Cook Illinois Petty Cash Form is a standardized document designed to help businesses in managing small and immediate expenses efficiently. It is primarily utilized to track and document cash disbursements that are too small for the hassle of writing a check or processing through a regular account. This form acts as a safeguard to ensure transparency and accountability in petty cash management. The Cook Illinois Petty Cash Form typically consists of several sections that cover crucial information pertaining to the cash disbursement. These sections include: 1. Title and Identification: The form usually starts with the title "Cook Illinois Petty Cash Form" to clearly indicate its purpose. It may also display a unique identification number or reference for easy identification and tracking. 2. Date and Purpose: There will be spaces designated to record the date of the petty cash transaction and a description of its purpose. This helps in maintaining an organized record of each disbursement. 3. Amount and Currency: The form will provide fields to input the amount of cash disbursed, along with the currency used. This ensures accurate tracking of expenditures and helps reconcile the petty cash fund. 4. Payee Information: This section requires the payee's name, designation, and other relevant details. It helps in identifying the individuals or vendors receiving the cash and aids in audits or reconciliation processes. 5. Approval and Signatures: A vital component of the Cook Illinois Petty Cash Form is the space for signatures. The form may include areas for the recipient's signature, the employee authorizing the disbursement, and any additional supervisors or managerial signatures, depending on the company's approval process. 6. Receipts and Documentation: The form may have an attached section or provide additional space to attach receipts or supporting documentation for the disbursement. This step is crucial to maintaining a comprehensive and verifiable record of all transactions. Cook Illinois Petty Cash Form streamlines the process of petty cash handling and prevents misuse or mishandling of funds. It enables businesses to track expenses, control spending, and maintain accurate records for internal review or external audits. By utilizing the Cook Illinois Petty Cash Form, companies can optimize their financial operations, foster transparency, and ensure compliance with internal policies and regulations. Different types or variations of Cook Illinois Petty Cash Form may exist depending on the organization's specific requirements or industry regulations. These variations may include modified sections, additional fields, or formatting changes to align with the company's needs.

Cook Illinois Petty Cash Form

Description

How to fill out Cook Illinois Petty Cash Form?

