expenses that are important to consider when planning your budget. From housing costs to transportation and everyday essentials, understanding the different types of yearly expenses in San Diego can help you make informed financial decisions. 1. Housing Expenses: San Diego boasts a diverse real estate market, with options ranging from apartments and condos to single-family homes. The costs of housing in San Diego can vary greatly depending on the neighborhood and size of the property. Keywords: San Diego housing costs, San Diego rent, San Diego home prices. 2. Utilities: Utilities such as electricity, water, and gas are necessary expenses for any household. While rates may differ based on usage and provider choices, it's essential to consider these expenses when estimating yearly costs. Keywords: San Diego utility bills, San Diego electricity rates, San Diego water costs. 3. Transportation: Whether you own a car, use public transportation, or rely on ride-share services, transportation costs should be factored into your yearly budget. San Diego's gas prices, vehicle registration fees, parking expenses, and public transportation pass costs should be considered. Keywords: San Diego transportation expenses, San Diego gas prices, San Diego vehicle registration fees. 4. Groceries and Dining Out: Food expenses make up a significant portion of the budget. While grocery costs depend on personal preferences and dietary needs, dining out in San Diego can range from budget-friendly to high-end establishments. Keywords: San Diego grocery prices, San Diego dining costs, San Diego restaurant expenses. 5. Health Insurance: Maintaining a health insurance plan is crucial for healthcare coverage. Consider the costs associated with health insurance premiums, deductibles, and copay when calculating your yearly expenses in San Diego. Keywords: San Diego health insurance premiums, San Diego healthcare costs. 6. Education: If you have children, private school tuition or college fees may be part of your yearly expenses. Additionally, San Diego is home to reputable universities and colleges that offer various educational opportunities. Keywords: San Diego private school fees, San Diego college tuition. 7. Recreation and Entertainment: San Diego offers a wide range of recreational activities and entertainment options, from visiting theme parks and museums to enjoying outdoor adventures. Budgeting for these activities ensures you can make the most of what the city has to offer. Keywords: San Diego entertainment expenses, San Diego recreation costs. 8. Taxes: San Diego residents are subject to various taxes, including income tax, property tax, and sales tax. Understanding the tax rates and potential deductions is crucial when estimating your yearly expenses. Keywords: San Diego tax rates, San Diego property tax, San Diego sales tax. By considering these different types of yearly expenses in San Diego, you can develop a comprehensive budget that reflects the cost of living in this dynamic city. It is recommended to conduct further research and consult with local resources to obtain accurate and up-to-date information on the specific costs associated with living in San Diego, California.

San Diego California Yearly Expenses

Description

How to fill out San Diego California Yearly Expenses?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the San Diego Yearly Expenses, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the San Diego Yearly Expenses from the My Forms tab.

For new users, it's necessary to make some more steps to get the San Diego Yearly Expenses:

