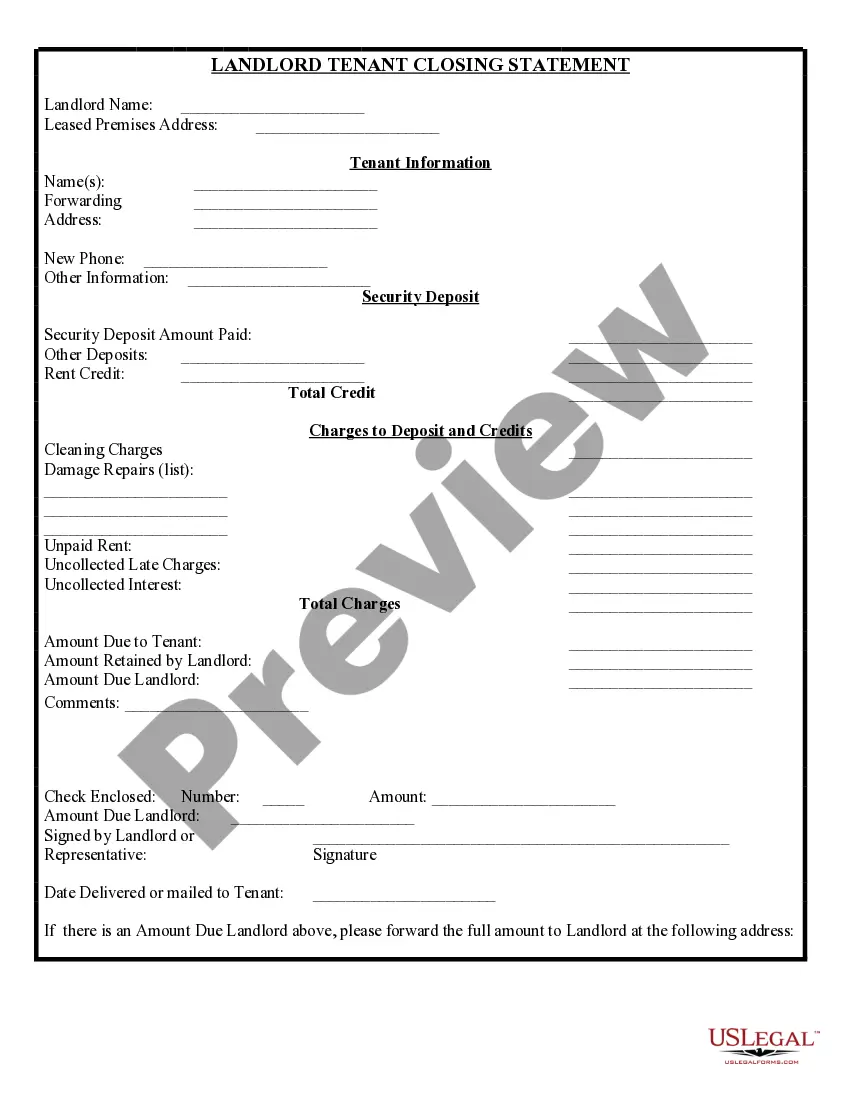

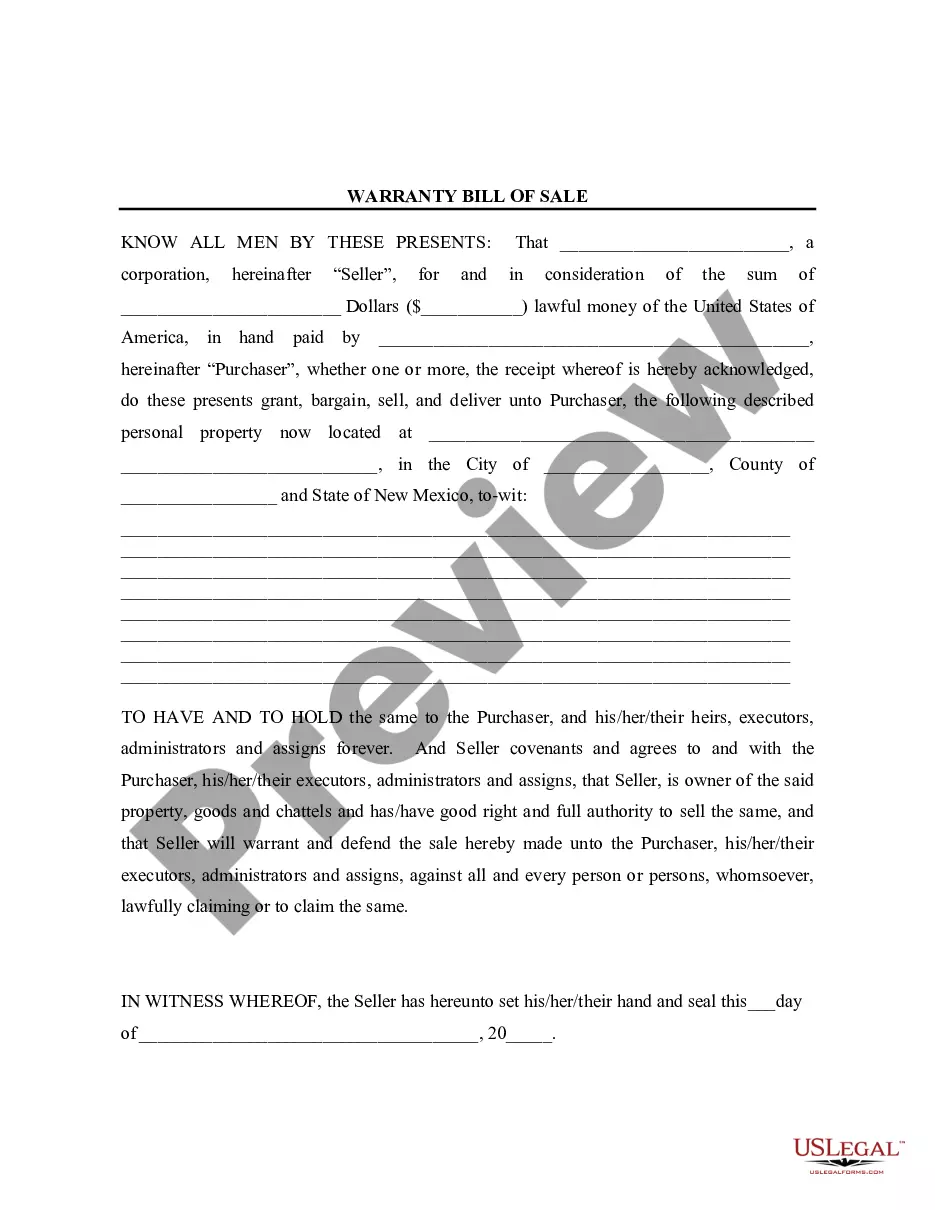

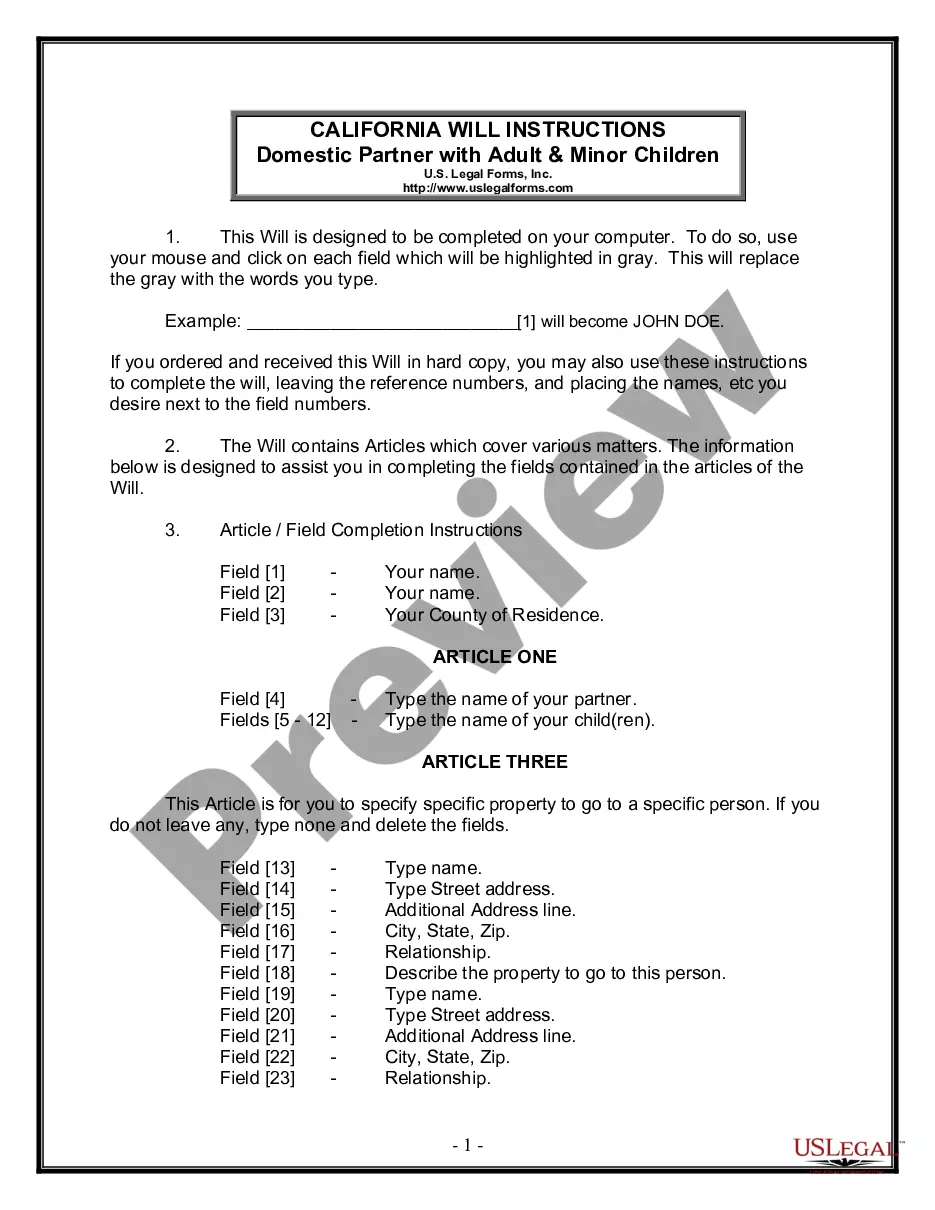

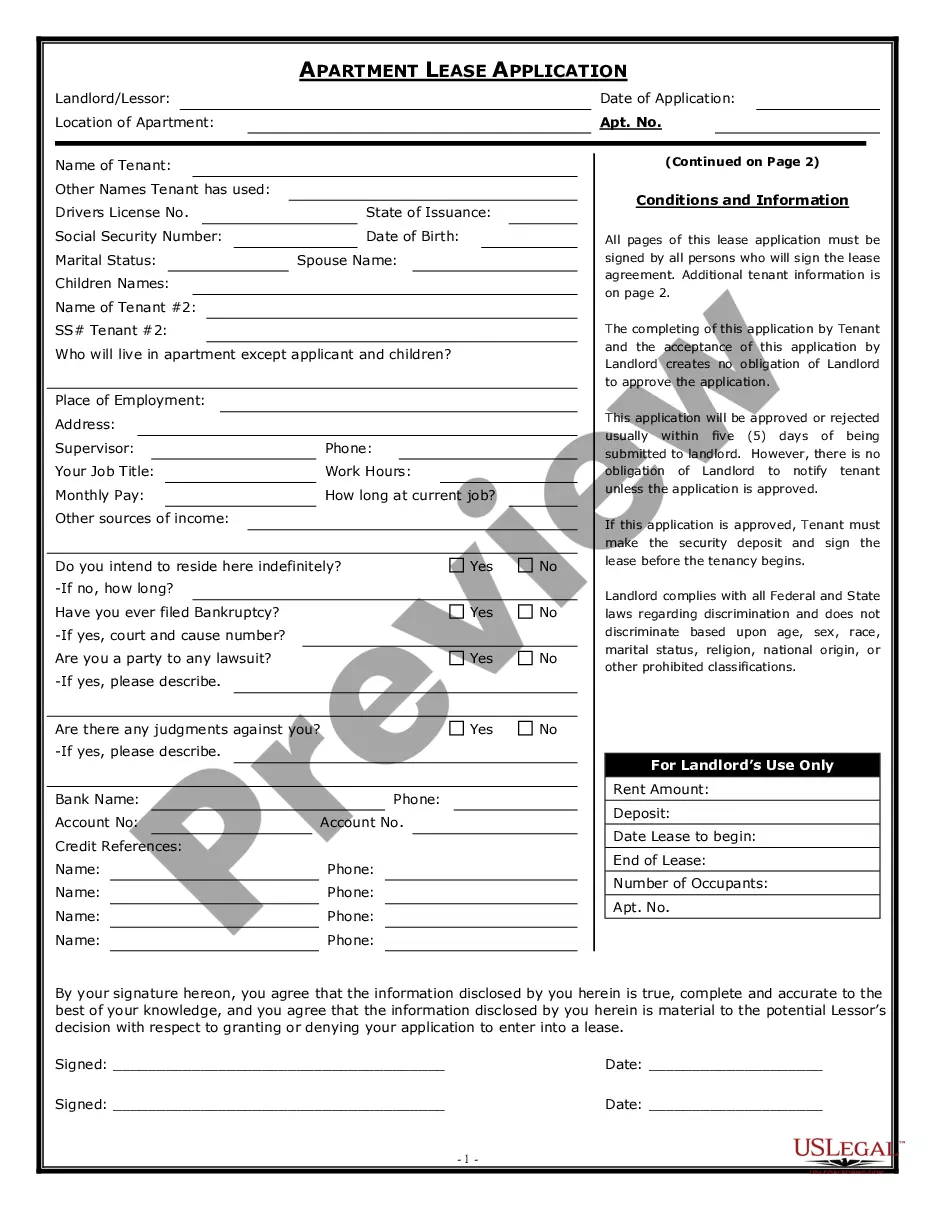

Nassau New York Petty Cash Funds are small amounts of cash set aside for minor expenses or emergencies in the Nassau County area of New York. These funds are typically managed by organizations, businesses, or government agencies and serve as a convenient way to handle small transactions without relying on formal payment methods. Like petty cash funds in other locations, Nassau New York Petty Cash Funds are used for various purposes such as reimbursing employees for small business expenses or purchasing office supplies. The funds are typically placed in a secure location like a cash box or petty cash drawer and controlled by an assigned petty cash custodian who is responsible for its management. There are different types of petty cash funds