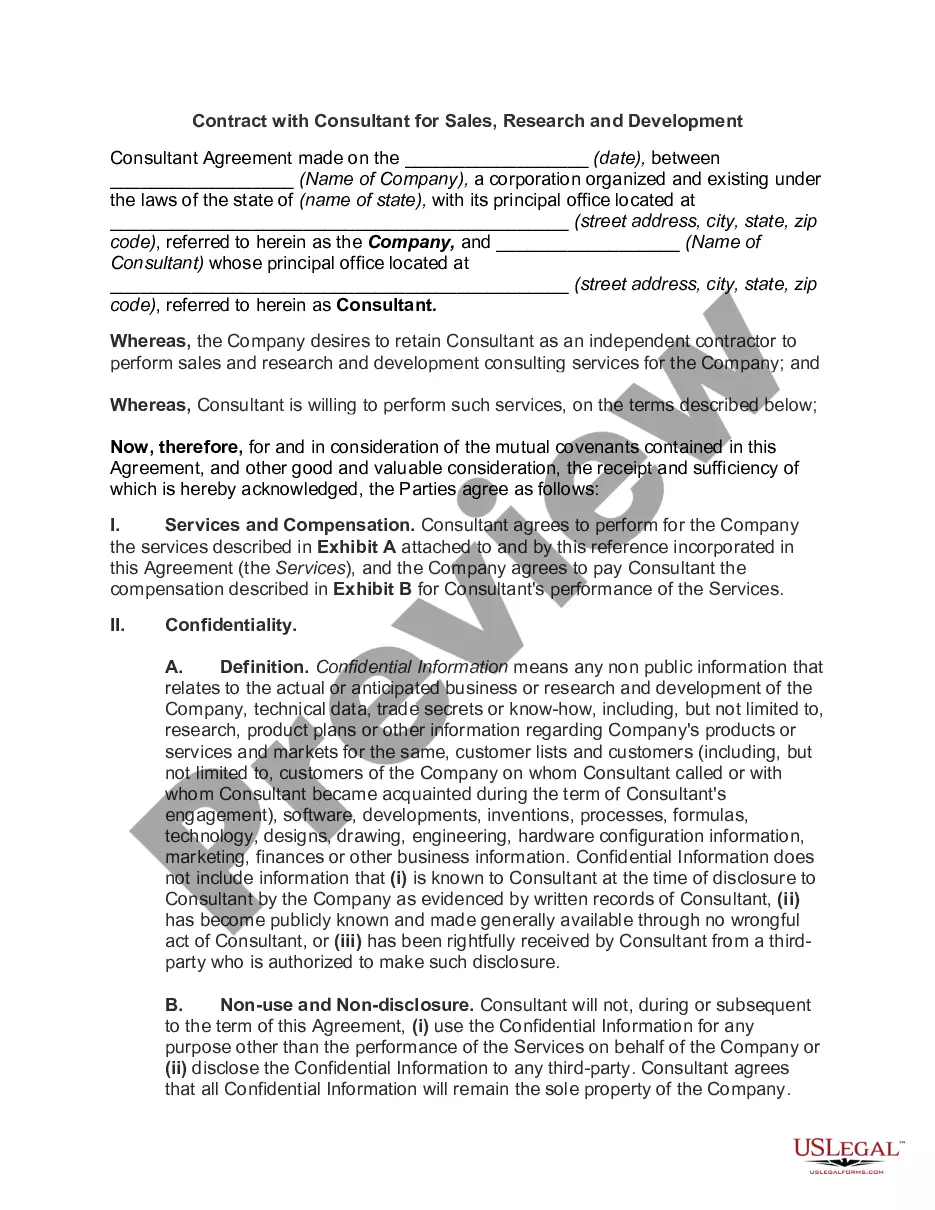

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life sphere, locating a Cook Petty Cash Form suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, gathered by states and areas of use. Aside from the Cook Petty Cash Form, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Experts verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

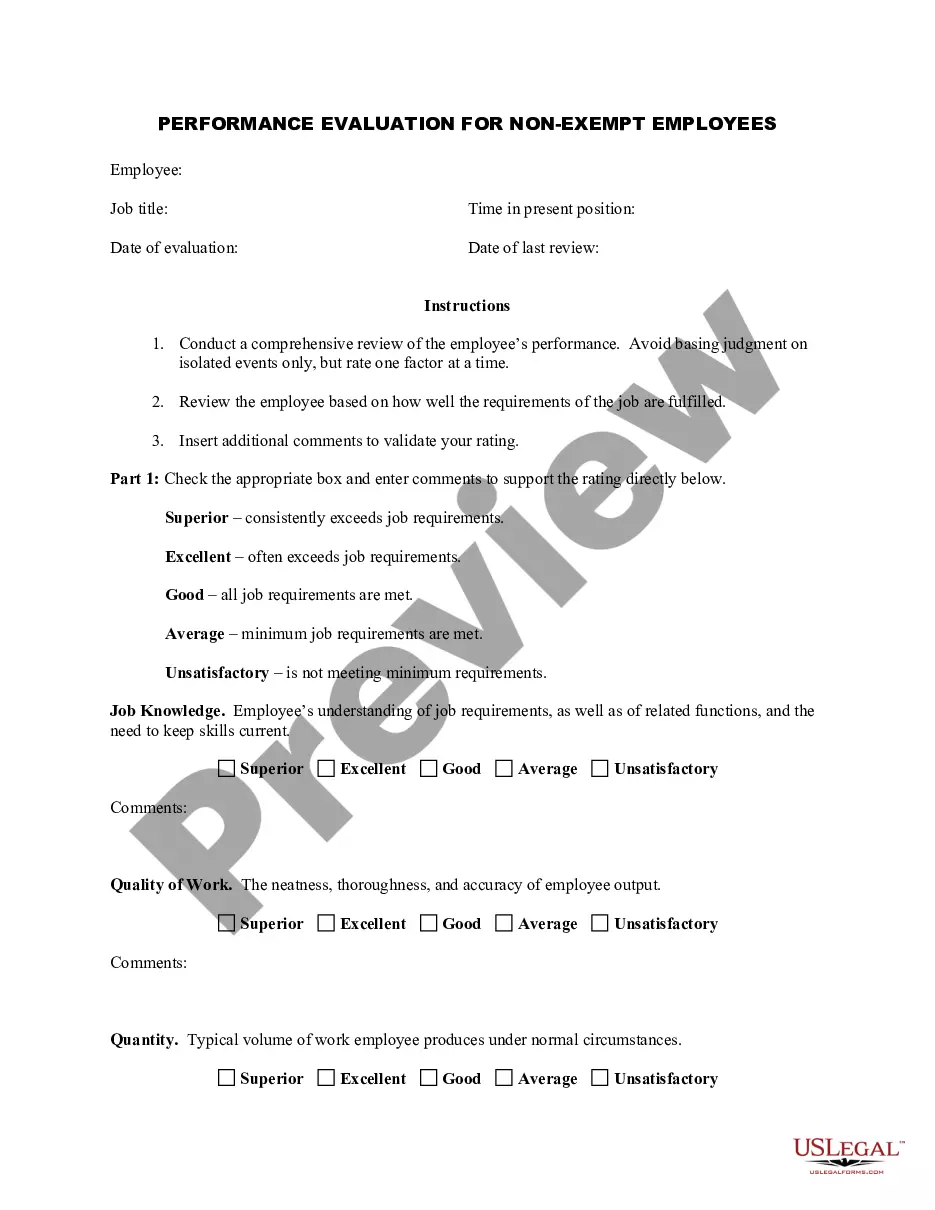

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Cook Petty Cash Form:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Cook Petty Cash Form.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!