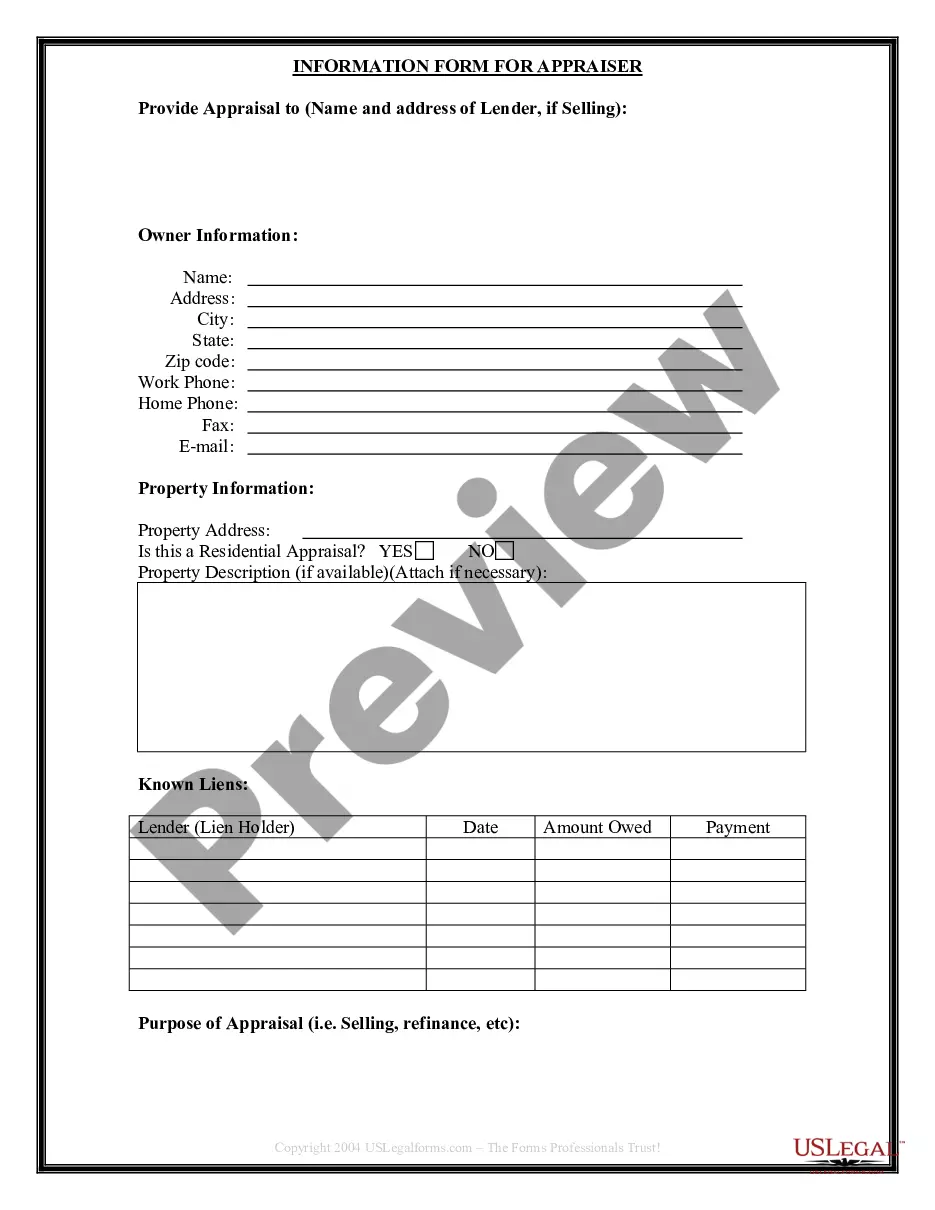

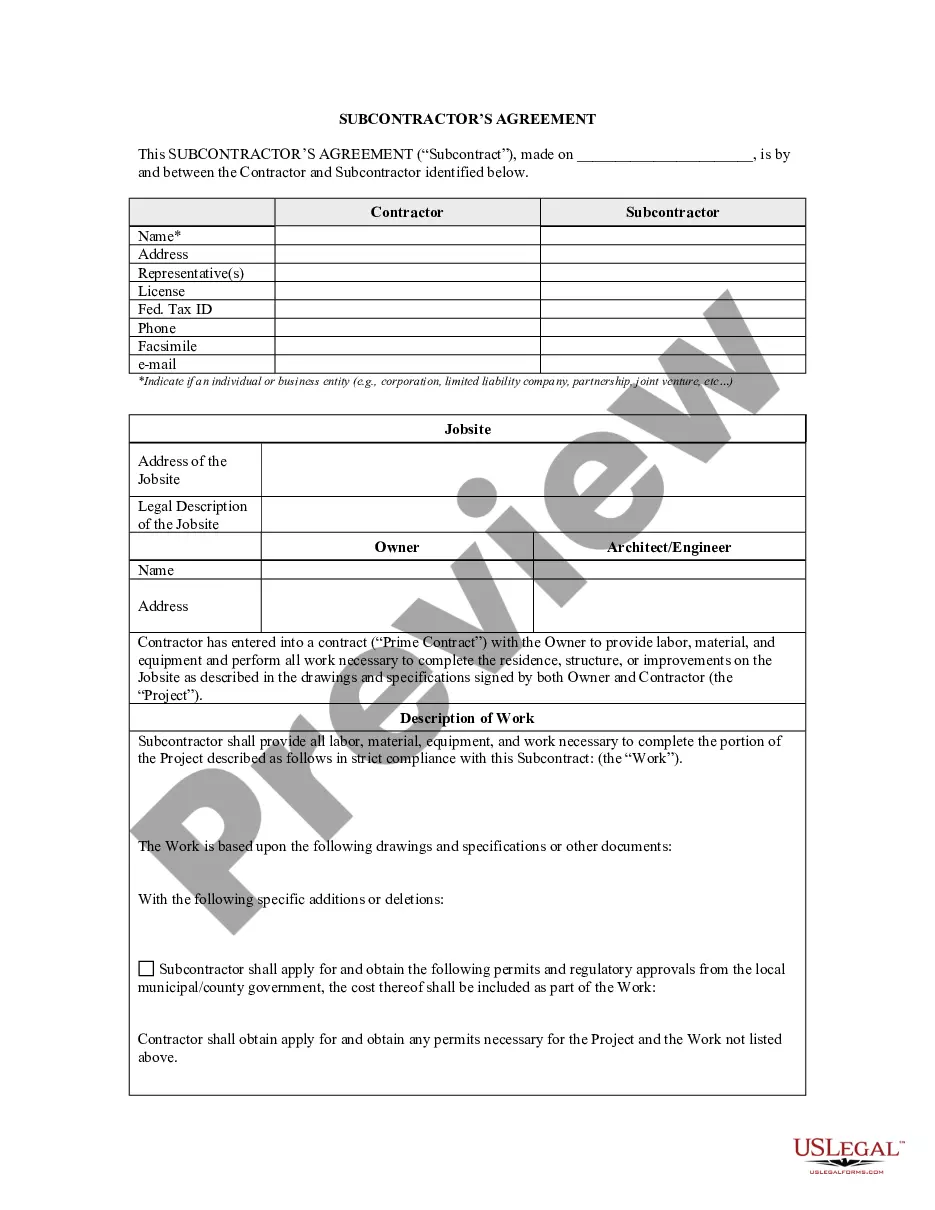