that may exist in Nassau County, New York, which cater to specific needs or departments within an organization. Some commonly known types include: 1. Office Petty Cash Fund: This type of fund is primarily used for reimbursing employees for small office-related expenses like stationery, postage, or minor repairs. 2. Travel Petty Cash Fund: Organizations with employees frequently traveling may set up a separate petty cash fund dedicated to reimbursing travel-related expenses such as taxi fares, meals, or emergency purchases. 3. Event Petty Cash Fund: For organizations hosting events in Nassau County, creating a separate petty cash fund can help cover miscellaneous expenses like decorations, last-minute supplies, or unforeseen requirements. 4. Department-Specific Petty Cash Funds: Some organizations may create individual petty cash funds for each department to streamline expense management. This allows for better control and accountability within different areas of the organization. It is important to maintain clear and accurate records for all petty cash transactions. These records should include details such as date, purpose, amount of cash disbursed, name of the recipient, and supporting receipts to ensure transparency and accountability. Nassau New York Petty Cash Funds provide a flexible and convenient way to handle minor expenses within organizations and ensure smooth operations. However, it is crucial for organizations to establish proper guidelines and controls to prevent any misuse or mishandling of the funds.

Nassau New York Petty Cash Funds

Description

How to fill out Nassau New York Petty Cash Funds?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Nassau Petty Cash Funds, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different types varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less challenging. You can also find detailed materials and guides on the website to make any activities associated with document execution simple.

Here's how to locate and download Nassau Petty Cash Funds.

- Go over the document's preview and outline (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the legality of some records.

- Check the similar document templates or start the search over to locate the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and buy Nassau Petty Cash Funds.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Nassau Petty Cash Funds, log in to your account, and download it. Needless to say, our platform can’t replace an attorney entirely. If you have to cope with an extremely challenging situation, we recommend using the services of a lawyer to check your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and get your state-compliant paperwork with ease!