The Harris Texas Purchasing Cost Estimate is a comprehensive tool used to determine the projected costs associated with purchasing goods, services, or properties in Harris County, Texas. It assists individuals, businesses, and organizations in making informed decisions regarding their budgets and financial planning. This cost estimate takes into account various factors such as market trends, inflation rates, labor costs, transportation expenses, taxes, and other relevant considerations specific to Harris County. There are several types of Harris Texas Purchasing Cost Estimates, each designed to cater to different needs and requirements. These variation types may include: 1. Residential Property Purchasing Cost Estimate: This estimate primarily focuses on determining the cost involved in purchasing residential properties, such as houses, apartments, or condominiums, within Harris County. It considers factors like property value, real estate agent fees, closing costs, property taxes, and potential maintenance or renovation expenses. 2. Commercial Property Purchasing Cost Estimate: This type of estimate is geared towards businesses or investors looking to purchase commercial real estate in Harris County. It factors in elements like property size, location, zoning regulations, construction costs, environmental assessments, and any additional expenses related to tenant improvements or leasing. 3. Goods Purchasing Cost Estimate: This estimate is relevant for businesses or individuals looking to procure goods or products in Harris County. It includes expenses such as wholesale or retail prices, shipping costs, inventory taxes, customs duties (if applicable), storage fees, and potential markups or discounts. 4. Services Purchasing Cost Estimate: This estimate focuses on estimating costs associated with purchasing services from Harris County-based service providers. It takes into account factors like hourly or project-based rates, material or equipment costs, travel expenses, licensing fees, insurance premiums, and other relevant charges. 5. Government Contract Purchasing Cost Estimate: This specific estimate relates to estimating costs for businesses or organizations seeking government contracts within Harris County. It involves factors such as bidding costs, administrative fees, compliance with government regulations, insurance requirements, and potential ongoing expenses associated with fulfilling the contract. The Harris Texas Purchasing Cost Estimate, regardless of its type, serves as a valuable tool for evaluating potential expenses accurately. By utilizing this estimate, individuals, businesses, and organizations can effectively plan their purchasing decisions, negotiate contracts, and maintain financial stability while operating within Harris County, Texas.

Harris Texas Purchasing Cost Estimate

Description

How to fill out Harris Texas Purchasing Cost Estimate?

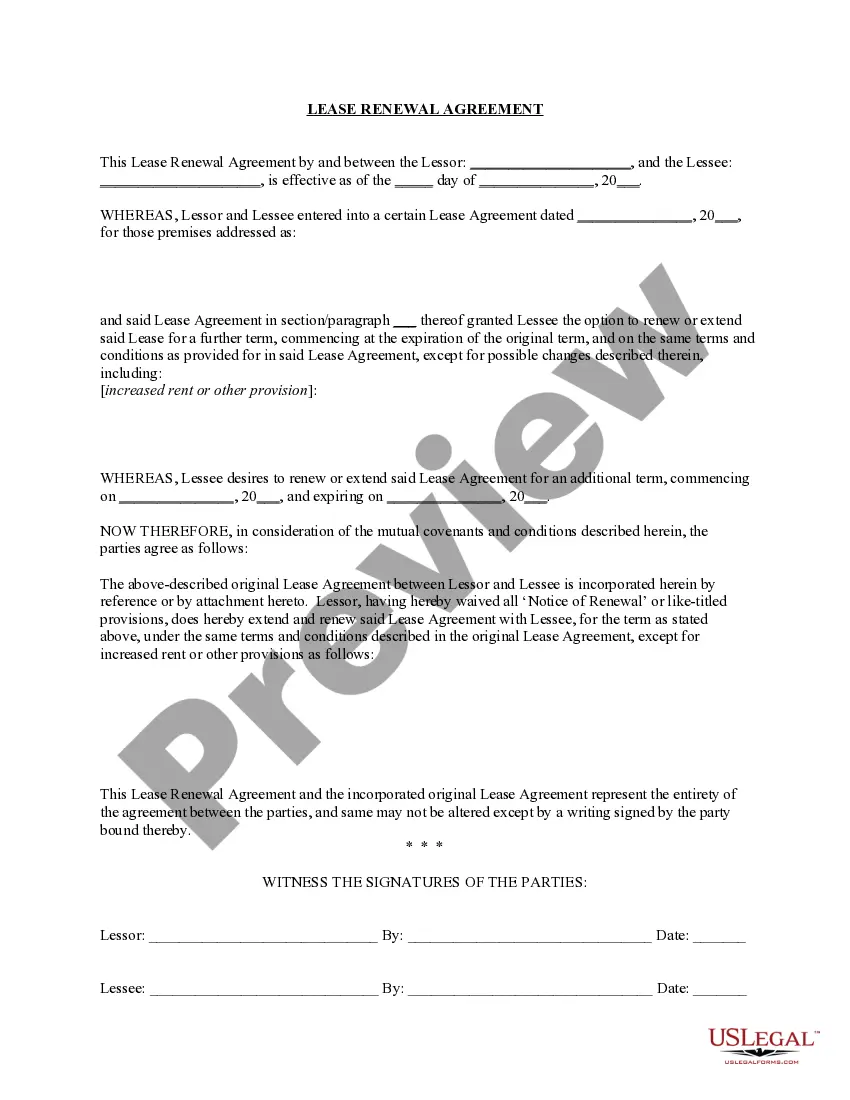

If you need to get a trustworthy legal form supplier to find the Harris Purchasing Cost Estimate, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of learning resources, and dedicated support team make it simple to locate and complete different documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Harris Purchasing Cost Estimate, either by a keyword or by the state/county the document is created for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Harris Purchasing Cost Estimate template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be immediately ready for download once the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less pricey and more affordable. Set up your first business, arrange your advance care planning, draft a real estate contract, or complete the Harris Purchasing Cost Estimate - all from the comfort of your sofa.

Join US Legal Forms now!