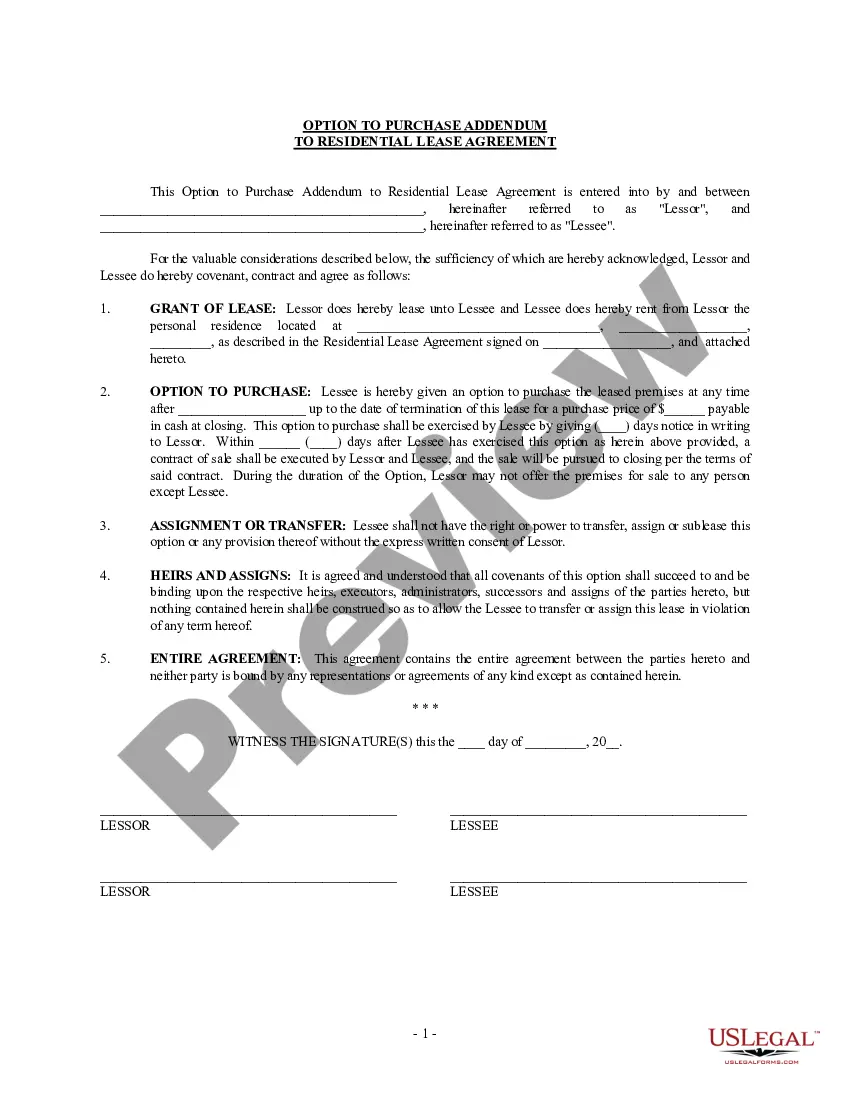

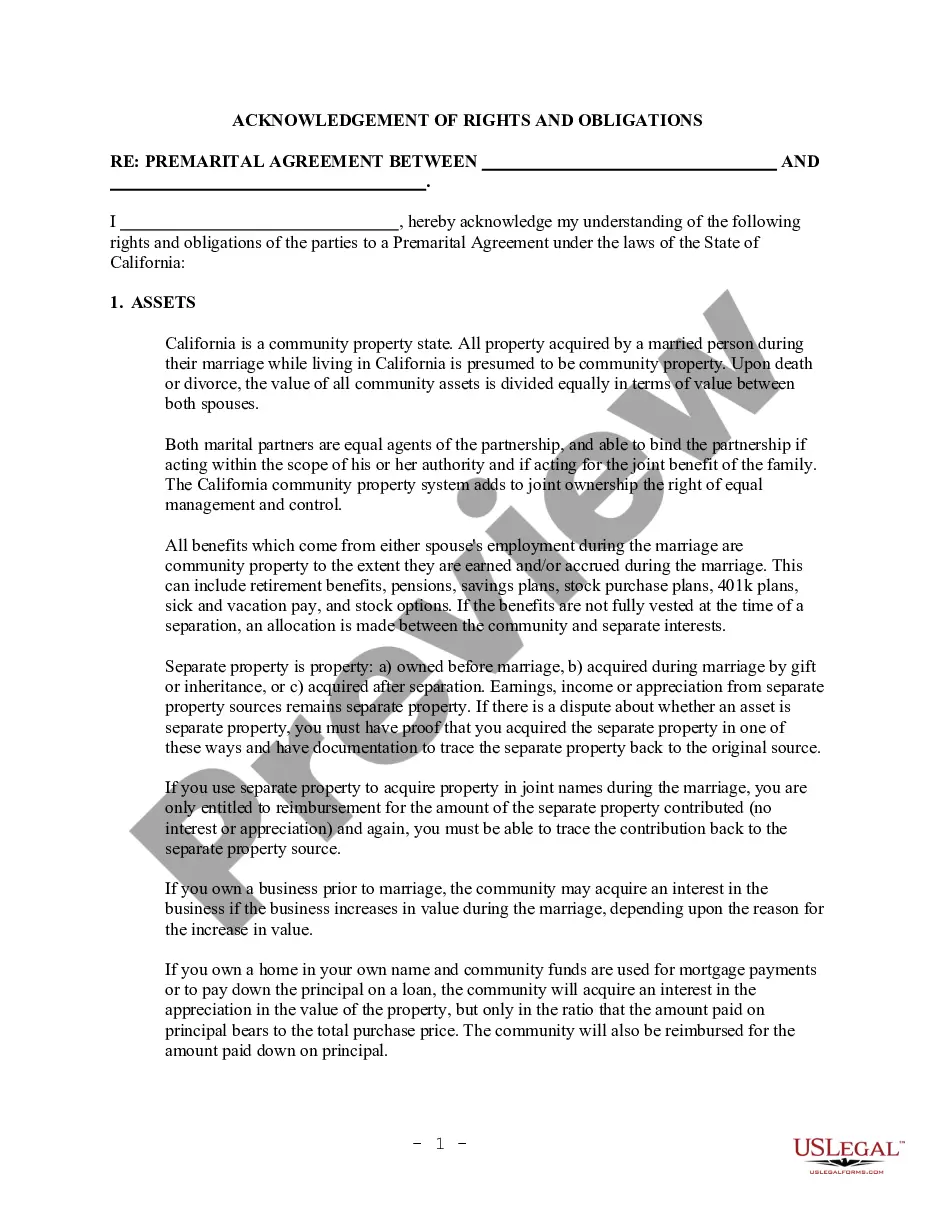

- Analyze the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!